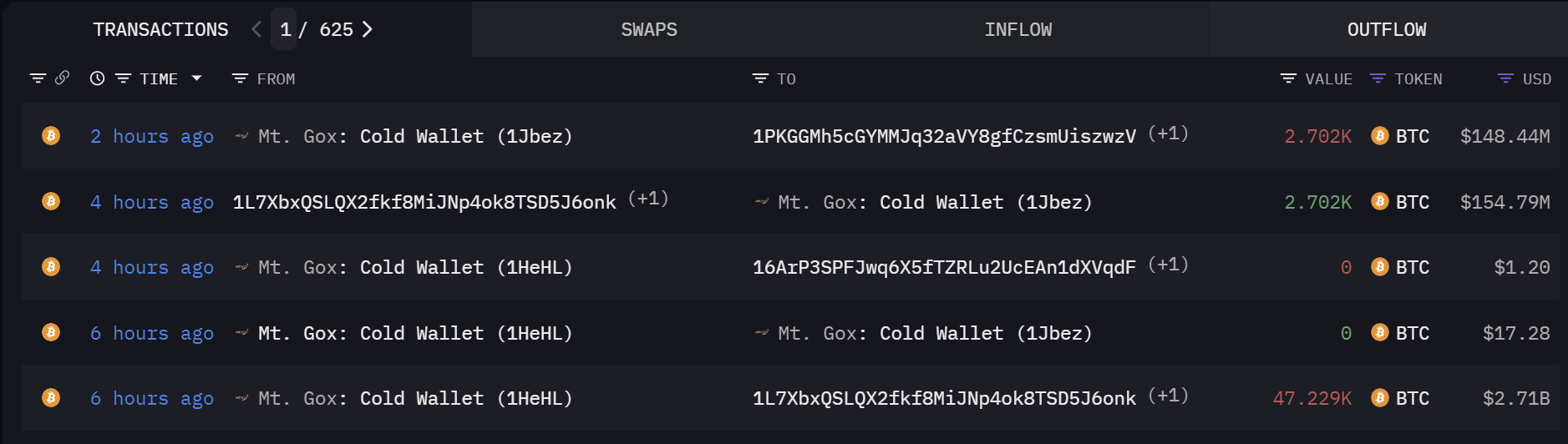

Mt. Gox’s Bitcoin Repayments

Mt. Gox, a bankrupt crypto exchange, is distributing 142,000 BTC to its creditors. This has raised concerns as creditors may sell their BTC, potentially flooding the market and driving down prices.

German Government’s Bitcoin Sales

The German government has started selling its Bitcoin holdings. This move has made investors nervous as a large-scale sell-off could further depress prices.

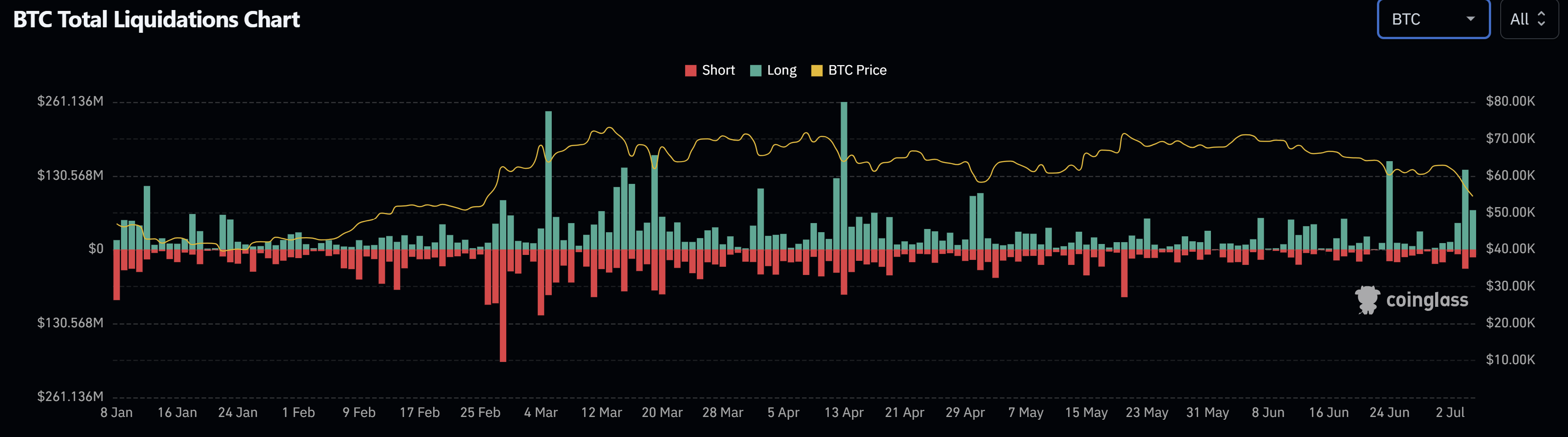

Massive Long Liquidations

Traders have been liquidating their long positions in Bitcoin, leading to a sharp decline in the market. This is a sign of overleveraging and can trigger a chain reaction of sell-offs.

