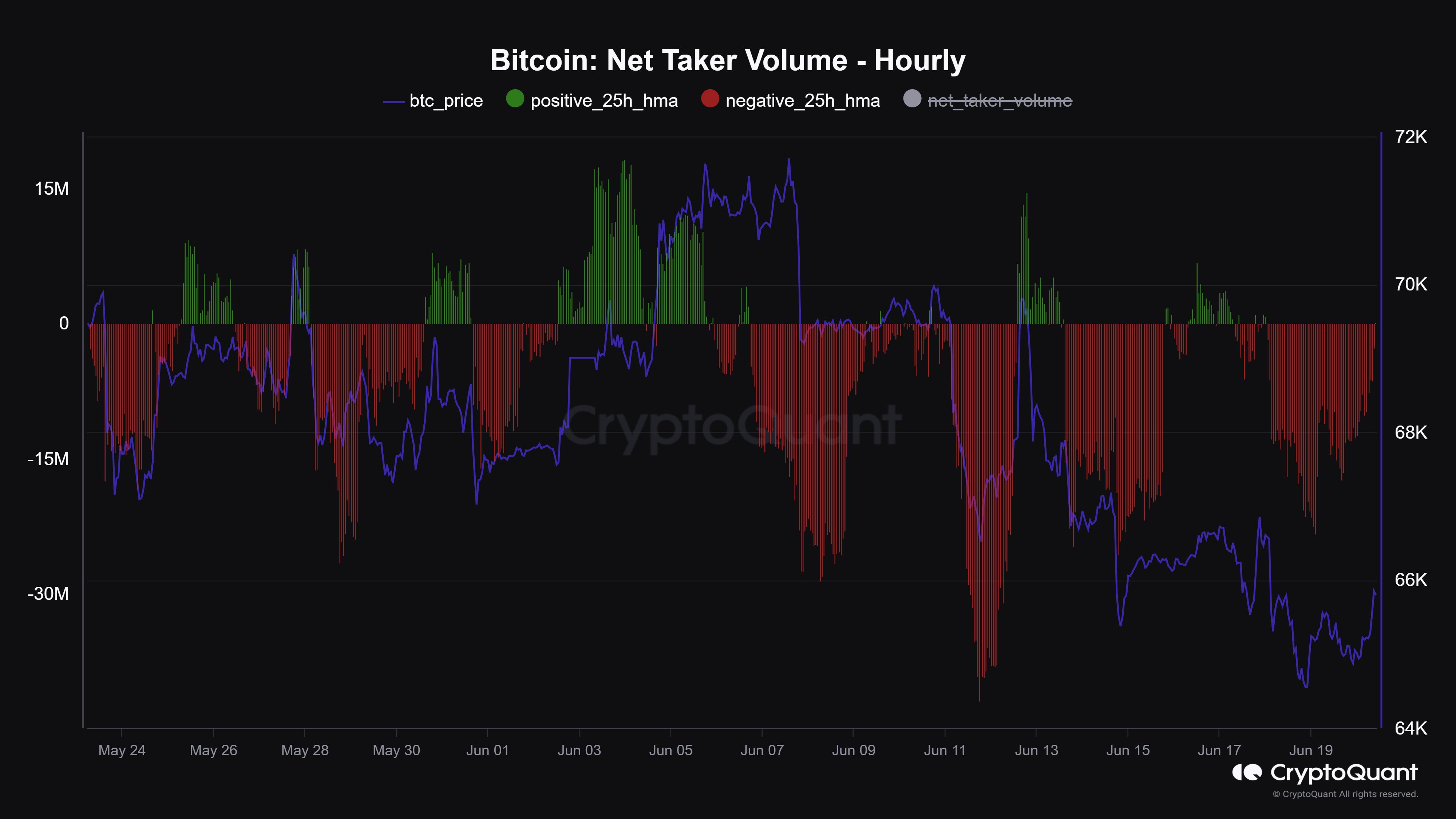

Negative Net Taker Volume

The Bitcoin Net Taker Volume, which measures the difference between taker buy and sell volumes, has been mostly negative over the past month. This indicates a lack of strong buying interest in the market.

Dominance of Bearish Sentiment

When the Net Taker Volume is below zero, it suggests that taker sell volume outweighs taker buy volume, indicating a bearish sentiment among traders. This has been the case for most of the past month.

