Why the Bitcoin Halving Could Be Important

Ki Young Ju, CEO of CryptoQuant, recently discussed the behavior of US-based Bitcoin miners in the lead-up to the upcoming halving. The halving is a periodic event where Bitcoin’s block rewards are permanently cut in half. It occurs every four years, with the next one estimated to happen in April.

Miners receive BTC rewards for adding blocks to the network. Since these rewards make up most of their revenue, halvings significantly impact mining economics.

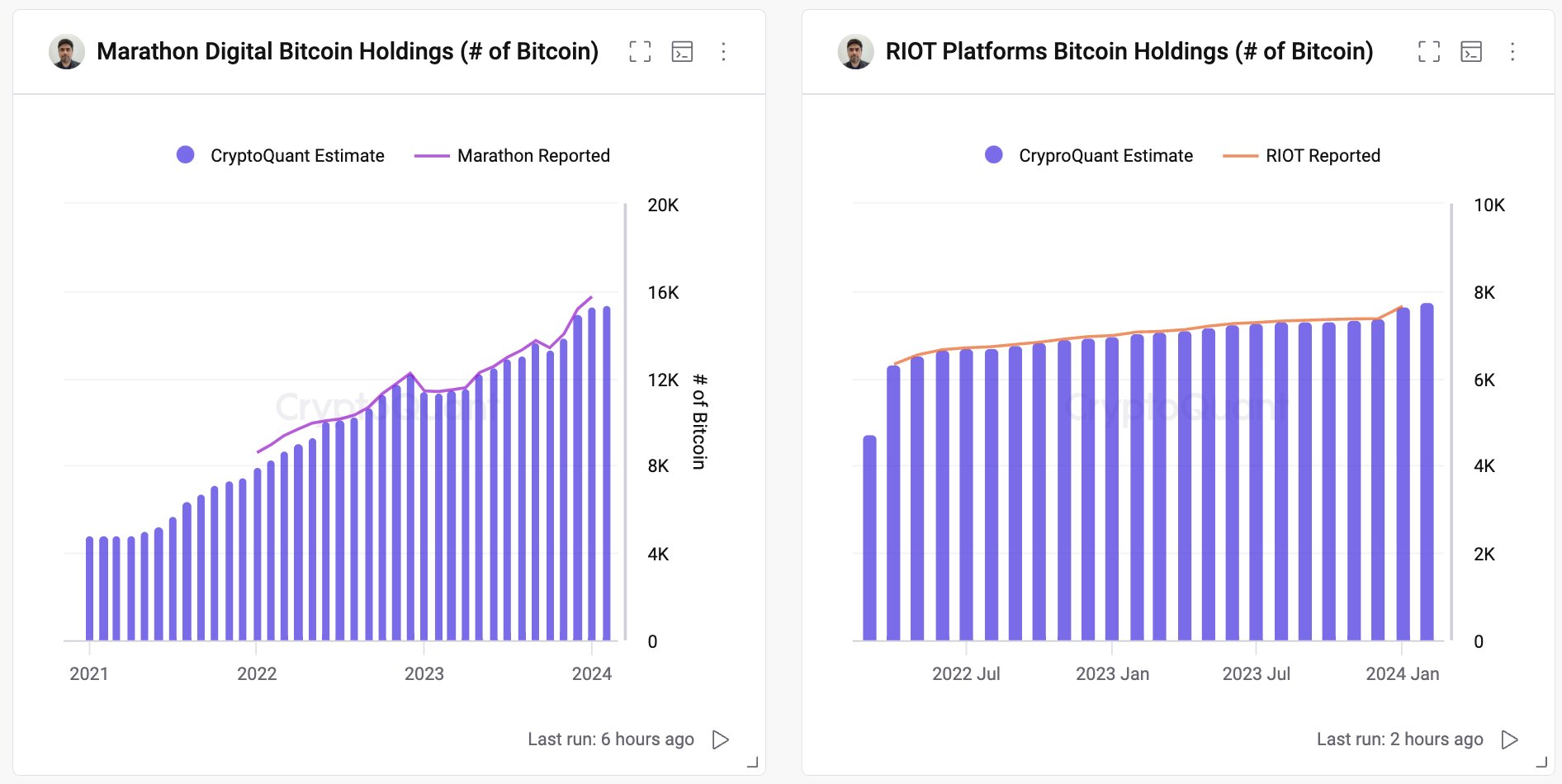

Despite the halving approaching, US public mining companies are holding onto their Bitcoin instead of selling it. This suggests they anticipate a supply shock effect from the halving.

Supply Shock Effect of Halving

The halving is a supply shock event where the new supply of Bitcoin is reduced by half. If demand remains the same while supply decreases, the price tends to increase.

