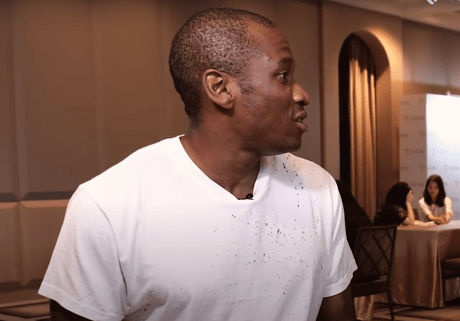

Bitcoin has taken a hit, falling below $64,000. But Arthur Hayes, co-founder of BitMEX, is urging investors to “buy the dip.”

Why Hayes Is Bullish

Hayes believes the global economy and central bank policies favor cryptocurrencies like Bitcoin.

Central Bank Policies

Central banks, like the US Federal Reserve, are raising interest rates aggressively to fight inflation. This has hurt the bond market, especially US Treasuries.

Japanese banks, which invested heavily in US Treasuries, have lost money as interest rates have risen. This has forced them to sell off these bonds, adding to the downward pressure on prices.

Implications for Bitcoin

Hayes argues that these events benefit Bitcoin because central banks are intervening to stabilize financial markets. This intervention boosts Bitcoin’s price, making it an attractive alternative investment during times of uncertainty.

FIMA Repo Facility

The Fed has expanded its FIMA repo facility, which allows central banks to exchange US Treasuries for dollars. This increases the dollar supply without flooding the market with bonds.

Hayes believes this could drive investors towards cryptocurrencies, which are seen as a hedge against inflation and currency debasement.

Hayes’s Call to Action

Hayes encourages investors to “buy the dip,” despite the recent price decline. He believes the underlying economic and monetary factors will continue to support Bitcoin’s growth.