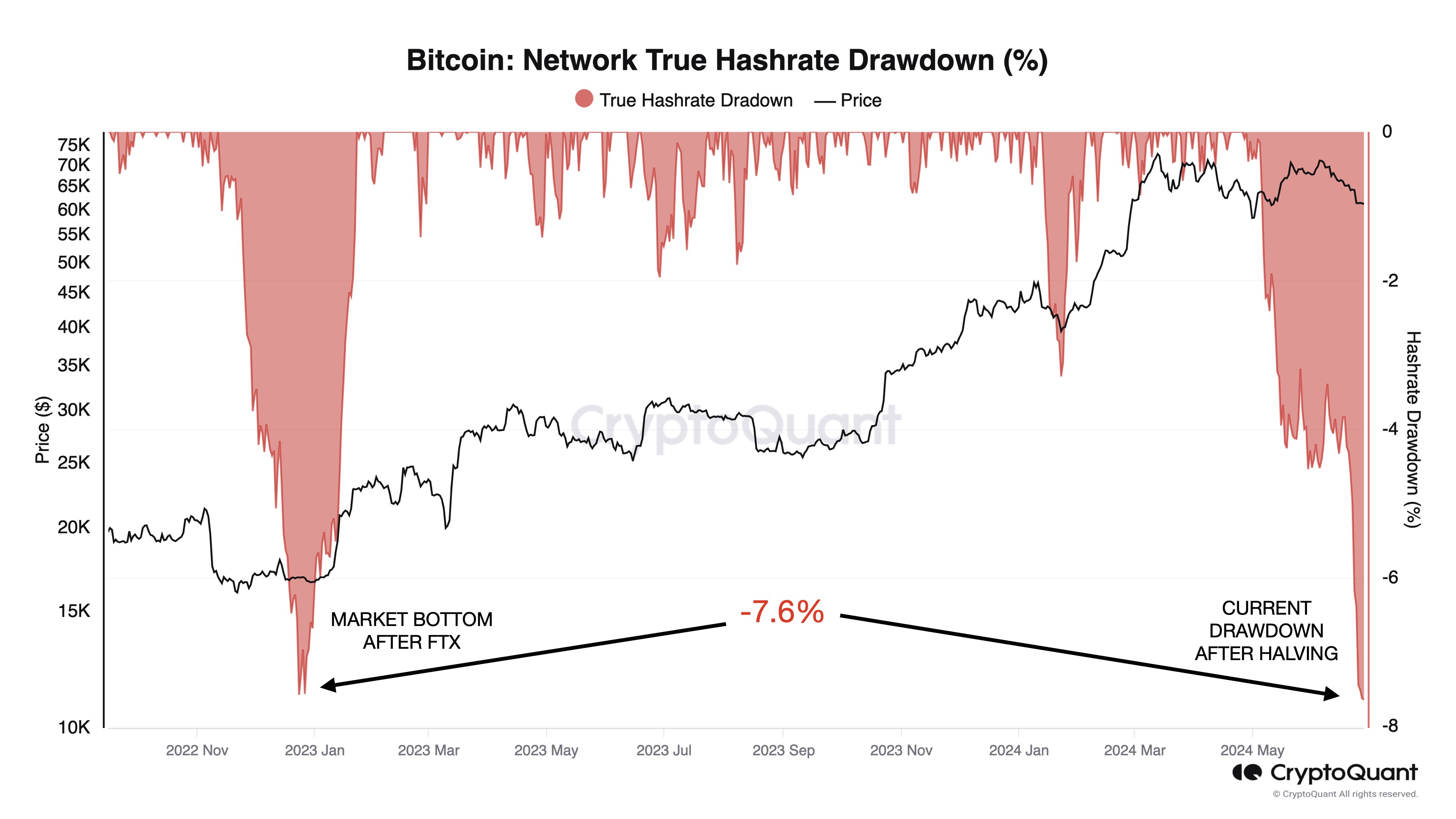

BTC Miner Capitulation

After the Bitcoin halving in 2024, miners have faced increased economic pressures. They are now selling off their BTC, contributing to the downward trend.

Slowdown in US Spot Bitcoin ETF Activity

The anticipated influx of institutional money through spot Bitcoin ETFs has not materialized. This has dampened enthusiasm and slowed down ETF activity.

Additional Factors

- Long-term BTC holders have been selling off their holdings, adding to the downward pressure.

- Bitcoin is currently trading at $54,434.