Over the past few years, Bitcoin has captured the attention of institutional investors, leading to a surge in the number and capitalization of publicly traded Bitcoin mining companies, with heavyweights like BlackRock joining the fray.

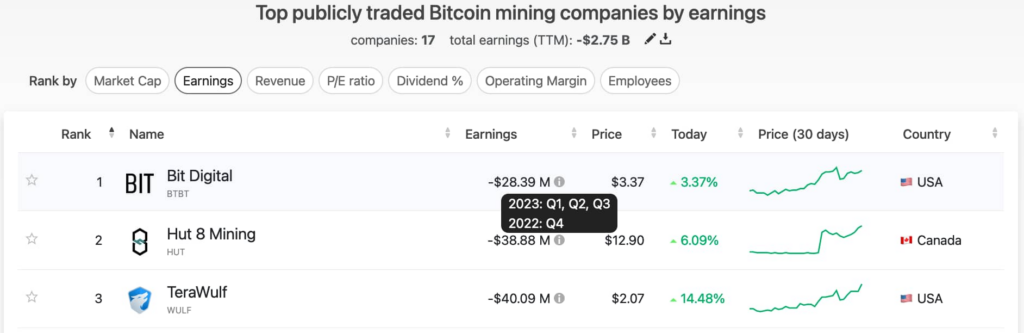

Despite this growing interest, the sector faces significant hurdles. Recent data indicates a collective loss of $2.75 billion across 17 companies. Bit Digital (NASDAQ: BTBT) stands out as the “most profitable” among them, despite a striking loss of $28.39 million since the fourth quarter of 2022. With a market capitalization of $300 million, BTBT’s financial situation reflects the broader challenges in the industry.

Financial Struggles of the Leading Bitcoin Mining Firms

The top three players in this domain — Marathon Digital Holdings (NASDAQ: MARA), Riot Blockchain (NASDAQ: RIOT), and Hut 8 Mining (NASDAQ: HUT) — also depict a grim financial picture. They have market caps of $4.85 billion, $3.52 billion, and $2.86 billion, respectively, yet they’ve amassed considerable losses. MARA leads with a loss of $380 million, followed by RIOT at $300 million, and HUT with $38.88 million in losses.

The Complexities of Bitcoin Mining

Bitcoin mining is an intense, high-stakes arena where the winner takes it all. About every 10 minutes, one entity succeeds in mining a block and reaps the rewards. However, the cost of mining increases with more competition, as miners need a higher hashrate (and thus incur higher costs) to maintain the same probability of mining a successful block.

Once a block is mined, the real challenge for these companies is to sell the acquired Bitcoin at a profit to cover their expenses. The profitability of Bitcoin mining companies hinges heavily on the fluctuating price of Bitcoin and the level of centralization in the industry. This centralization not only impacts Bitcoin’s perceived value but also its security, creating a complex situation that these companies need to navigate.

Please note, this content is not intended as investment advice. Investment in this field involves risks and the possibility of losing capital.