Stablecoins Are Flowing In

Bitcoin could be on the verge of a price surge, according to market researcher Markus Thielen. He says a massive influx of stablecoins, totaling $2.5 billion, is a strong indicator of institutional investors pouring money into the crypto market.

Thielen explains that monitoring money flows in the crypto market is crucial for understanding price movements. He points out that a sustained increase in money flows can drive prices higher, while a decrease can signal a correction.

Tether and Circle Issuing Big Bucks

Recently, Tether minted $1 billion in USDT, which Thielen interprets as a sign of preparation for future market activity rather than an immediate liquidity injection.

Additionally, Tether and Circle have issued a combined $2.8 billion in stablecoins, which Thielen sees as a clear sign of institutional investment.

On-Chain Data Supports the Bullish Narrative

On-chain analysis platform Lookonchain has also observed a significant flow of USDT to Cumberland, a major crypto trading firm. This suggests that these stablecoins are being injected into the market, potentially driving prices higher.

Other Bullish Signals

Crypto analyst Miles Deutscher believes that the current market conditions resemble the consolidation period from 2023, which ended with a price surge. He points to declining retail interest and a lack of clear narratives as signs that this phase is coming to an end.

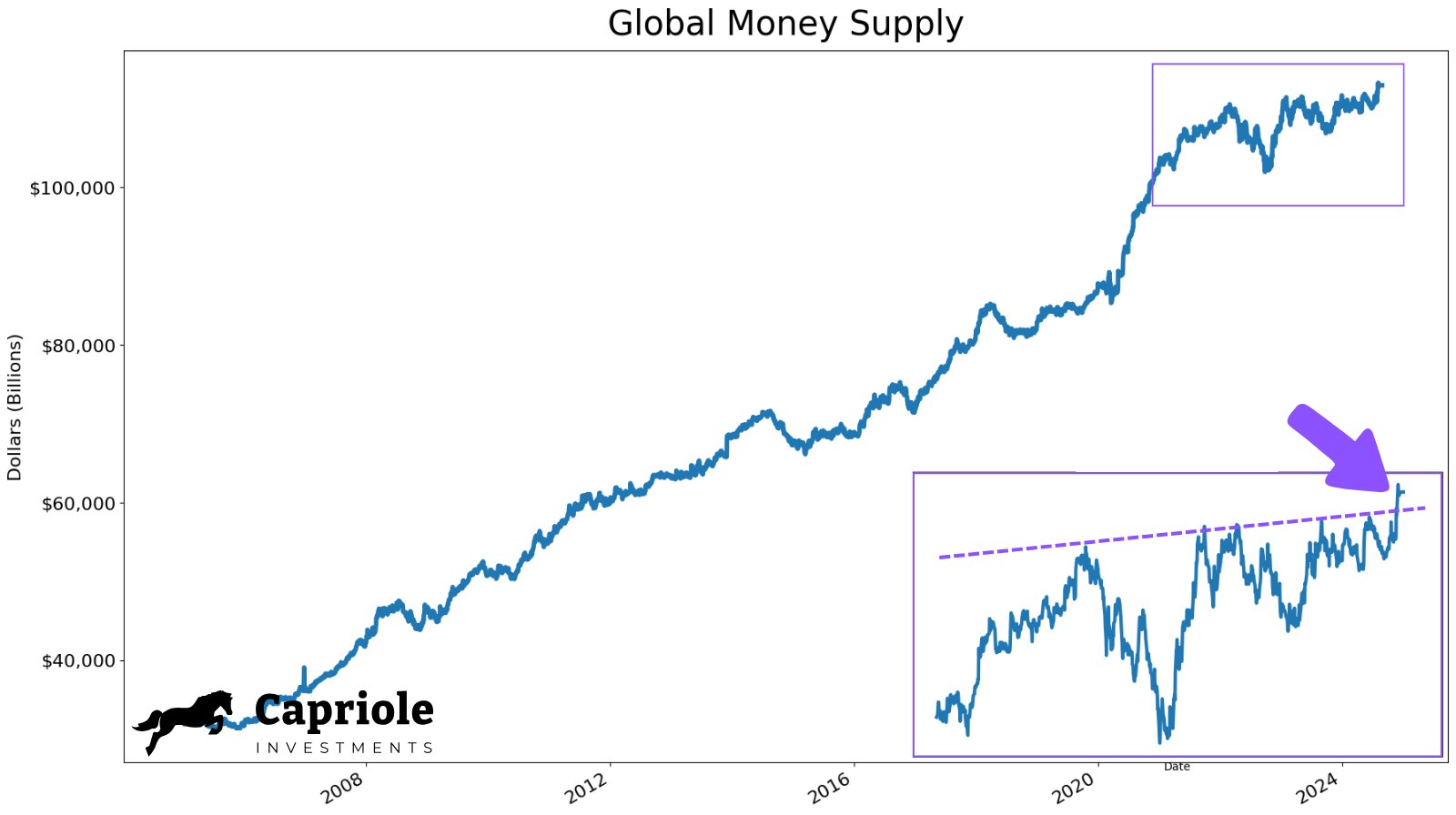

Charles Edwards, founder of Capriole Investments, adds a macroeconomic perspective, highlighting the expansion of the global money supply as a historical driver for Bitcoin price increases.

The Bottom Line

With a massive influx of stablecoins, institutional investment, and positive macroeconomic factors, Bitcoin is looking bullish. The price is currently trading at $60,853 and could see further gains if these trends continue.