Bitcoin’s price has been stuck between $100,000 and $102,000 lately, showing less upward movement than expected in the final month of 2024. While it briefly broke $100,000 earlier in December, the overall bullish momentum seems to have slowed.

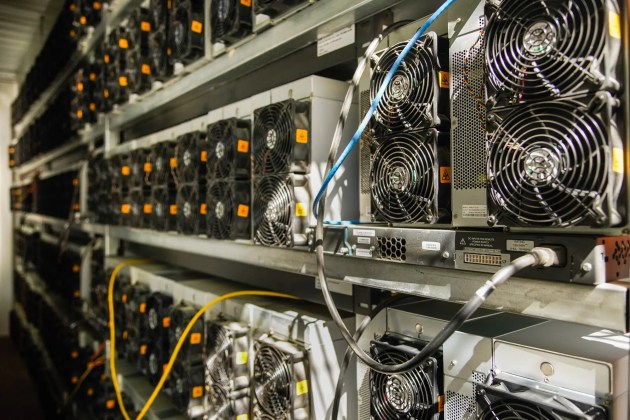

Miners Dump Billions in Bitcoin

Adding to the uncertainty, Bitcoin miners have been selling off a huge chunk of their holdings. According to crypto analyst Ali Martinez, they’ve offloaded over 140,000 BTC (worth about $13.72 billion!) in December alone. This drops their total holdings from roughly 2.08 million BTC to 1.95 million BTC.

This massive sell-off is usually a bad sign, potentially putting downward pressure on the price if the supply exceeds demand. While miners might sell to cover costs, this scale suggests possible financial trouble or even a “miner capitulation” – a mass sell-off often seen during prolonged bear markets. Surprisingly, the Bitcoin price hasn’t reacted dramatically yet, only seeing minor dips.

A Bullish Prediction?

On the other hand, analyst Egrag Crypto on X is still bullish, predicting Bitcoin will hit $176,000 in this bull cycle. They used Fibonacci levels to make this prediction, which they made before Bitcoin’s November rally. Their forecast involves Bitcoin first hitting $105,000, then $130,000, before finally reaching $176,000. They also predict a future bear market, with Bitcoin potentially falling to between $33,000 and $44,600.

Bitcoin’s November rally. Their forecast involves Bitcoin first hitting $105,000, then $130,000, before finally reaching $176,000. They also predict a future bear market, with Bitcoin potentially falling to between $33,000 and $44,600.

Current Market Snapshot

At the time of writing, Bitcoin is trading around $101,870, up slightly over the past week. However, trading volume is down significantly (by 36.10%). Only time will tell if the miners’ sell-off will trigger a price crash or if Egrag Crypto’s bullish prediction will come true.