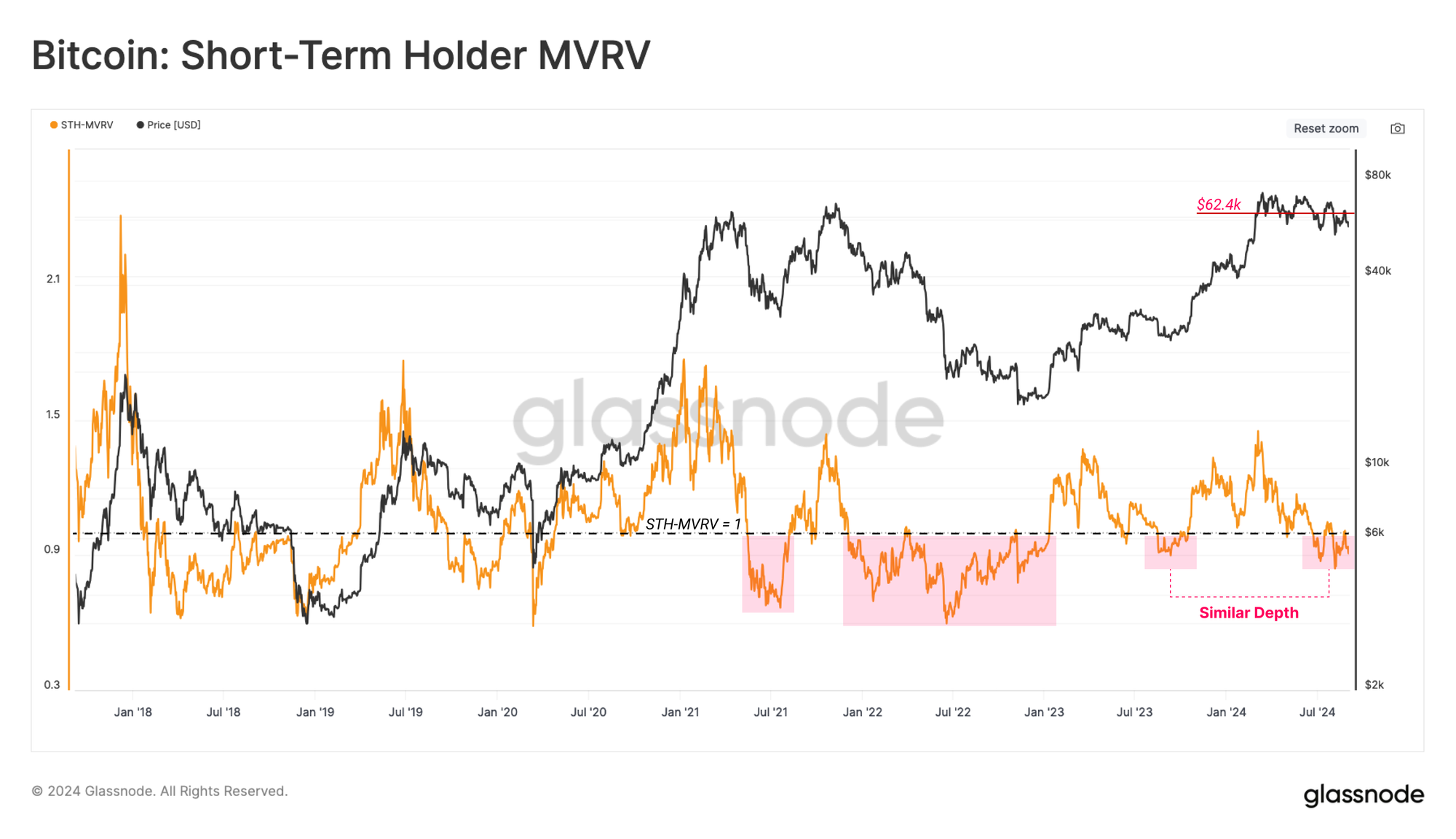

Bitcoin has been on a downward trend lately, and it’s causing some pain for short-term investors. According to data from Glassnode, these investors are currently holding Bitcoin at a loss, which could lead to more volatility in the market.

Short-Term Holders Under Pressure

Glassnode, a cryptocurrency analytics firm, says that short-term Bitcoin holders are “underwater” on their investments. This means they bought Bitcoin at a higher price than it’s currently trading for.

This situation creates a risk for the market because these investors might be tempted to sell their Bitcoin to cut their losses, further driving down the price.

Signs of Potential Volatility

Glassnode points to several factors that suggest the market could become more volatile in the near future.

- High Unrealized Losses: Short-term holders are sitting on significant losses, making them more likely to sell.

- Low Trading Activity: There hasn’t been much buying or selling of Bitcoin recently, indicating a market that’s stuck in a narrow range.

- MVRV Ratio: This ratio compares Bitcoin’s market capitalization to its realized capitalization (the value of all coins at the price they were bought). The current MVRV ratio suggests that new investors are holding Bitcoin at a loss, which could lead to further price declines.

What’s Next for Bitcoin?

Glassnode believes that Bitcoin needs to climb back above $62,400 to ease the pressure on short-term holders. Until then, the market could see more volatility and potential price drops.

It’s important to remember that this is just one perspective on the market. Bitcoin is a volatile asset, and its price can fluctuate significantly. Investors should always do their own research and consider their risk tolerance before making any investment decisions. /p>