Bitcoin’s long-term holders, often called “HODLers,” are accumulating Bitcoin again – a big change in how investors feel about the market.

HODLers Scoop Up Bitcoin

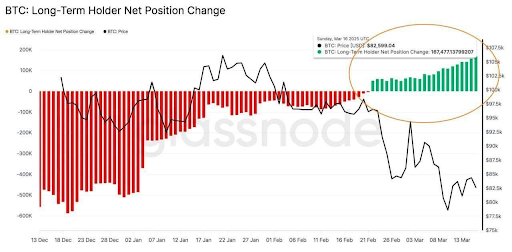

Data from Glassnode shows that the net position of long-term Bitcoin holders has turned positive for the first time in 2025. This means these experienced investors are buying up Bitcoin, taking advantage of recent price drops.

Earlier this month, Bitcoin’s price took a dive, falling from over $90,000 to around $80,000. While this scared off many short-term investors, long-term holders saw it as a great opportunity to buy low. They added over 167,000 BTC, worth almost $14 billion, to their holdings.

Is This the Start of a Bitcoin Price Recovery?

The timing of this buying spree is interesting. It suggests that the recent price drop was mainly caused by short-term investors panicking and selling. This is similar to what happened in August and September 2024, when long-term holders also bought aggressively during a price dip.

It’s not just long-term holders showing confidence. Bitcoin ETFs (exchange-traded funds) have also seen a surge in investment. On March 17th, they received a massive $274.6 million – the biggest single-day inflow in a month. This shows renewed interest from investors.

With Bitcoin currently trading around $83,500, this combination of long-term holder accumulation and increased ETF investment could signal a positive shift in the market.