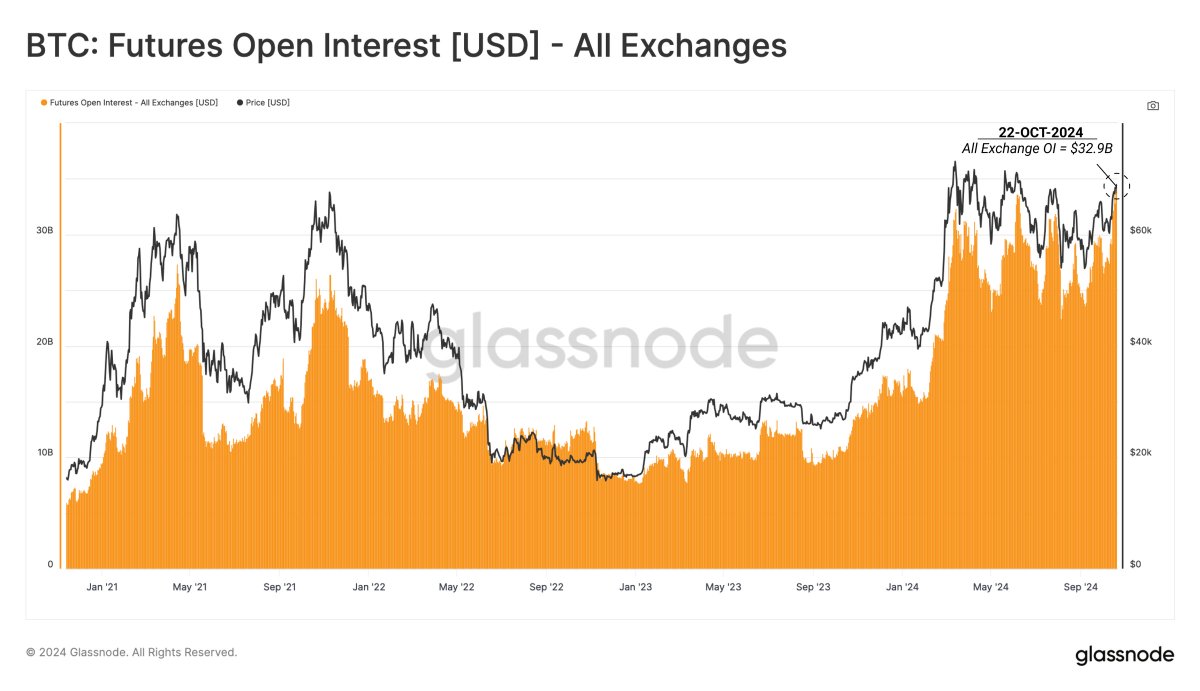

Bitcoin’s open interest has been making headlines lately. It’s a measure of how much money is being bet on Bitcoin’s future price, and it’s been hitting record highs.

What Does Open Interest Mean?

Open interest tells us how much money is tied up in Bitcoin futures contracts. These contracts are basically bets on whether the price of Bitcoin will go up or down. When open interest goes up, it means more people are betting on Bitcoin, and there’s more potential for big price swings.

Bitcoin Open Interest Reaches a New High

Data from Glassnode shows that Bitcoin’s open interest has hit a new all-time high of $32.9 billion. This means there’s a lot of money being put into Bitcoin futures contracts right now.

What Does This Mean for Bitcoin’s Price?

It’s hard to say for sure what this means for Bitcoin’s price. But historically, when open interest is high, Bitcoin’s price can be more volatile. This means it could go up or down quickly.

Bitcoin’s Recent Price Action

Bitcoin has been struggling a bit in October. It had a good run in the previous week, but it hasn’t been able to keep up that momentum. Right now, it’s trading just below $67,000, down about 2% in the past 24 hours.

The Bottom Line

With Bitcoin’s open interest at a record high, there’s a lot of potential for volatility in the market. It’s going to be interesting to see what happens to Bitcoin’s price in the coming weeks.