Amidst the recent crypto market downturn, Bitcoin miners are reportedly exploring alternative cryptocurrencies to hedge against the falling prices.

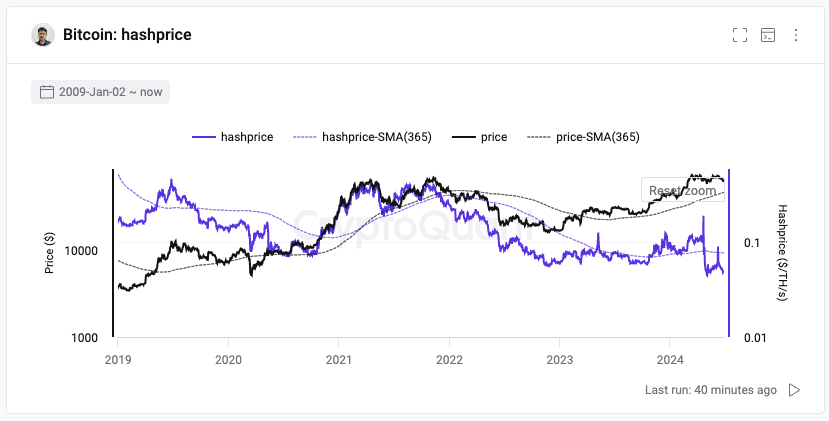

Hashprice Hits Record Low

According to Ki Young Ju, CEO of CryptoQuant, Bitcoin’s hashprice has reached an all-time low. This metric measures the expected earnings from a given amount of hashing power. The low hashprice is discouraging investments in mining rigs, prompting miners to seek more cost-effective options.

Miners Capitulate, But Long-Term Outlook Remains Bullish

Ju suggests that the trend indicates a capitulation among miners, a sign that often precedes a Bitcoin bull run. However, he emphasizes that miners are not bearish in the long term. They are simply hedging their bets and waiting for market conditions to improve.

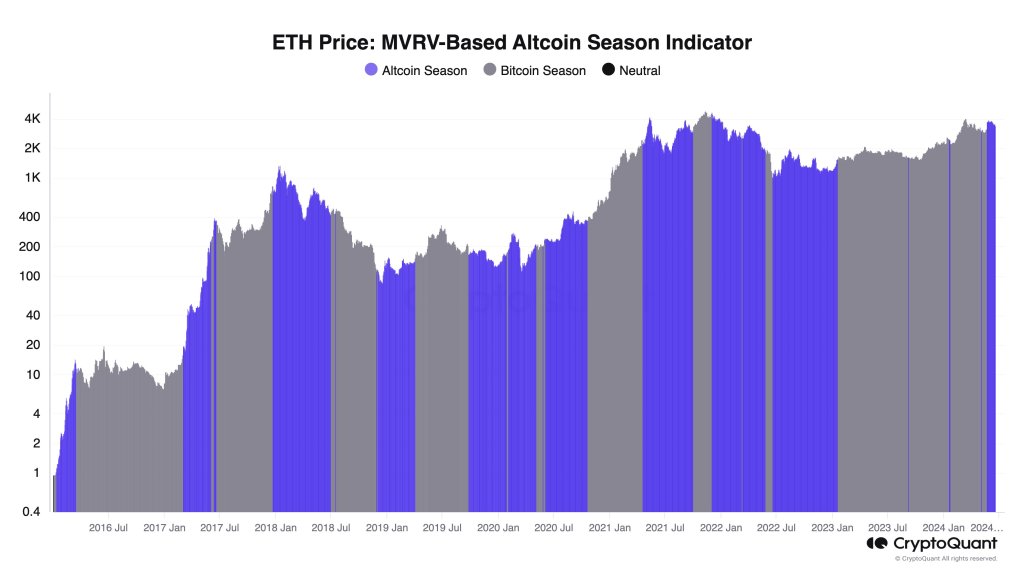

Altcoin Season Emerges

Ju also notes that Ethereum’s Market Value to Realized Value (MVRV) indicator is signaling the start of an altcoin season. This indicator suggests that Ethereum is undervalued relative to its on-chain fundamentals. Historically, when Ethereum surges, other altcoins tend to follow.

Conclusion

As Bitcoin mining becomes less profitable, miners are shifting to alternative proof-of-work coins to minimize their losses. This trend is a sign of the current market uncertainty but does not necessarily indicate a long-term bearish outlook for Bitcoin. Meanwhile, the altcoin market is showing signs of heating up, with Ethereum leading the charge.