Bitcoin’s recent price action has been a rollercoaster, but there’s a glimmer of hope on the horizon. Long-term holders (LTHs) and big investors are starting to buy Bitcoin again, a trend that could signal a bullish future for the cryptocurrency.

The Bullish Signs

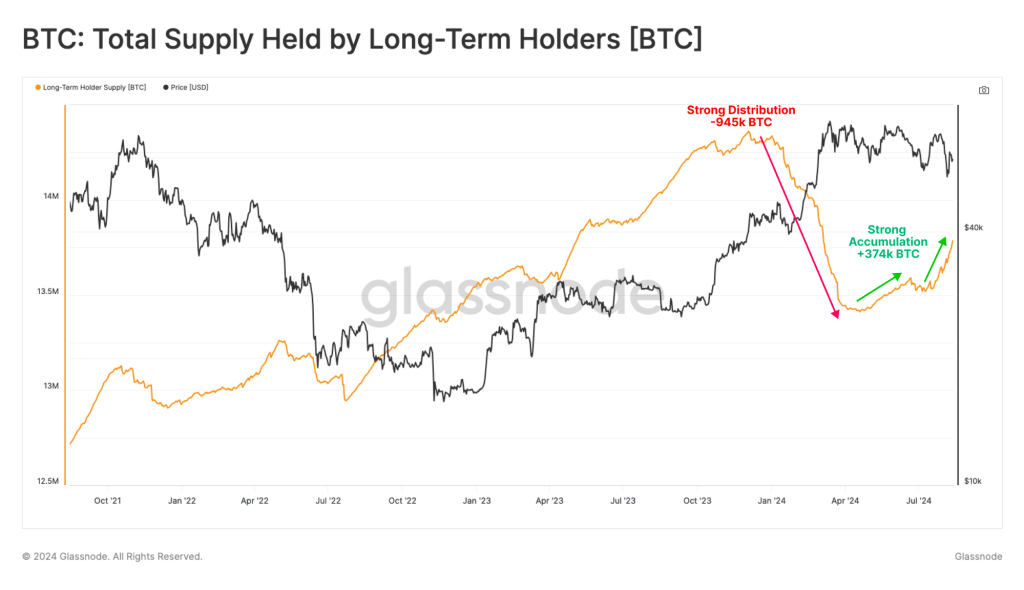

After a period of selling off their Bitcoin, LTHs are now accumulating more coins. This is a big deal because these investors are known for holding onto their Bitcoin for the long haul. They’re not easily swayed by short-term price fluctuations.

Here’s what’s supporting the bullish outlook:

- Accumulation Trend Score (ATS) is at its highest point: This means that investors are buying more Bitcoin than they’re selling.

- LTHs are adding to their holdings: Over the past three months, LTHs have bought about 374,000 Bitcoin.

- Bitcoin’s price is holding above a key support level: This suggests that investors are still optimistic about the future of Bitcoin.

The Bearish Concerns

While the accumulation trend is encouraging, there are still some challenges to consider:

- Spot market demand is weak: This could be holding back Bitcoin’s price from breaking through key resistance levels.

- LTHs are still holding a lot of Bitcoin: This means they could sell off their holdings if the price dips significantly.

The Bottom Line

Despite some lingering concerns, the return to accumulation by Bitcoin holders is a positive sign. It suggests that investors are confident in the long-term future of Bitcoin and are willing to hold on through market volatility. If this trend continues, it could lead to a significant price increase for Bitcoin.