The crypto market has been a bit of a rollercoaster lately, and Bitcoin hasn’t been immune to the ups and downs. While many are hoping for a return to the bull market, some on-chain data suggests that things might not be as rosy as they seem.

Selling Pressure in the Bitcoin Market

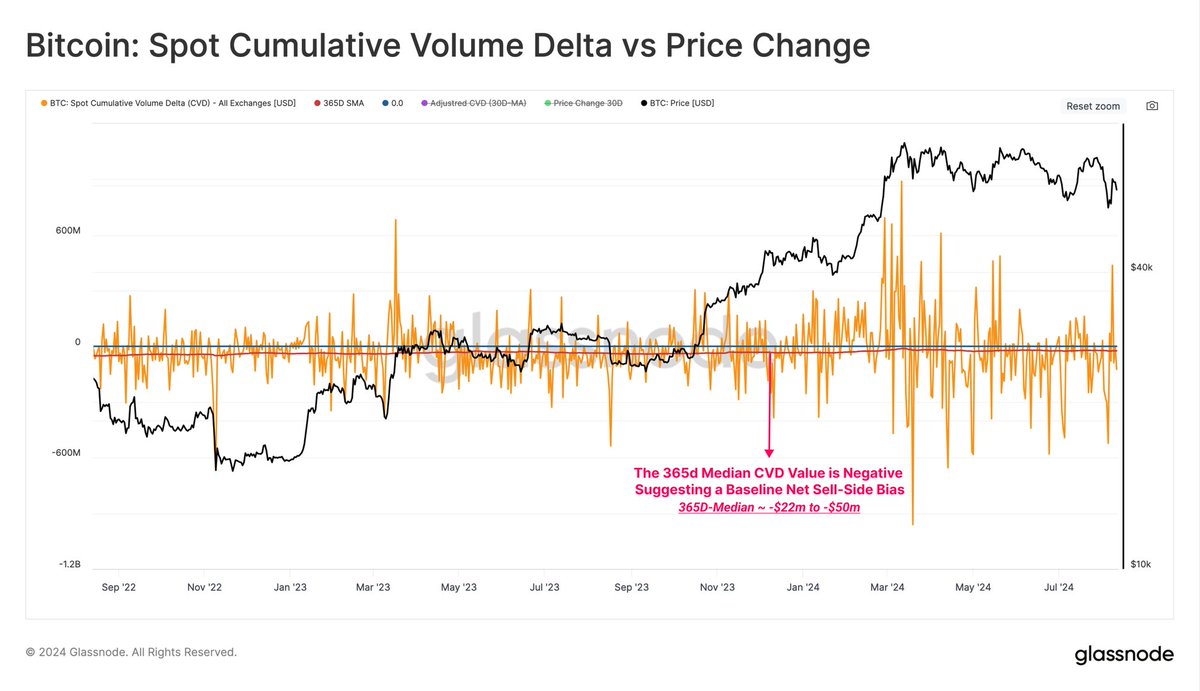

A recent analysis by blockchain data company Glassnode shows that the Bitcoin spot market has been dominated by sellers for the past two years. This is based on the Spot Cumulative Volume Delta (CVD) indicator, which measures the difference between buying and selling volume.

A positive CVD value means that buyers are more active, while a negative value indicates that sellers are in control. For the past two years, the CVD for Bitcoin has been consistently negative, with the median value ranging from -$22 million to -$50 million.

This doesn’t necessarily mean that Bitcoin is doomed, but it does suggest that investors are cautious and not actively buying up the coin.

What Does This Mean for Bitcoin?

While the negative CVD might be a cause for concern, it’s important to remember that it’s just one indicator. The overall market sentiment and other factors also play a role in Bitcoin’s price.

A shift to a positive CVD could signal a change in market sentiment and potentially lead to an increase in Bitcoin’s price. However, it’s difficult to predict how the CVD will change in the future.

Bitcoin’s Current Price

At the time of writing, Bitcoin is trading slightly above $59,000, up more than 2.5% in the past 24 hours. However, this recent bump isn’t enough to erase the losses from the past week, with Bitcoin down over 2% in the last seven days.

While the recent price action might be encouraging, investors should keep an eye on the CVD and other market indicators to get a better understanding of the overall sentiment and potential future price movements.