Fidelity’s Jurrien Timmer recently shared his insights on how the economy is impacting markets, especially Bitcoin and gold. He points out some surprising market shifts in early 2025.

Unexpected Market Twists

The beginning of 2025 saw some major market surprises. The prediction of higher interest rates, a stronger dollar, and US stocks outperforming was completely wrong. Instead, we’ve seen the opposite happen.

Top Performers: Bitcoin and Gold

Interestingly, Bitcoin has been a top performer over the past three months, closely followed by gold, Chinese stocks, commodities, and European markets. The US dollar and US Treasuries are lagging behind. Even though the S&P 500 hit record highs, Timmer describes this as a “digestion period” after the post-election optimism. He notes that many individual stocks aren’t doing as well as the overall index suggests.

The Fed’s Role and Inflation

Timmer focuses heavily on the Federal Reserve’s actions. With core inflation at 3.5%, the consensus is that the Fed will hold interest rates steady for now. He agrees with this, suggesting that interest rates should be slightly above the neutral rate (around 4%) given the inflation picture. He warns against cutting rates too soon, as past mistakes have shown this can lead to higher inflation later on.

He believes that long-term interest rates will be driven by government spending. High government spending could lead to higher interest rates, hurting stock valuations. Conversely, fiscal responsibility could keep interest rates lower. Jobless claims might also become more important to watch, as government spending impacts employment.

Commodities and Gold’s Rise

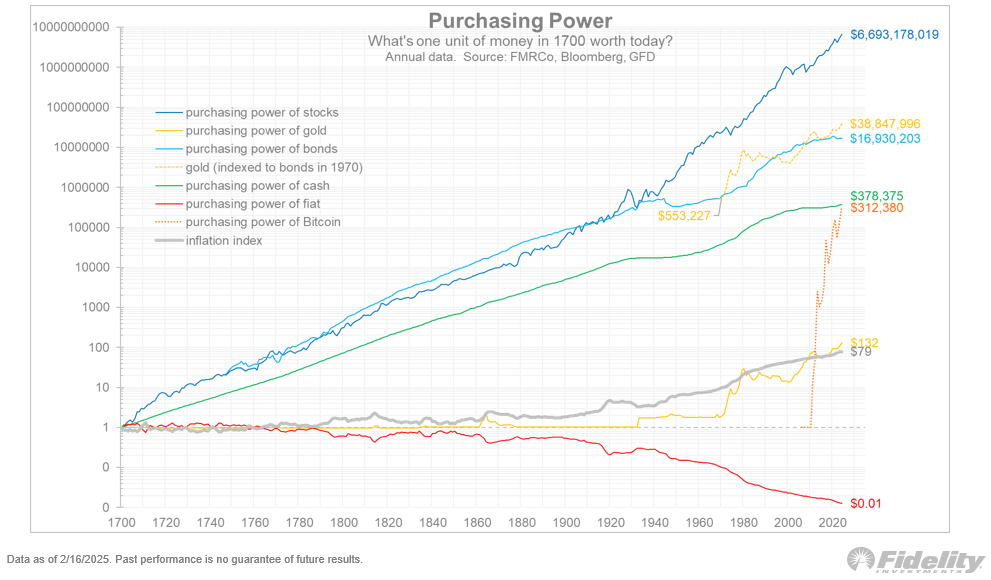

Timmer sees a potential bullish signal in commodity prices, suggesting they could rise further if inflation remains high or government spending continues. Gold has performed exceptionally well, outperforming many expectations and even matching the S&P 500’s returns since 2020, but with lower volatility. He sees gold hitting $3,000 as a possibility. This strength might be due to geopolitical factors like increased demand from China and Russia.

