Bitcoin’s price recently hit a three-month high, and things are looking good. But what’s really interesting is what Bitcoin miners are doing.

Miners Are Holding Onto Their Bitcoin

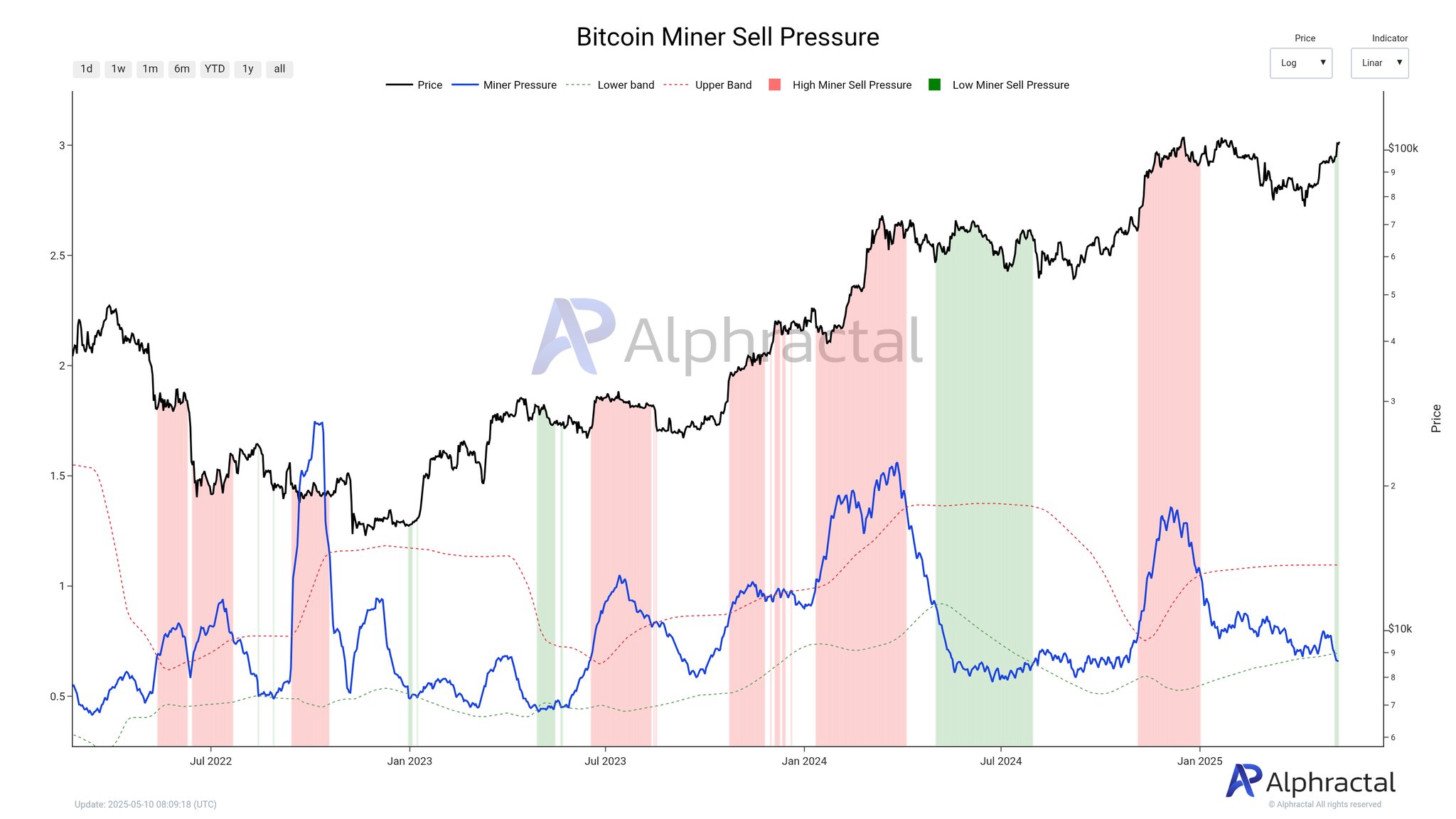

Recently, Bitcoin miners have been holding onto their mined Bitcoin instead of immediately selling it. This is a significant shift, especially considering their past reactions. This change in behavior suggests increased confidence in Bitcoin’s future price.

The Miner Sell Pressure Metric: A Key Indicator

A metric called “Miner Sell Pressure” tracks how much Bitcoin miners are selling. High selling pressure (red on the chart) usually means a weak market. Low selling pressure (green) is generally a positive sign. Currently, this metric is at its lowest point since 2024 – a very bullish signal.

This means miners are accumulating their rewards rather than dumping them on the market. This is a significant change from their behavior in previous periods.

What Does This Mean for Bitcoin’s Price?

While miners’ selling doesn’t have the same massive impact on the market as it once did, consistently low selling pressure is usually good news for Bitcoin’s price. It suggests a belief that the price will continue to rise. However, it’s important to remember that this could change as the price fluctuates.

Bitcoin Price Update

At the time of writing, Bitcoin is trading around $104,250, up over 1% in the last 24 hours.