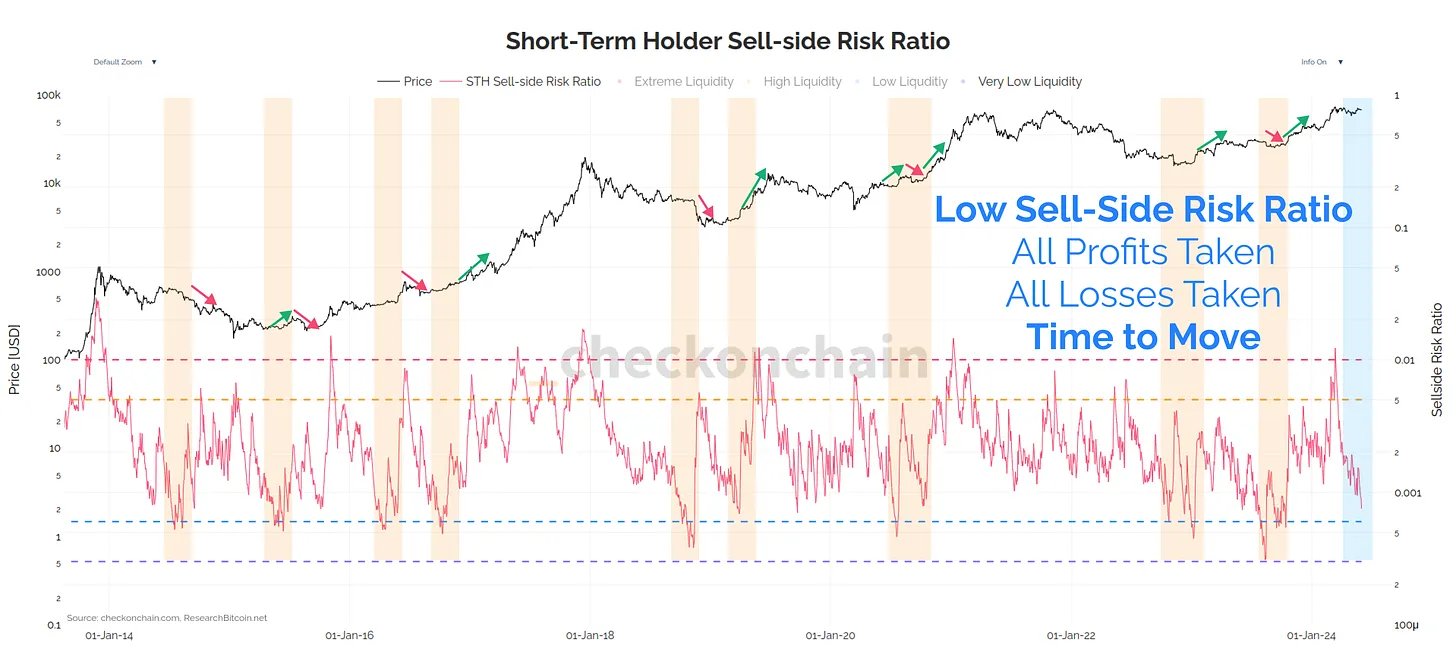

On-chain analyst Checkmate is predicting a major price move for Bitcoin (BTC) after months of consolidation.

Declining Sell-Side Risk

Checkmate analyzed the sell-side risk ratio for short-term holders (those holding BTC for less than 155 days) and found it rapidly declining. This indicates that sellers are losing their leverage.

Bond Market Watch

Checkmate is also monitoring the US bond market, specifically the 10-year yield (US10Y). He believes that if the US10Y approaches 5%, it could create a negative environment for Bitcoin and cryptocurrencies.

Past Correlation

In the past, when US10Y yields approached 5%, Bitcoin and other risk assets experienced significant sell-offs. However, these sell-offs were often followed by rallies.

Potential Catalyst

Checkmate suggests that a rise in US10Y yields could trigger the next big Bitcoin move. If yields continue to climb, it could create uncertainty and reduced risk tolerance, potentially leading to a sell-off in Bitcoin.

Current Market Conditions

At the time of writing, US10Y is hovering around 4.394%, while BTC is trading at $68,643.