Bitcoin’s price has been a rollercoaster lately. It dipped to around $91,000 earlier this week due to worries about international trade tensions, then bounced back above $102,000 before settling around $96,000. But here’s the interesting part: while big investors are selling, small investors are buying like crazy.

Small Fish, Big Appetite

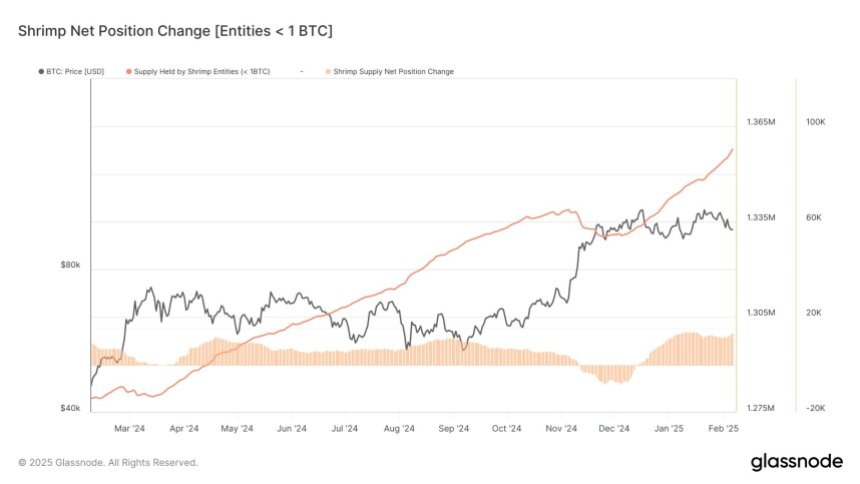

Data shows that small Bitcoin investors (those holding less than one Bitcoin) have been accumulating BTC at a furious pace since mid-December. They’re buying an average of 10,627 Bitcoins per day – that’s a whopping 72% increase compared to last year! This is a big shift from November, when they cashed in some profits as the price soared past $100,000. Their current buying spree suggests they’re pretty confident about Bitcoin’s long-term prospects.

Whale Watching: Massive Sell-Off

On the other hand, the big players – the “whales” holding over 1000 Bitcoins – have been unloading their holdings at an unprecedented rate. Since late November, they’ve been sending an average of 32,509 Bitcoins to exchanges daily. That’s about nine times their usual selling rate! Normally, this kind of massive sell-off would be a bad sign, but the situation is more nuanced.

A lot of this whale selling might just be profit-taking, not necessarily a sign of losing faith in Bitcoin. Plus, the small investors’ buying spree is soaking up a lot of those sold coins, preventing a huge price crash.

The Current Bitcoin Market: A Waiting Game

Currently, Bitcoin is trading around $96,679, down slightly over the past day and week. Trading volume is actually up, though, which suggests people are still interested. The price seems to be stuck between $95,000 and $100,000, waiting for a breakout. If Bitcoin can break through the $105,000 resistance level, that would be a strong signal of a continued upward trend. For now, it all depends on whether the small investors keep up their buying pace.