Declining Long-Term Holder Supply

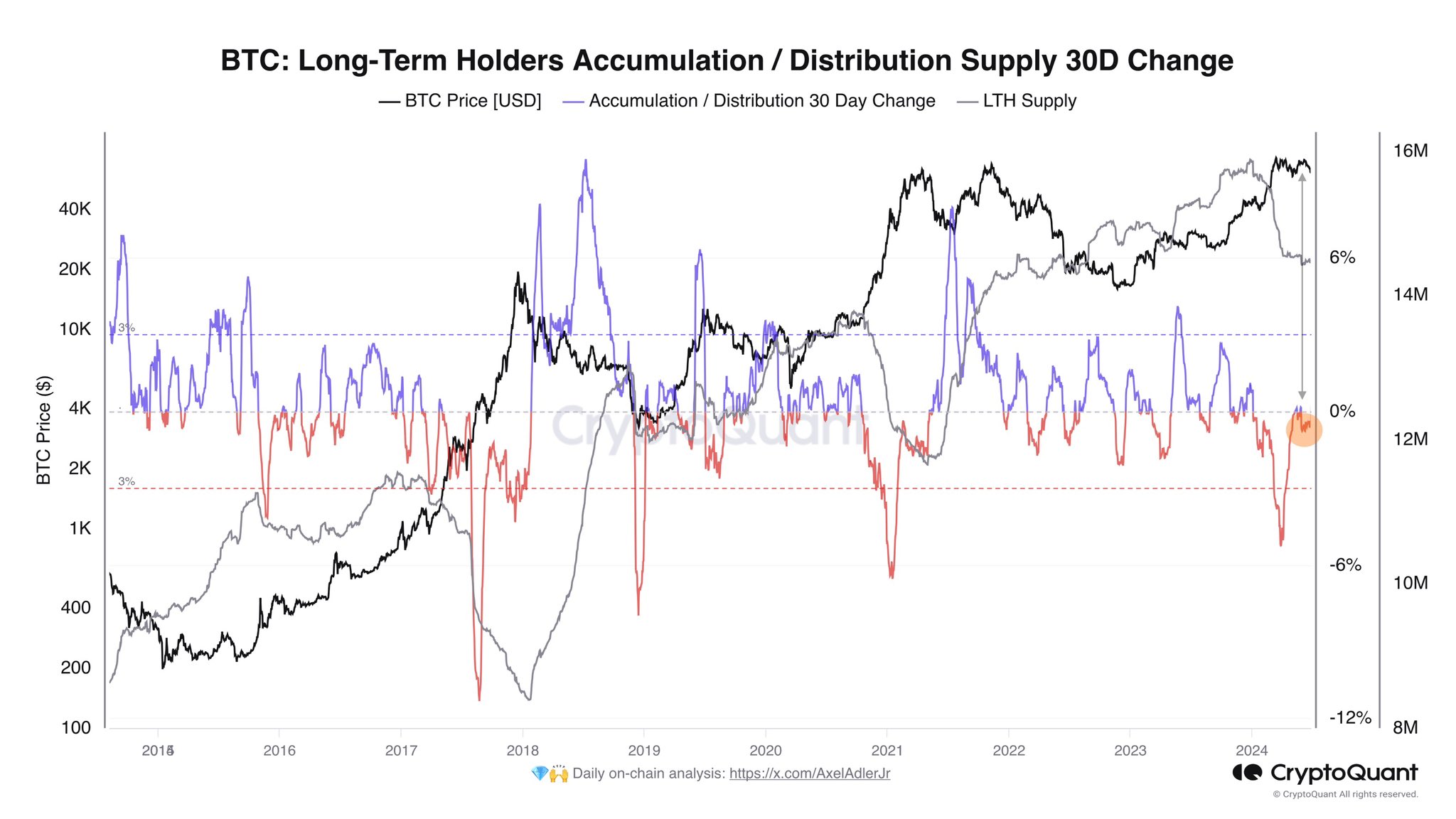

Data from CryptoQuant shows that Bitcoin’s long-term holder (LTH) supply has been decreasing lately. LTHs are investors who have held their coins for over 155 days and are known for their resilience.

Selloff by LTHs

The chart below shows the trend in the total supply held by LTHs and its 30-day change.

[Image of chart showing declining LTH supply]

The sharpest decline occurred during the rally to the all-time high. LTHs typically hold their coins for long periods and accumulate large gains. This selloff suggests that they may have taken profits during the rally.

Continued Decline Despite ETF Approval

Even after the approval of spot exchange-traded funds (ETFs), the LTH supply has continued to decline, albeit at a slower pace. This indicates that fresh selling from older LTHs is offsetting any buying that occurred after the ETF approval.

Market-Wide Pessimism?

The lack of growth in the LTH supply could indicate market-wide pessimism. However, it’s worth noting that LTHs have also participated in selloffs during previous bull runs.

Bitcoin Price

At the time of writing, Bitcoin is trading at around $61,200, down over 4% in the past week.