Bitcoin miners are significantly scaling back their activity, according to recent data. This could have interesting implications for the future of Bitcoin’s price.

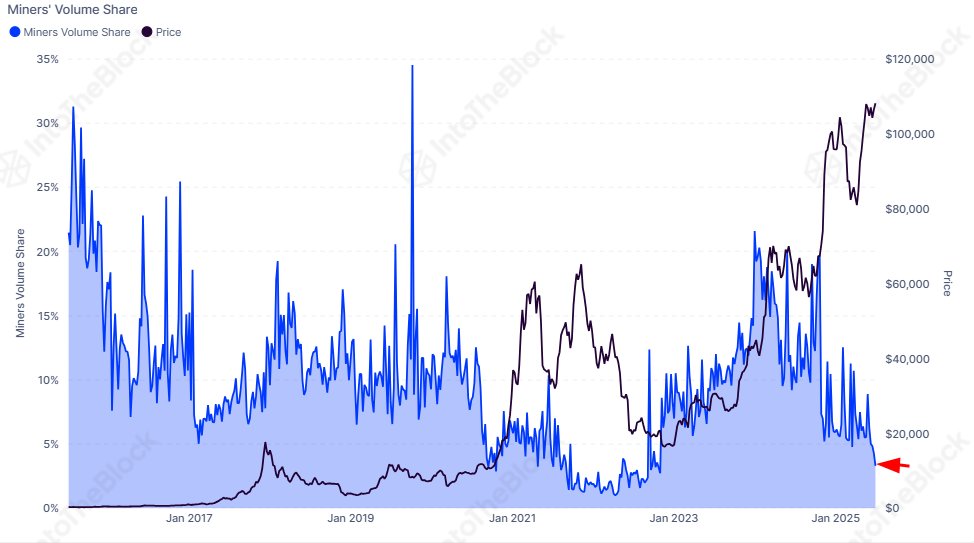

Miner Activity at a Multi-Year Low

Data shows that the percentage of Bitcoin transactions coming from miners has plummeted. This “miner volume share” is currently at its lowest point since November 2022, a level not seen since the bottom of the bear market. Last year, miners were much more active, sometimes accounting for as much as 20% of all transactions. Now, that number is down to a measly 3.3%.

This reduced activity might mean miners aren’t eager to sell their Bitcoin. However, it’s still too early to say for sure how this will affect the price of Bitcoin.

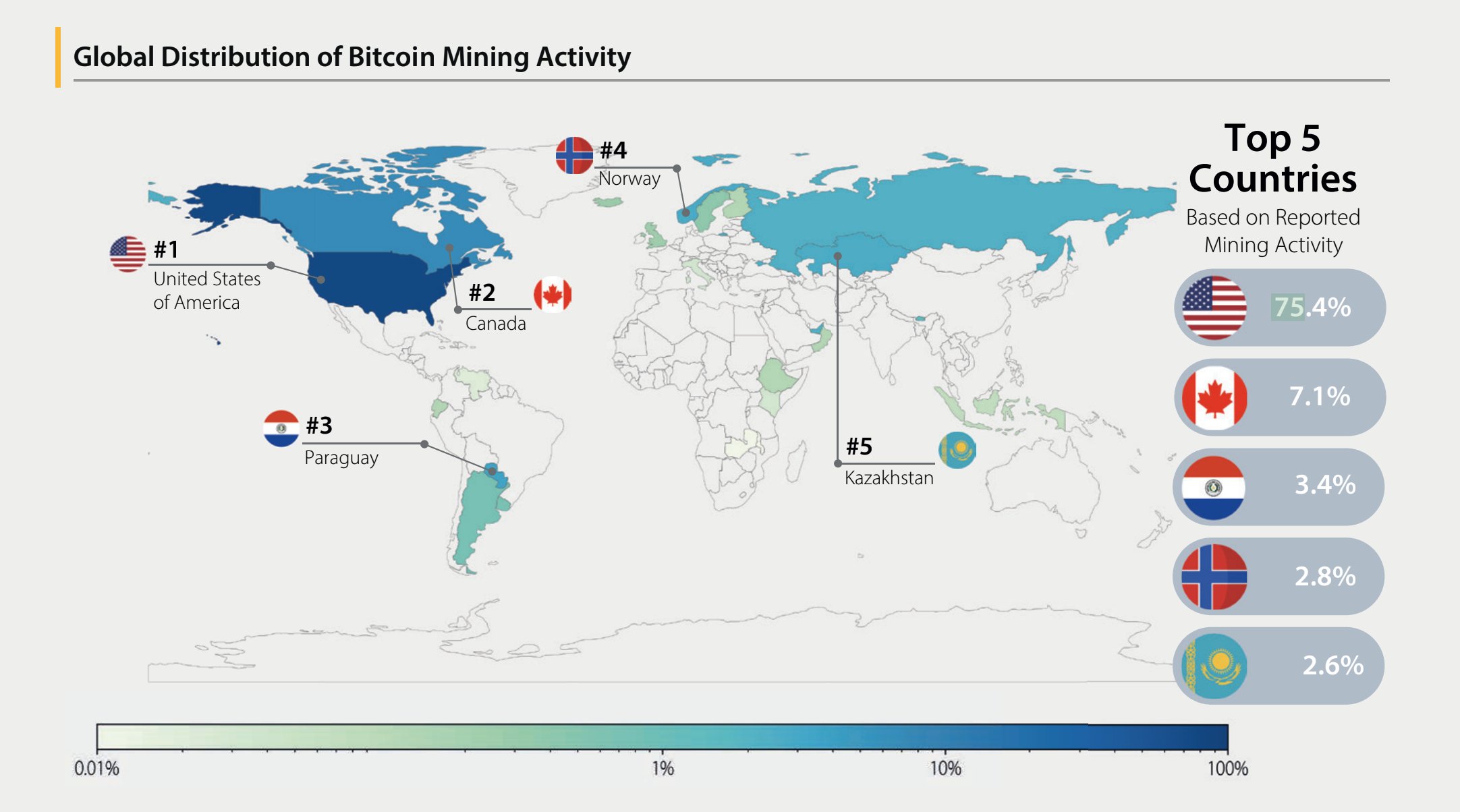

The US is Now the Top Bitcoin Mining Hub

A new report reveals a major shift in the Bitcoin mining landscape. The US now accounts for a whopping 75% of all reported mining activity. This is a dramatic change from just four years ago when China held the top spot, before a government ban forced miners to relocate. One analyst even declared that Bitcoin is now officially “Made in America.”

The report also confirmed the average electricity cost for miners: $45 per megawatt-hour (MWh). This cost, representing 80% of miners’ expenses, is a key factor in determining Bitcoin’s production cost. This information is valuable for predicting potential buying opportunities.

Bitcoin Price Remains Stable

Despite the decreased miner activity, the price of Bitcoin is currently hovering around $108,800, showing relatively little movement.