Impact on Price

Historically, positive Net Taker Volume has coincided with price increases for Bitcoin. Conversely, negative Net Taker Volume has been associated with price declines. Therefore, a reversal to positive Net Taker Volume may be necessary for a Bitcoin price recovery.

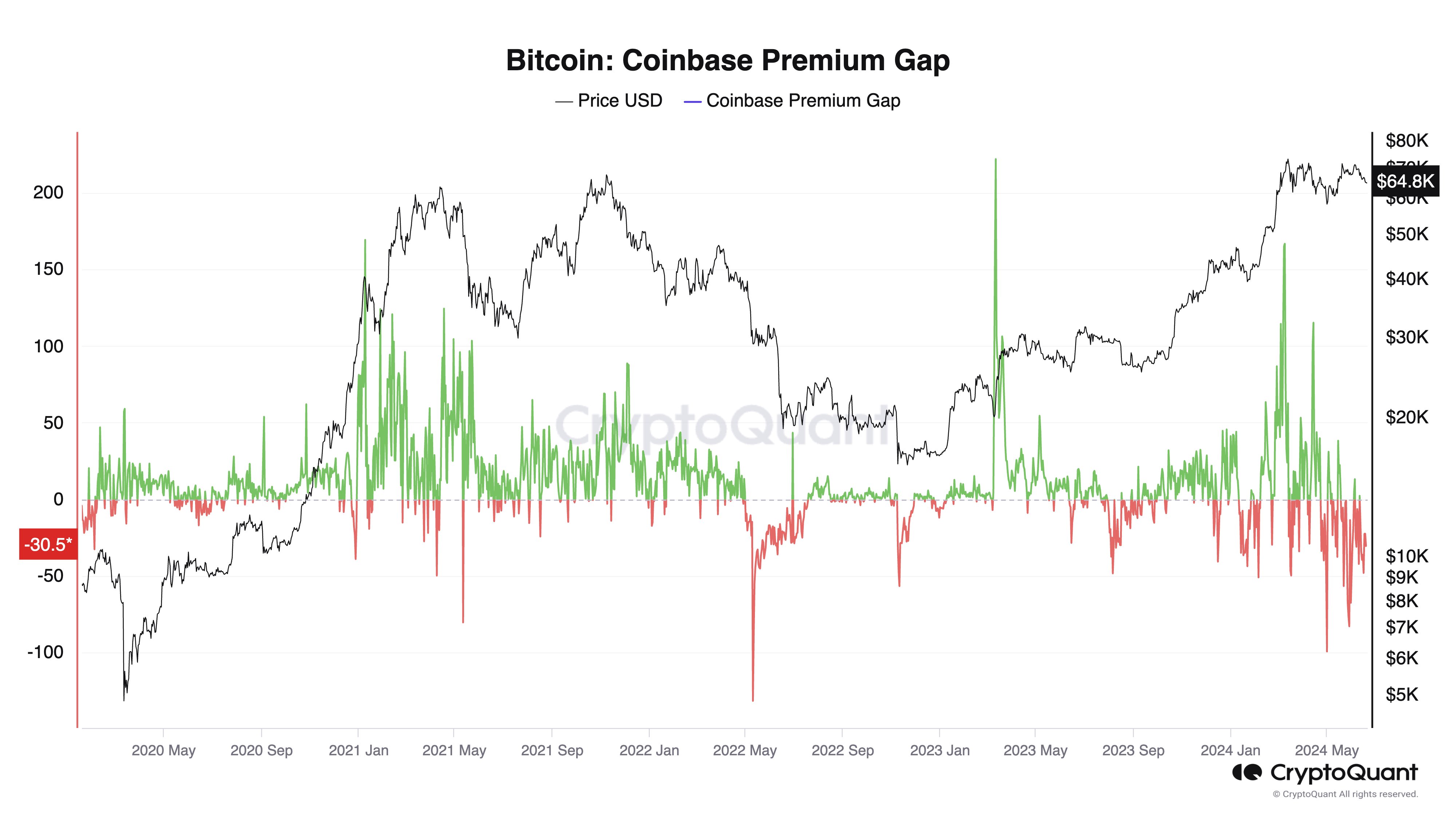

Other Bearish Indicators

In addition to negative Net Taker Volume, the Coinbase Premium Gap has also been negative recently. This indicator measures the difference between Bitcoin prices on Coinbase and Binance. A negative Coinbase Premium Gap suggests that there is more selling pressure on Coinbase than on Binance.

Current Price

As of writing, Bitcoin is trading around $64,800, within a range where it has been consolidating for some time.