A crypto analyst, known as Rekt Capital, believes the recent Bitcoin price drop isn’t the start of a bear market. Instead, they see it as a temporary dip within a continuing bull run.

Rekt Capital’s Take

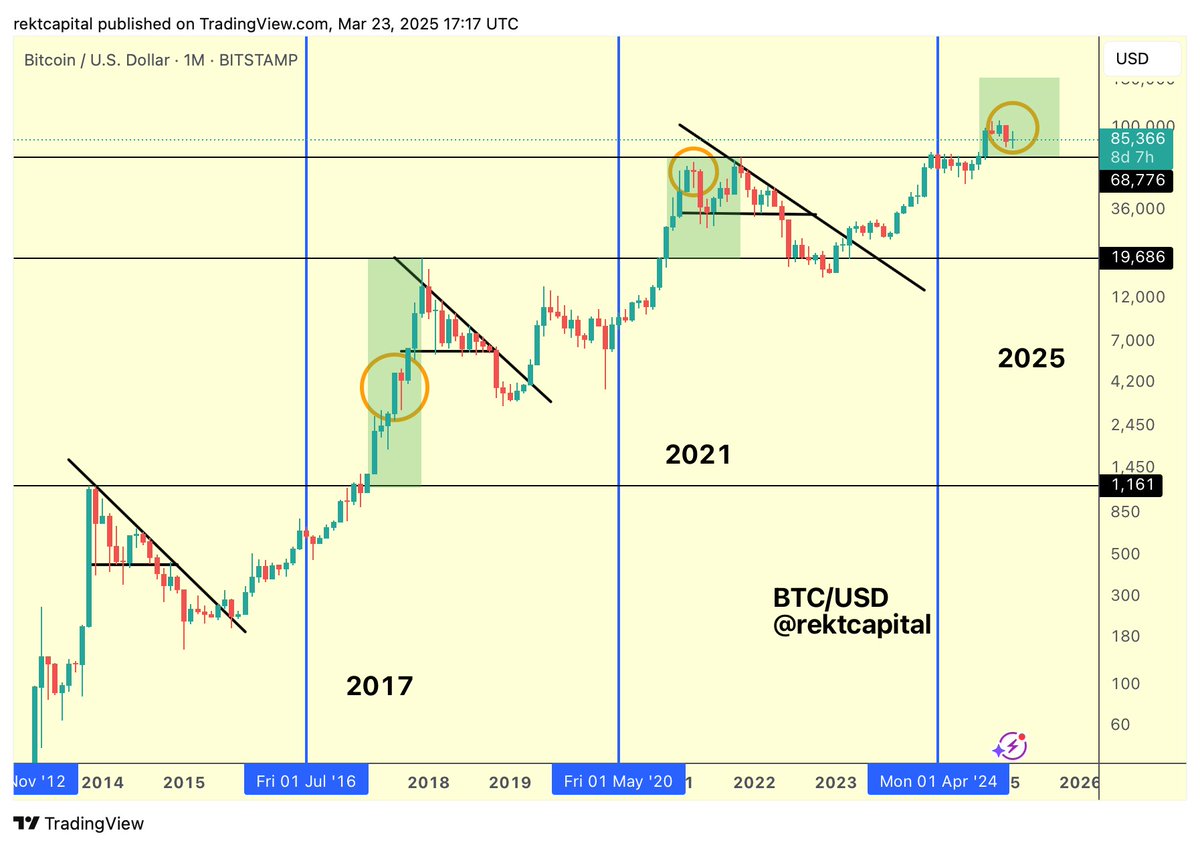

Rekt Capital, boasting a large following on X and YouTube, maintains that Bitcoin’s bull market is far from over. They estimate the market’s progress at 82.5%, suggesting significant upside potential remains. The analyst emphasizes that progress will naturally slow during corrections, and speed up during rapid price increases.

The $76,000 Correction: A “Downside Deviation”?

