Bitcoin exchange-traded funds (ETFs) have officially hit a major milestone: over $40 billion in lifetime inflows. This massive influx of investment cash marks a historic high for the crypto market.

Record-Breaking Inflows

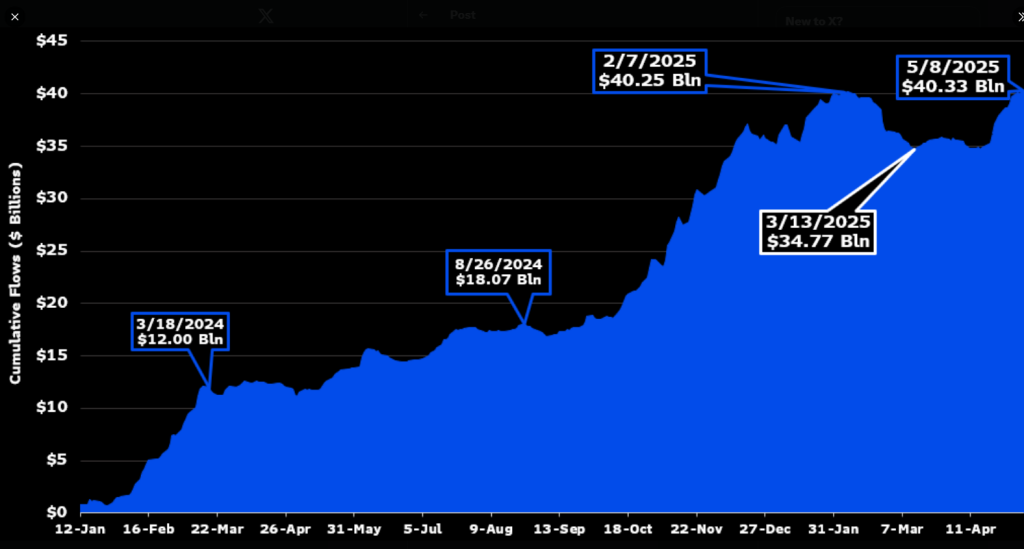

According to Bloomberg analyst James Seyffart, the total surpassed $40 billion on May 8th, 2025. This single-day surge exceeded previous records, demonstrating continued strong investor interest in Bitcoin through regulated funds. This shows growing confidence from both individual investors and large institutions.

Explosive Growth

The journey to $40 billion has been remarkably swift. When US spot Bitcoin ETFs launched around March 2024, total inflows were around $12 billion. By August 2024, this had climbed to approximately $18 billion. A further jump to nearly $35 billion by March 2025 set the stage for the recent $40 billion breakthrough. This consistent growth highlights the sustained appeal of Bitcoin ETFs as a straightforward investment option.

Institutional Investment Fuels the Surge

A significant driver of this growth is the participation of large institutional investors. Asset managers and hedge funds are increasingly using ETFs to gain Bitcoin exposure, preferring this regulated approach to direct coin purchases. This shift offers benefits like portfolio diversification and increased regulatory oversight, potentially leading to Bitcoin’s wider acceptance as a mainstream asset.

Positive Market Sentiment

The $40 billion milestone generated significant buzz on social media, with many celebrating Bitcoin’s dominance and the ease of access through regulated ETFs. While some expressed concerns about potential price slowdowns impacting future inflows, the overall sentiment remains overwhelmingly positive.

The Future of Bitcoin ETFs

While Bitcoin ETFs represent a substantial portion of the market, they are just one piece of the puzzle. Mining, exchange trading, and over-the-counter transactions still account for larger volumes. Going forward, ETF inflows will likely serve as a key indicator of market sentiment, with increasing inflows suggesting growing confidence and vice versa.