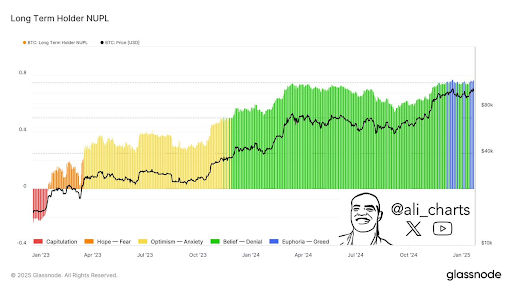

Bitcoin’s long-term holders are feeling pretty greedy these days, according to analyst Ali Martinez. This could be a short-term boost for Bitcoin’s price, but it might not be such good news in the long run.

Greed is Good (For Now?)

Martinez says these experienced holders, having weathered market ups and downs, are now fully embracing greed. They’ve gone from panic selling to cautious hope, then optimism, belief, and now, full-blown greed. This often leads to impulsive buying without much thought.

In the short term, this is bullish for Bitcoin. Increased buying pressure from greedy investors could push the price even higher. We’re already seeing signs of this: the number of wallets holding 100-1000 BTC just hit an all-time high, and big investors (“whales”) are also very active.

The Price Could Crash

However, this extreme optimism could be a problem. If Bitcoin’s price is driven too high, it could become overbought, leading to a massive sell-off and a significant price drop.

This greed is partly fueled by optimism surrounding Donald Trump’s administration and potential plans for a Bitcoin reserve. But, if this reserve doesn’t materialize, Bitcoin could be drastically overvalued.

What to Watch

To keep the positive momentum going, Martinez says Bitcoin needs to stay above $97,530. This is a crucial support level. If it falls below that, things could get ugly.

Another analyst, Crypto Rover, points to $102,000 as a key support level. A break below this could send Bitcoin down to around $98,000.

At the time of writing, Bitcoin is trading around $104,900, up slightly in the last 24 hours. So, for now, the greed is winning. But, it might not last.