Demand Metrics Tell the Tale

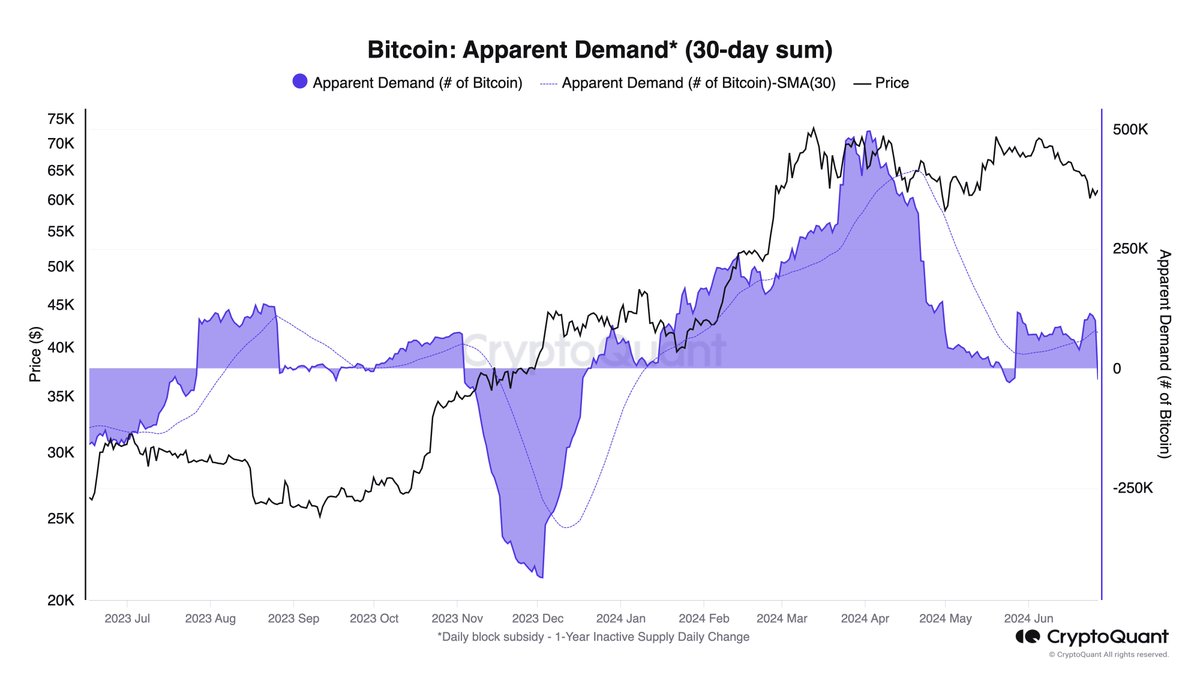

CryptoQuant’s research chief, Julio Moreno, has shed light on the recent Bitcoin price drop. He points to the falling demand for Bitcoin as a major factor.

The “apparent demand” metric measures the balance between production and inventory changes. In Bitcoin’s case, it tracks the amount of Bitcoin that has not been moved in over a year.

Inactive Supply on the Move

According to CryptoQuant, about 23,000 BTC has left the 1-year inactive supply in the past month. This suggests that long-term investors are selling their Bitcoin.

Consequences of Low Demand

The decline in demand has led to a price correction. When the supply increases (due to long-term holders selling), it puts downward pressure on prices.

Demand and the Bull Run

The Bitcoin demand has dropped since the launch of US spot exchange-traded funds in Q1. To resume the bull run, demand needs to pick up.

Current Bitcoin Price

As of writing, Bitcoin is trading around $60,790, down 1.6% in the past week.