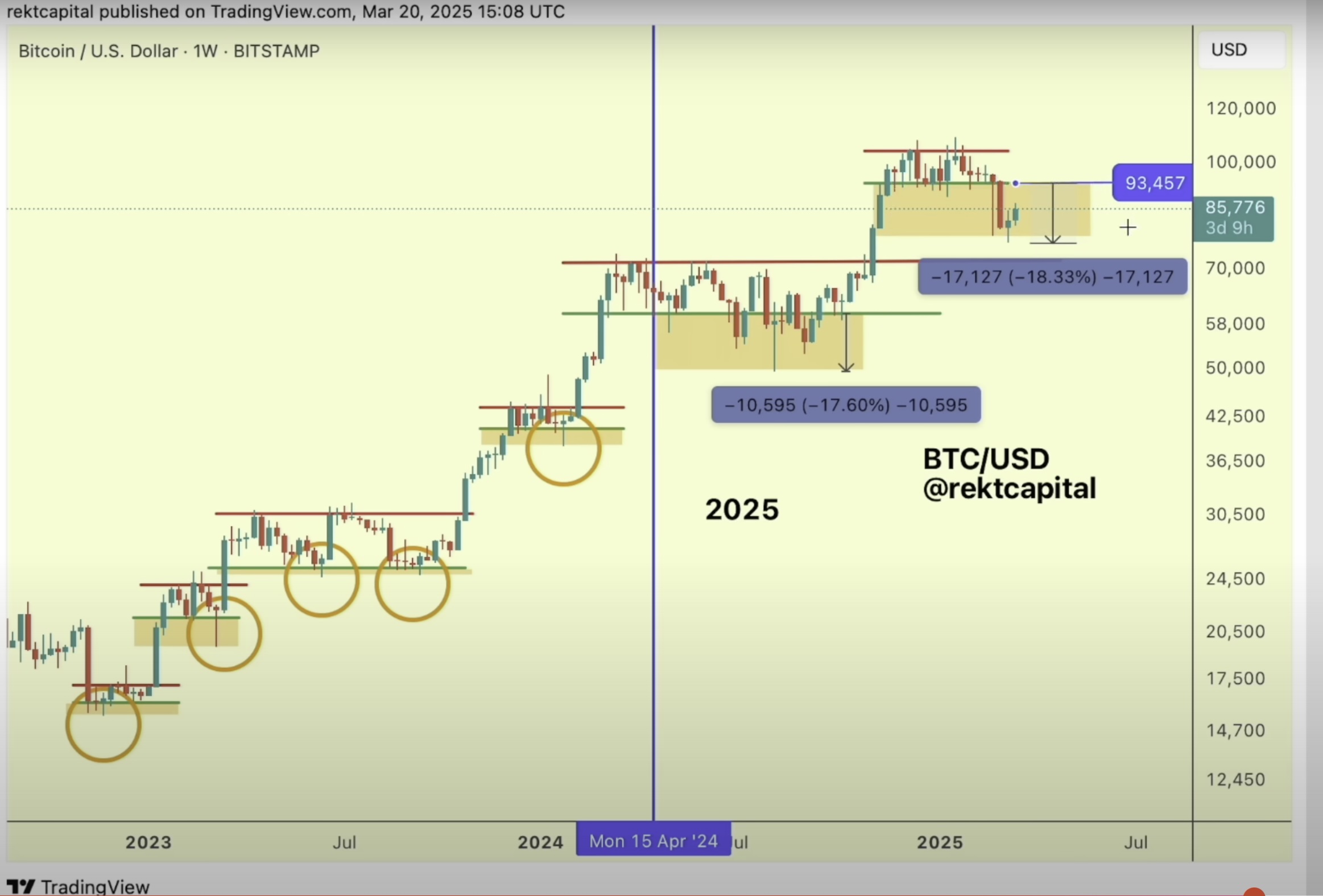

Rekt Capital argues that the recent correction to around $76,000 mirrors previous market behavior. They refer to it as a “downside deviation,” a technical term describing a temporary price drop that’s followed by a recovery and further gains. This current dip, around 30%, is similar to a 32% drop seen earlier in 2024, further supporting their argument. They urge investors to maintain a calm, data-driven perspective and avoid panic selling.

Current Market Status

At the time of writing, Bitcoin is trading above $88,000, showing a recent price increase. Rekt Capital’s analysis suggests this price action supports their view of a continuing bull market, with the recent correction being a temporary setback.

Disclaimer: This information is for general knowledge and shouldn’t be considered investment advice. Always do your own research before investing in cryptocurrencies.

/p>