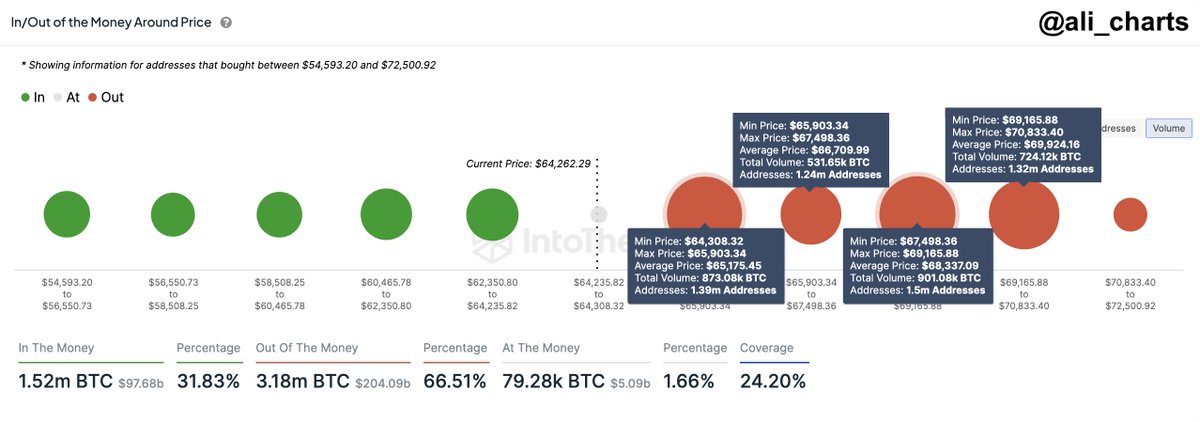

A crypto expert named Ali Martinez believes that Bitcoin’s price could fall further due to a large number of investors who bought it between $64,300 and $70,800. This range has become a “supply barrier” because these investors may sell their coins to avoid losing money if the price drops below that level.

Selling Pressure from Investors

If a significant number of investors sell their Bitcoin, it could lead to a steep price correction. This selling pressure could be exacerbated by negative market sentiment and panic selling from other investors.

Miners Selling Bitcoin

In addition to investors, Bitcoin miners have also been selling their coins recently. Over 30,000 BTC have been sold since June, which is the fastest rate of decline in over a year. This sell-off is likely due to the reduced profitability of mining after the recent halving event, which reduced the reward for miners.

Current Price and Outlook

As of now, Bitcoin is trading around $64,460, with a slight increase in the past 24 hours. However, the supply barrier and miner sell-offs suggest that further price declines are possible.