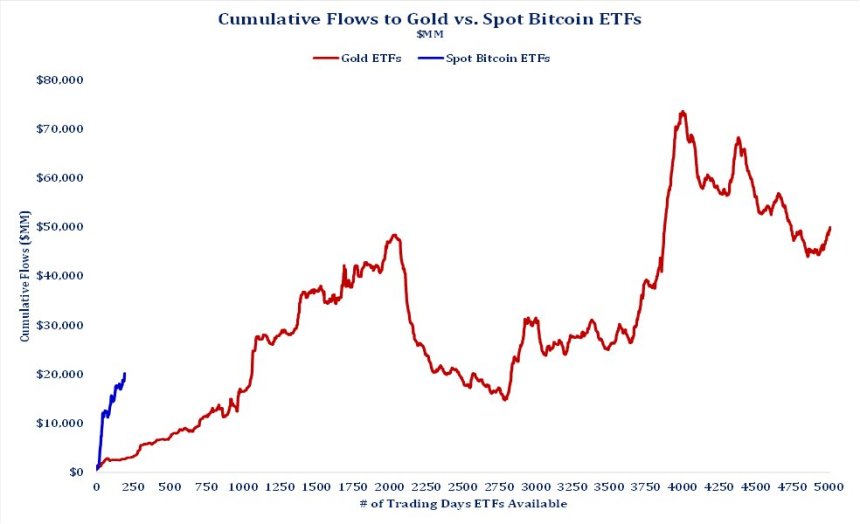

Bitcoin ETFs are booming, and one analyst thinks they’ll soon surpass gold ETFs in terms of investment.

Bitcoin ETFs are attracting huge amounts of money. In just the past week, they’ve pulled in over $2 billion! This is partly because Bitcoin itself has been on a tear, recently pushing towards $70,000.

Nate Geraci, a market analyst, predicts that Bitcoin ETFs will have more money invested in them than gold ETFs within the next two years. This might sound crazy, but consider this:

- Bitcoin ETFs are still new. They only launched in January, while gold ETFs have been around for over 20 years.

- Bitcoin ETFs are growing fast. They’ve already attracted over $65 billion in assets, a feat that took gold ETFs five years to achieve.

- There are fewer Bitcoin ETFs. There are only 11 Bitcoin ETFs compared to nearly 5,000 gold ETFs.

With the crypto market expected to continue growing, Bitcoin ETFs could be poised to overtake their gold counterparts.

But don’t get too excited just yet. Another analyst, Ali Martinez, is warning that Bitcoin could experience a short-term dip soon.

While Bitcoin has been on a strong run, some technical indicators suggest a sell signal. This could cause Bitcoin to drop back to $60,000 or even $55,000.

So, while Bitcoin ETFs are definitely hot right now, it’s important to remember that the market is volatile. /p>