Bitcoin vs. Gold: A Monetary Perspective

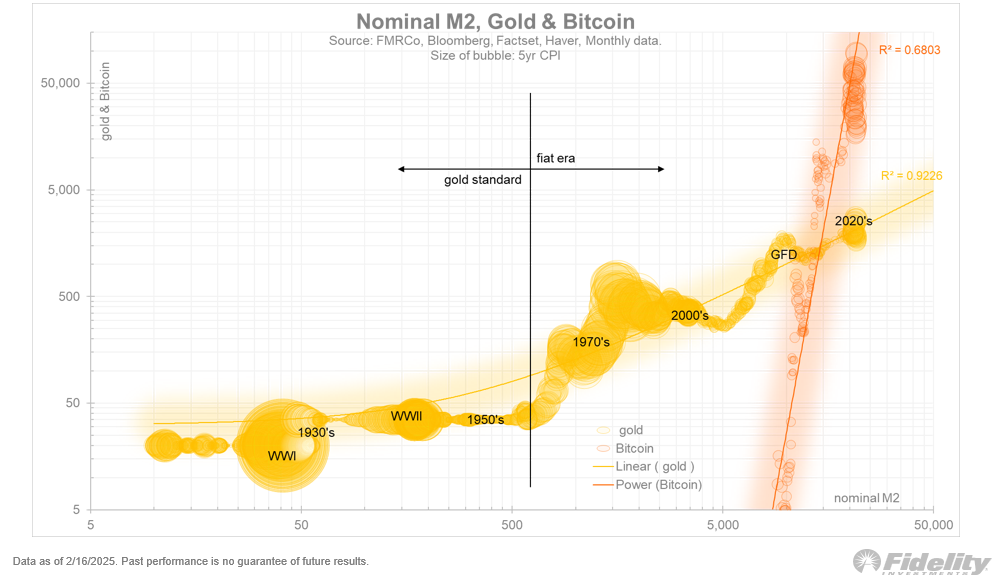

Timmer discusses the strong performance of both Bitcoin and gold, noting that it’s sparked debate about monetary inflation. He distinguishes between the amount of money (money supply) and the price of money (inflation). His analysis shows that while the money supply and GDP have grown together, inflation has lagged. He cautions against using the money supply alone to explain asset prices. Both Bitcoin and gold correlate with the money supply, but in different ways.

He highlights gold’s long-term success, showing it has kept pace with, or even surpassed, many bond portfolios. He sees it as a hedge against bonds, especially if government debt becomes a bigger problem. Bitcoin’s strong performance, he argues, might reflect concerns about government spending as much as monetary policy. He points out that Bitcoin has generated a massive amount of value in a relatively short time.

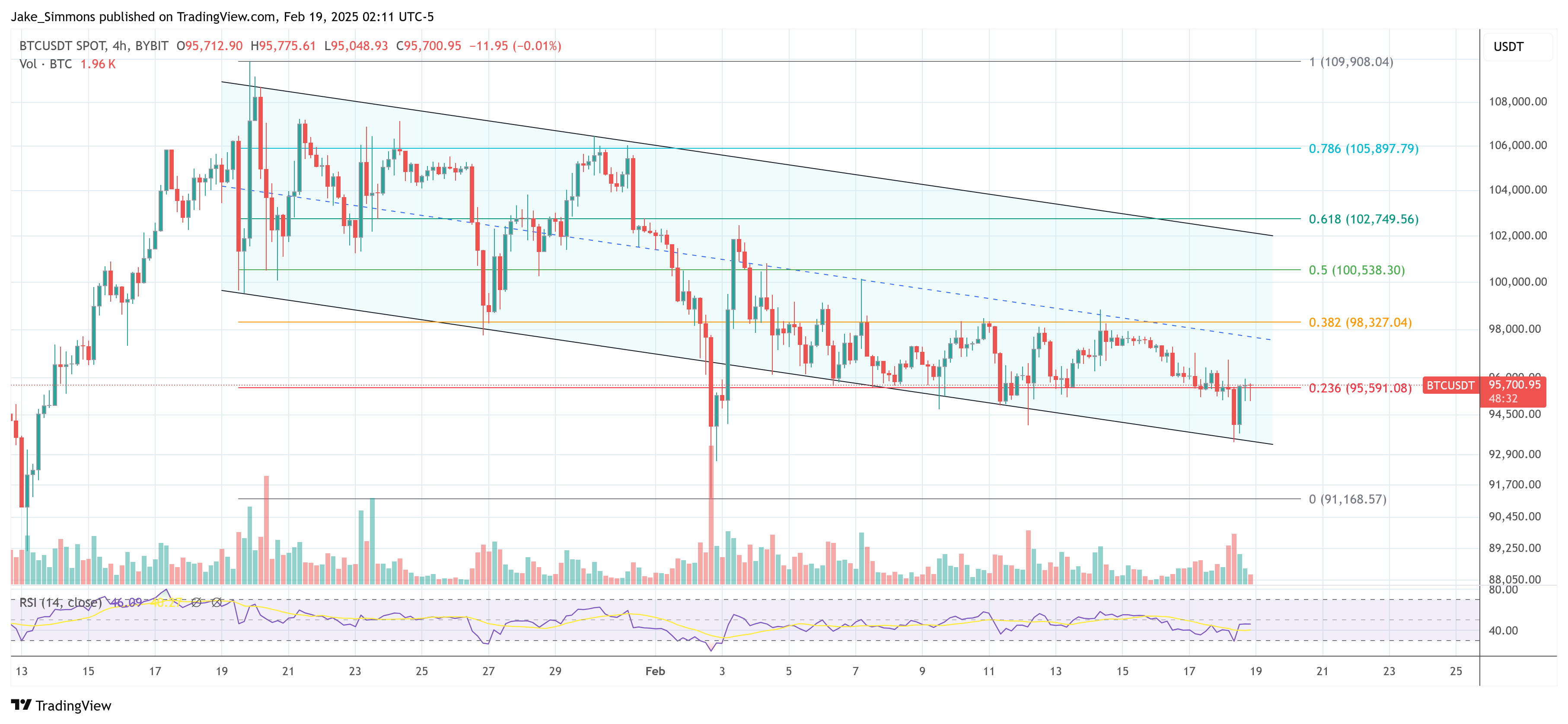

At the time of writing, Bitcoin was trading at $95,700.