Bitcoin has experienced this supply shock effect throughout its cycles, but Ju believes it could be particularly significant this time.

Role of Big Players

Large players like Blackrock and spot ETF providers are now active in the Bitcoin market. These entities must purchase Bitcoin through well-regulated means.

With mining companies holding onto their Bitcoin, these institutional investors will have a limited supply to buy from.

Coinbase Premium Index

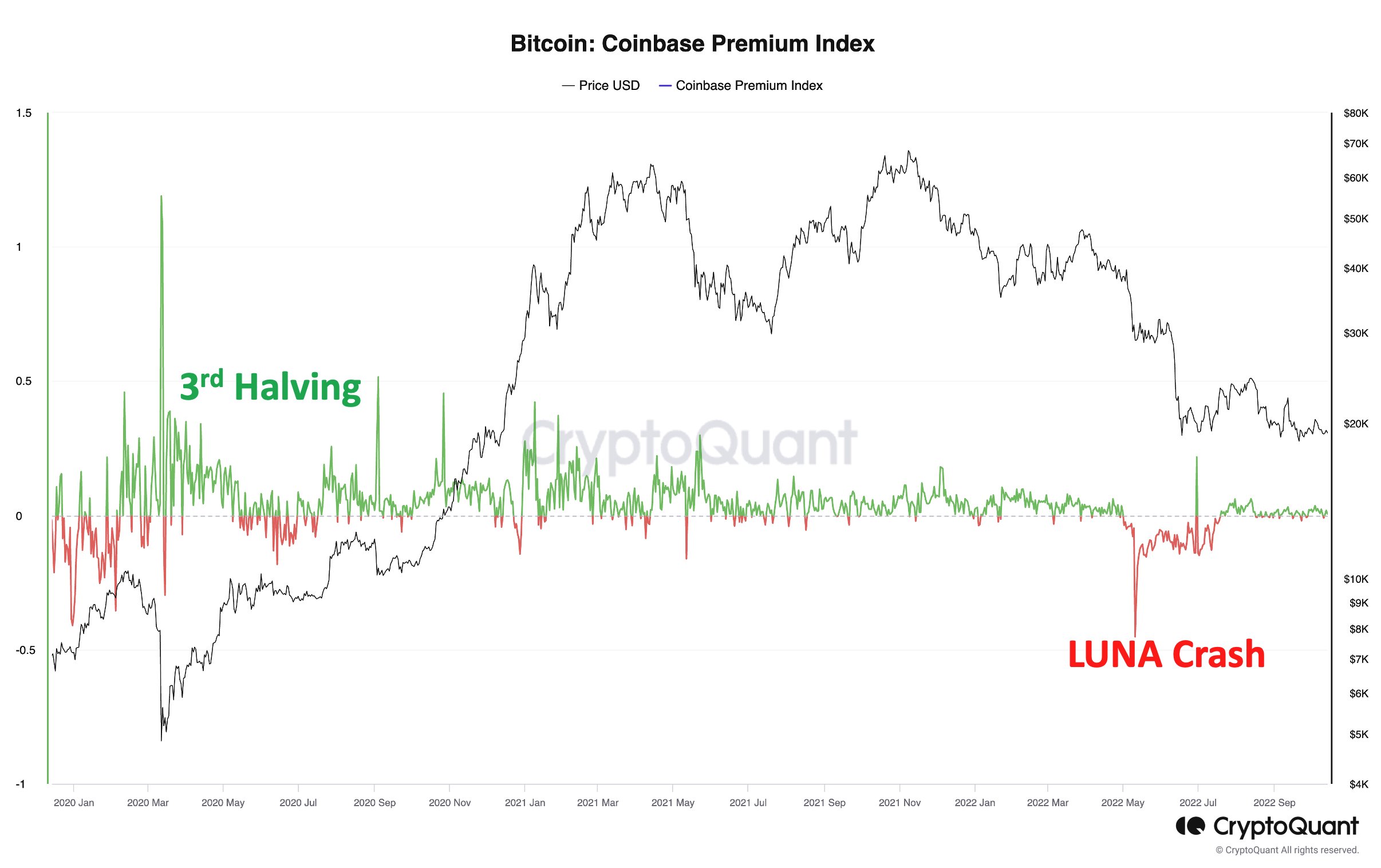

The Coinbase Premium Index tracks the percentage difference between BTC prices on Coinbase and Binance. A positive premium (higher price on Coinbase) can indicate significant buying pressure from institutional traders.

Ju expects the Coinbase premium to remain positive for a few months after the next halving, similar to what happened during the 2020-2021 bull run.

Current Bitcoin Price

Bitcoin has been trading within a range recently, hovering around the $42,900 level.