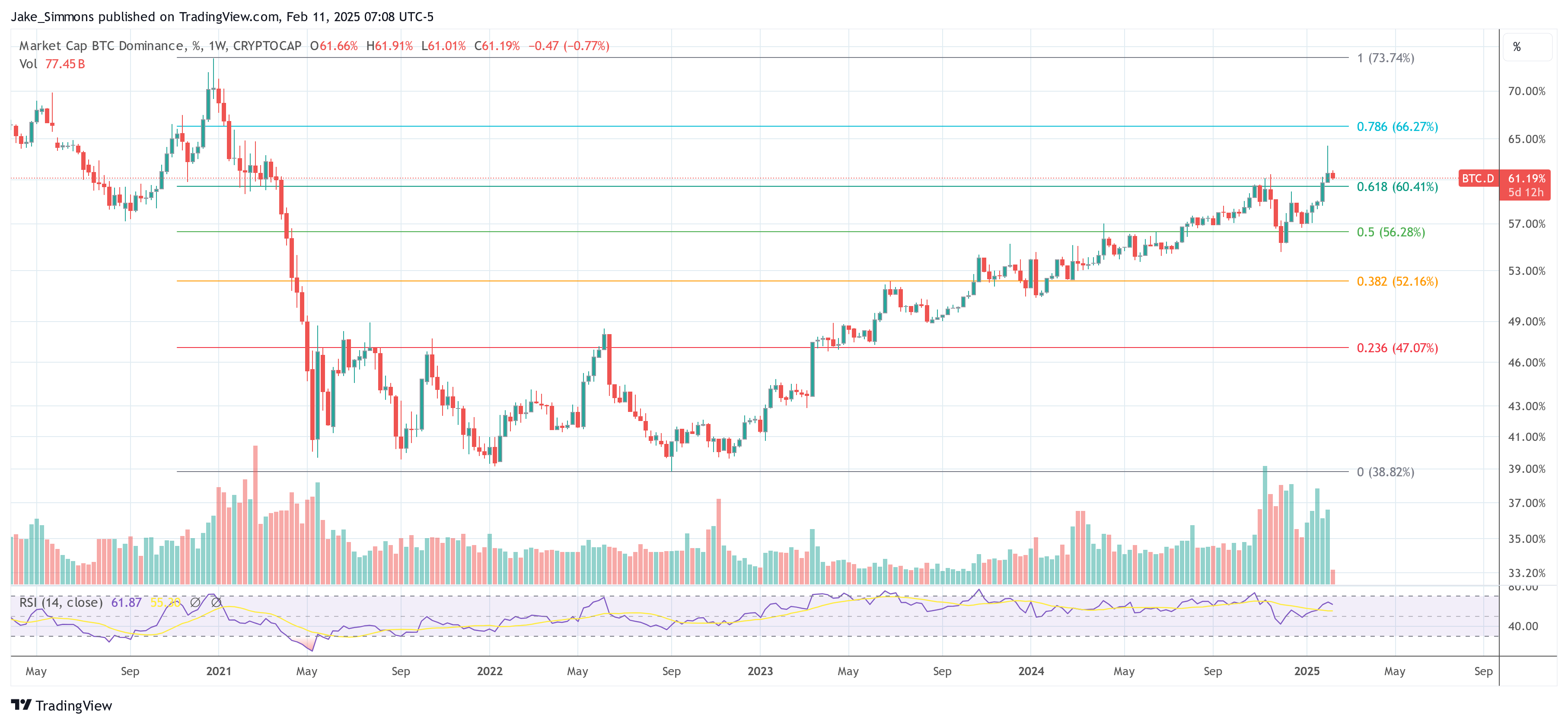

Bitcoin’s dominance is surging, hitting its highest point since March 2021. This has one expert predicting a massive short squeeze could be on the horizon, sending Bitcoin’s price soaring.

A Historic Shift in Bitcoin’s Market

Joe Consorti, Head of Growth at Theya, points out a significant change in Bitcoin’s market behavior. For the first time in its history, both Bitcoin’s price and its market dominance are rising simultaneously. Historically, as Bitcoin’s price rose, speculation would shift to other cryptocurrencies (altcoins), causing Bitcoin’s dominance to fall. This time, it’s different.

Consorti argues that institutional investors and long-term holders are now driving Bitcoin’s price, largely ignoring altcoins. This is a major shift from previous cycles driven by retail speculation.

The Altcoin Market in Crisis

The recent market turmoil saw a massive liquidation event, wiping out over $2.16 billion in positions in just 24 hours. Ethereum took the biggest hit. Consorti sees this as the beginning of the end for many altcoins, describing the situation as the “altcoin casino” collapsing. He argues that altcoins have relied on hype and narratives, none of which have proven sustainable in the long run. Bitcoin, on the other hand, he says, needs no hype; its value is inherent in its design.

Consorti also points to the failure of Ethereum’s “merge” to deliver on its deflationary promises as evidence of the weakness in altcoin narratives.

Government Recognition of Bitcoin’s Uniqueness

Consorti highlights the evolving government stance on Bitcoin, citing statements from Senator John Boozman and White House AI & Crypto Czar David Sacks. The shift in language from a “National Digital Asset Stockpile” to a potential “Strategic Bitcoin Reserve” suggests a growing recognition of Bitcoin’s unique position in the crypto market.

The Looming Short Squeeze

With funding rates on Bitcoin futures deeply negative, Consorti believes a short squeeze is imminent. Many traders are betting against Bitcoin, and if the price moves against them, a wave of forced buybacks could send the price skyrocketing. This is especially likely given the current low market liquidity. In essence, the massive short positions could trigger a rapid price increase as traders scramble to cover their bets. The longer this situation persists, the more powerful the potential short squeeze could be.