Miner Exodus

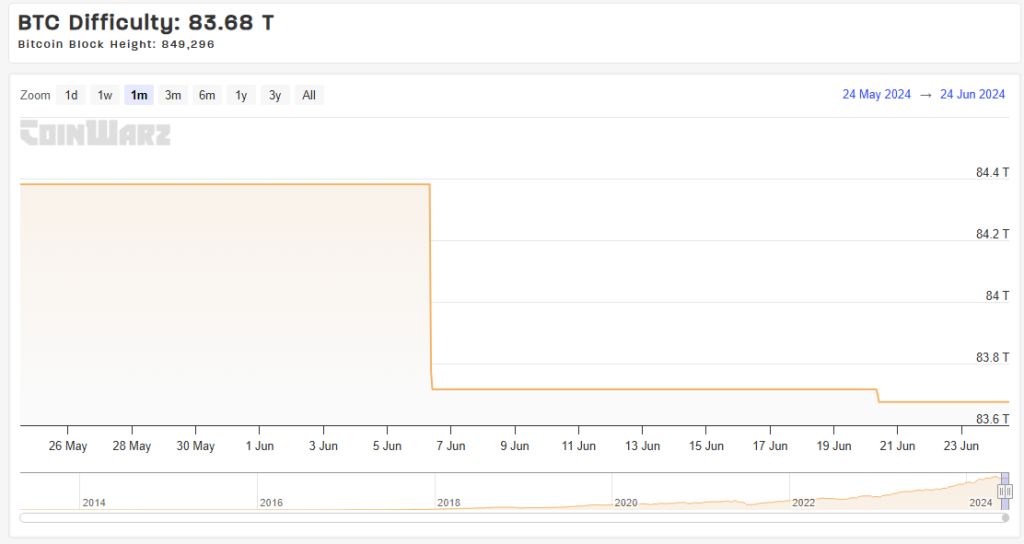

Since the Bitcoin halving in April, miners have seen their earnings cut in half. This, combined with low revenue, has led to a mass exodus of miners, especially those with less efficient equipment.

Impact on Bitcoin Price

The sell-off of over 30,000 BTC by miners has contributed to Bitcoin’s price drop to around $61,000.

Network Security Concerns

The exodus raises concerns about network security. Some argue that it’s a necessary shakeout, weeding out weaker miners and strengthening the overall security. However, it could also lead to increased energy consumption as larger, more efficient miners take over.

Environmental Impact

The exodus of less efficient miners may have environmental benefits, as they often rely on fossil fuels. However, the remaining miners may require more energy to maintain network security.

Institutional Investment

Despite the miner exodus, institutional investment in Bitcoin has surged, with Blackrock now managing over $20 billion in Bitcoin assets.

Future Outlook

The coming weeks will be crucial for Bitcoin. The potential approval of Ethereum ETFs could boost investor interest, but continued miner capitulation and ETF outflows could further pressure the price.