Bitcoin’s rocky start to the week, losing its footing above $52,000, has raised concerns. However, indicators suggest a possible continuation of the upward trend.

Fisher Transform Analysis

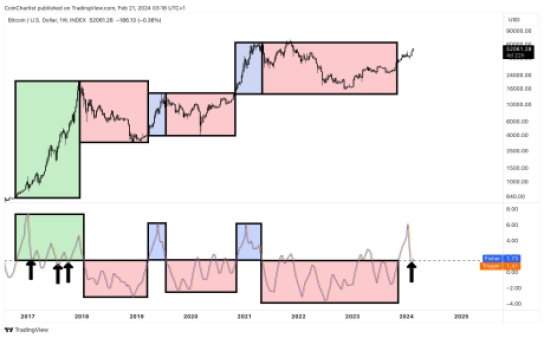

Crypto analyst Tony The Bull identified a significant trend in Bitcoin’s chart that could trigger a continuation of the rally above $52,000. The 1-week Fisher Transform shows similarities to trends seen in 2017, 2019, and 2021.

Critical Level

The current crucial level is the 1.5 Standard Deviation, which has been pivotal in similar historical trends. If the Fisher Transform stays above this level, it’s bullish for the price. Falling below it could be bearish.

Bulls and Bears Battle for Control

Bulls and bears are vying for control of Bitcoin’s price, causing wild fluctuations. Bitcoin’s price ranged from $53,000 to below $51,000 before bouncing back on Wednesday.

Investor Sentiment

Despite the price volatility, investor sentiment is climbing. The Bitcoin Fear & Greed Index reached Extreme Greed for the first time in a year. Historically, this has signaled a market top, followed by a downward trend.

Positive Indicators

Despite the Extreme Greed sentiment, Bitcoin is seeing positive indicators. Trading volume rose more than 40% in the last 24 hours, indicating continued interest in the cryptocurrency.