Consolidation Phase: A Bullish Precursor

As the Bitcoin halving approaches, analysts like Joe Consorti believe we’re in a crucial consolidation phase. Bitcoin has been hovering around $60,000 for several weeks, a pattern that has historically preceded bull runs.

Market Dynamics and Correlation Breaks

The current market cycle has seen correlation breaks between the stock market and the US economy. Factors like low interest rates and fiscal deficits have decoupled asset prices, including Bitcoin, from traditional economic indicators.

ETFs and Spot Market Interplay

Bitcoin ETFs have seen a slowdown in net inflows, but volume remains healthy. This suggests active trading and a stable foundation for Bitcoin’s price. The spot market is currently in control, providing a solid footing for the upcoming bull run.

Expert Consensus on Bullish Outlook

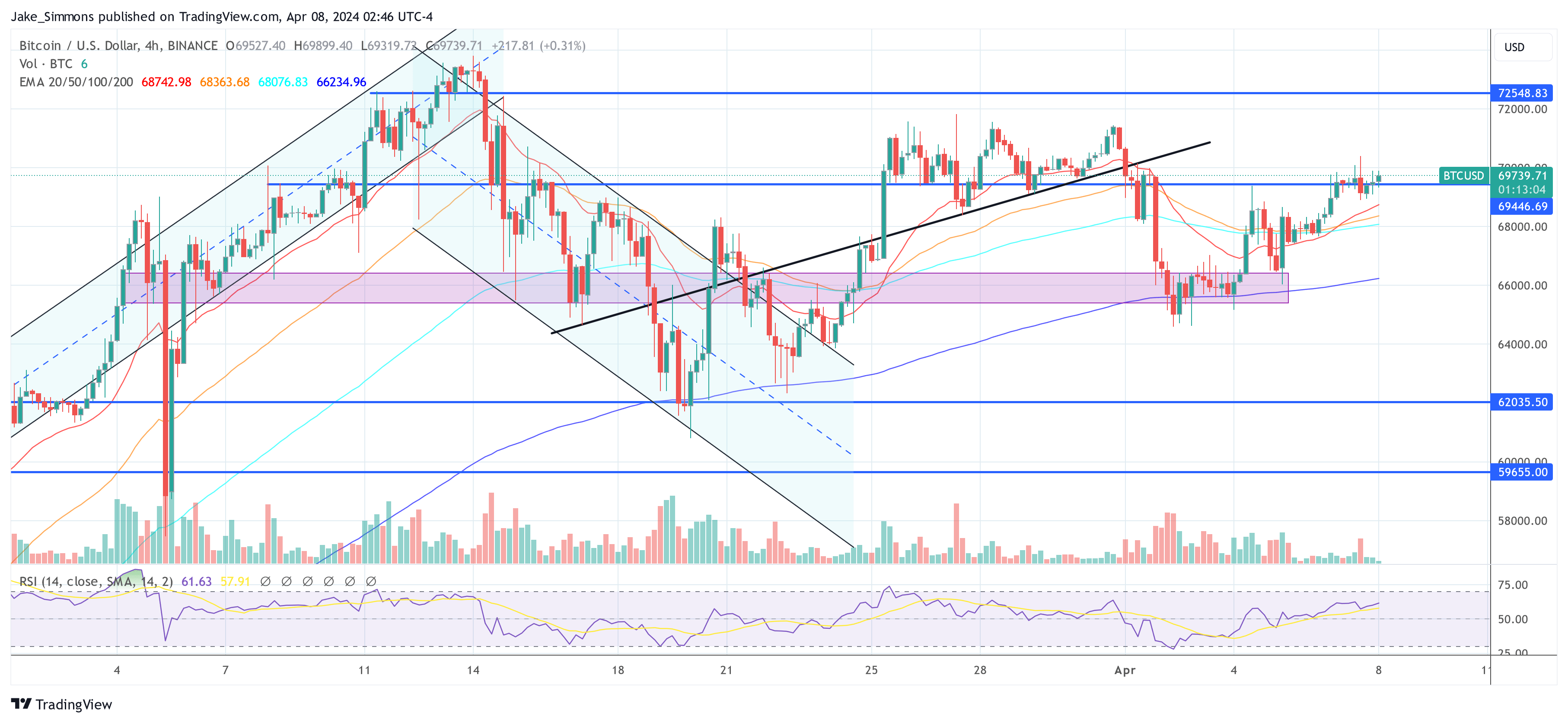

Industry experts share Consorti’s optimism. CRG highlights Bitcoin’s recent all-time highs, while TechDev notes a rare pattern that has historically led to significant price increases. Daan Crypto Trades identifies potential resistance levels and price targets above $100,000.

Conclusion

With the halving just around the corner, analysts believe Bitcoin is poised for a surge. The consolidation phase, market dynamics, and ETF behavior all point to a bullish outlook. While $100,000 may not be far off, experts emphasize that the journey may involve temporary resistance levels.