A popular crypto analyst is sounding the alarm, saying that Bitcoin’s recent price drop might be more than just a temporary dip. He’s pointing to some key indicators that suggest investors are losing interest in the cryptocurrency.

Bitcoin’s Warm Supply Realized Price: A Bearish Sign?

One of the indicators the analyst is watching closely is the “warm supply realized price.” This metric tracks the average price at which Bitcoin was bought by people who held it for between one week and six months.

According to the analyst, Bitcoin staying below this price level, currently around $66,000, could be a signal that a longer bear market is on the horizon. He’s advising Bitcoin bulls to be cautious.

Short-Term Holders: A Resistance Level

Another indicator the analyst is keeping an eye on is the “short-term holder realized price.” This metric tracks the average price at which Bitcoin was bought by people who held it for the past 155 days.

The analyst says this metric is acting as a resistance level for Bitcoin. Since June, Bitcoin has struggled to break above this level, currently around $63,250. Until Bitcoin reclaims this level as support, there’s a risk of continued selling pressure.

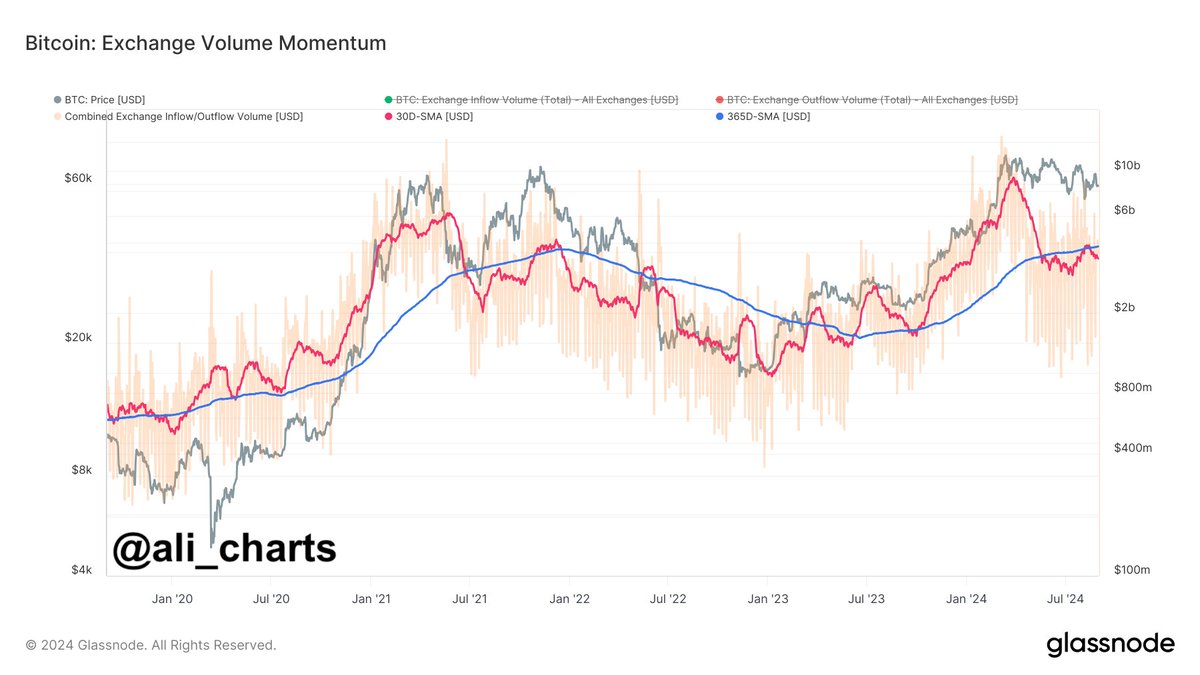

Exchange Volume Momentum: A Drop in Activity

Finally, the analyst is also looking at the “exchange volume momentum indicator.” This metric tracks the average monthly volume of Bitcoin trades on exchanges compared to the yearly average.

The analyst says this indicator shows a sustained drop in Bitcoin trading activity, which usually indicates lower investor interest and decreased network usage.

What’s Next for Bitcoin?

Bitcoin is currently trading around $59,697, up slightly in the past 24 hours. However, the analyst’s warnings suggest that the cryptocurrency might be in for a rough ride. Investors should be cautious and do their own research before making any decisions.