Bitcoin ETFs are attracting a lot of attention from big investors. In the last week, these funds saw almost $1 billion flow in, marking their third straight week of positive gains.

Bitcoin ETFs: A Winning Streak

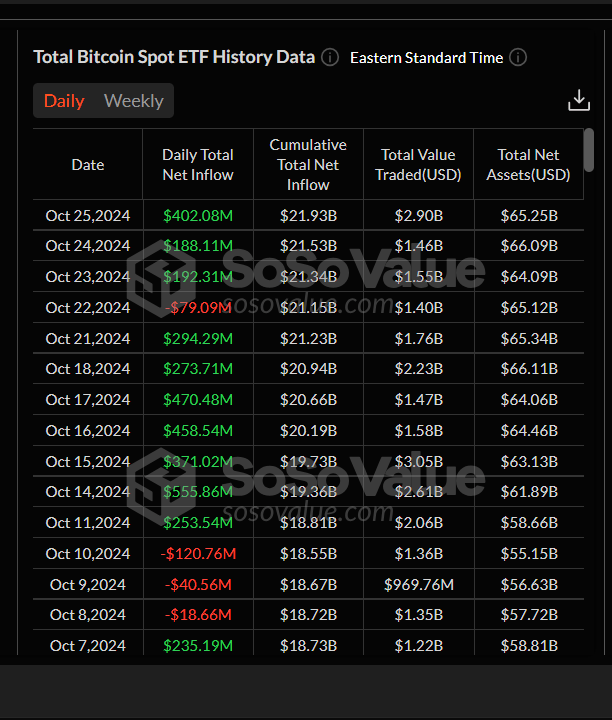

- October was a good month for Bitcoin ETFs. They brought in a whopping $2.18 billion in the third week alone, and the momentum continued the following week with another $997.70 million.

- BlackRock’s IBIT is a big player. This ETF attracted $291.96 million on Friday, October 25th, bringing its total inflows to a massive $23.99 billion.

- Other ETFs are also seeing gains. Fidelity’s FBTC, Ark & 21 Shares’s ARKB, Bitwise’s BITB, Grayscale’s BTC, and VanEck’s HODL all saw positive inflows.

- Overall, Bitcoin ETFs have seen over $3 billion flow in over the last 11 trading days. This is a strong signal that institutional investors are increasingly interested in Bitcoin.

Ethereum ETFs: A Different Story

Ethereum ETFs haven’t been as lucky. They’ve seen outflows for 11 weeks in a row, losing a total of $24.45 million in the last week.

They’ve seen outflows for 11 weeks in a row, losing a total of $24.45 million in the last week.

While Bitcoin ETFs are thriving, Ethereum ETFs are struggling to find their footing. This could be a sign that investors are more interested in Bitcoin’s potential for growth at the moment. /p>