Bitcoin exchange-traded funds (ETFs) are having a major moment. In October alone, they saw a whopping $3 billion in new investments! This is a huge deal, especially since retail investors are driving most of the demand.

Retail Investors Lead the Charge

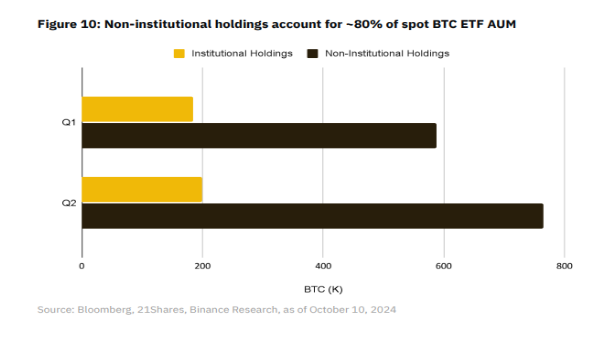

It turns out that regular folks are really excited about Bitcoin ETFs. They make up a whopping 80% of the total money invested in these funds. This is a big change from the original idea of ETFs being just for big institutions.

Bitcoin ETFs Dominate the Market

Bitcoin ETFs are totally crushing it in the ETF world. They’ve taken the top four spots for new investments this year, beating out all other types of ETFs. The BlackRock IBIT fund is the superstar, with over $23 billion in new investments since the beginning of the year.

Institutional Investors Are Jumping Onboard

While retail investors are leading the charge, institutions are also getting in on the action. Investment advisors, in particular, are really increasing their Bitcoin holdings.

What’s Next for Bitcoin ETFs?

The future looks bright for Bitcoin ETFs. With more and more institutions getting involved, Bitcoin is likely to see a lot of positive changes. This could mean a stronger Bitcoin price, a more efficient market, and less volatility.

Overall, Bitcoin ETFs are changing the game for cryptocurrency. They’re making it easier for everyone to invest in Bitcoin, and that’s driving a lot of excitement and growth in the market.