Sentiment Shifts to Neutral

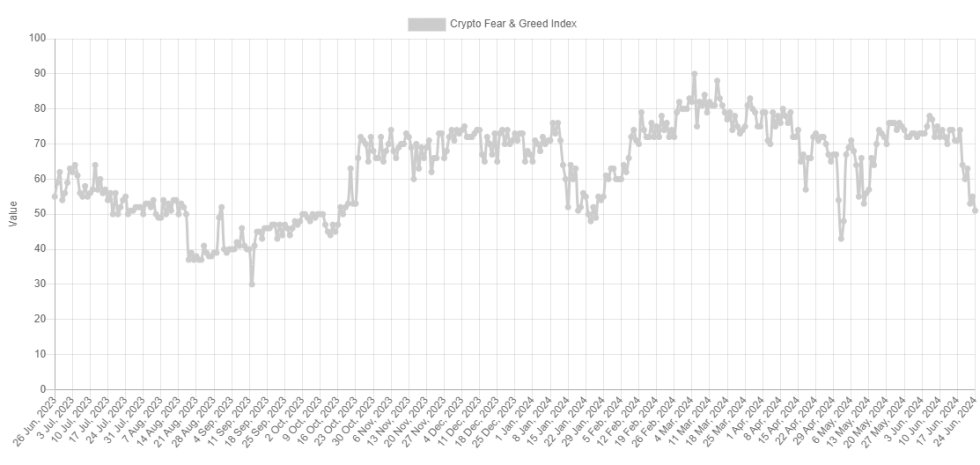

After the recent Bitcoin crash below $61,000, investors have shifted their sentiment from greed to neutral. The Fear & Greed Index, which measures market sentiment, has dropped to 51. This indicates a decrease in greed compared to yesterday’s value of 55.

Bearish Momentum

The drop in sentiment is attributed to the strong bearish momentum in cryptocurrency prices over the past 24 hours. The Fear & Greed Index has been declining steadily over the past week, reflecting the ongoing bearish trend.

Historical Significance of Greed Zone

Historically, the extreme greed zone (above 75) has been a turning point for Bitcoin. When the index enters this zone, it often signals a potential price correction. The recent decline in the index suggests that investors are becoming less optimistic about the asset’s short-term prospects.

Extreme Fear and Bull Markets

While extreme greed can lead to corrections, extreme fear (below 25) can indicate a potential bottom for Bitcoin. However, during bull markets, the index tends to remain in or near the greed zone.

Current Price

At the time of writing, Bitcoin is trading around $60,300, down over 10% from last week. While the sentiment has not yet reached extreme fear, the shift to neutral could be a positive sign for the coin’s potential to reverse its decline.