Glassnode, a cryptocurrency analytics firm, has revealed some interesting insights into Bitcoin investor behavior. It turns out, those who bought Bitcoin at its peak are surprisingly holding on tight.

Long-Term Holders (LTHs): Holding Steady

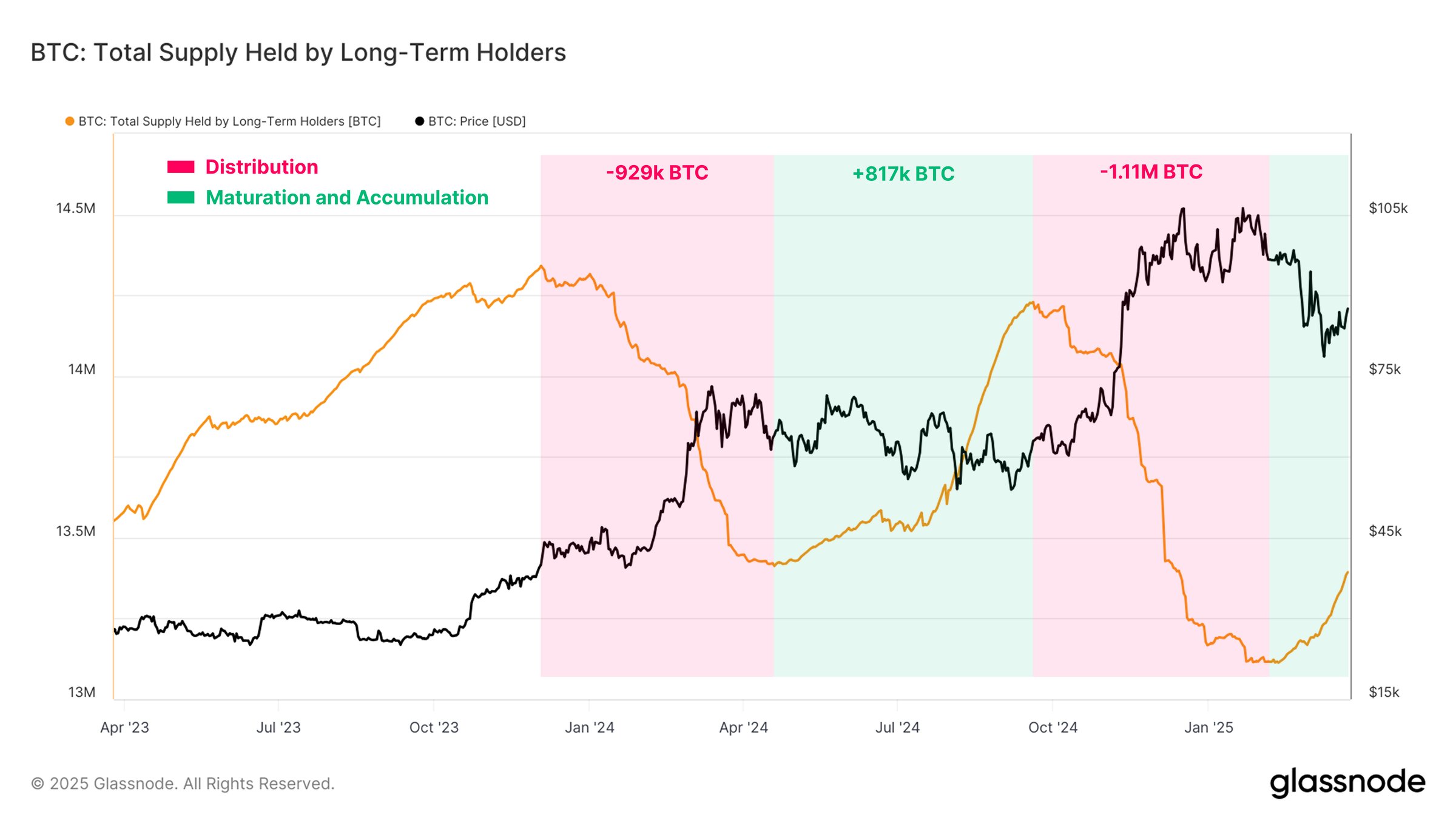

Glassnode looked at two groups of Bitcoin investors. First, they examined “long-term holders” (LTHs) – people who’ve held their Bitcoin for over 155 days. The longer someone holds, the less likely they are to sell. These are your classic “diamond hands.”

While LTHs are known for holding, they do sell sometimes. Glassnode noted two major selling periods where LTHs offloaded a total of 2 million BTC. However, after each sell-off, they quickly started buying again, bringing their holdings back up to near previous levels. This suggests a stabilizing effect on the market. It’s important to note that an increase in LTH supply doesn’t mean new

The recent increase in LTH supply is linked to buying that happened around November, when Bitcoin rallied above $90,000. Many of these November buyers are now in the red (meaning their Bitcoin is worth less than they paid), but they’re still holding.

3-6 Month Holders: Showing Resilience

Another group Glassnode analyzed were investors who’ve held Bitcoin for 3-6 months. This group likely bought near the all-time high and are currently underwater. Surprisingly, this group has also shown strong conviction, increasing their holdings despite the struggling Bitcoin price. Those who panicked and sold probably aren’t in this group anymore. The fact that these investors are still holding is a significant sign of market resilience.

Current Bitcoin Price

At the time of writing, Bitcoin is trading around $84,300, down slightly over the past week.