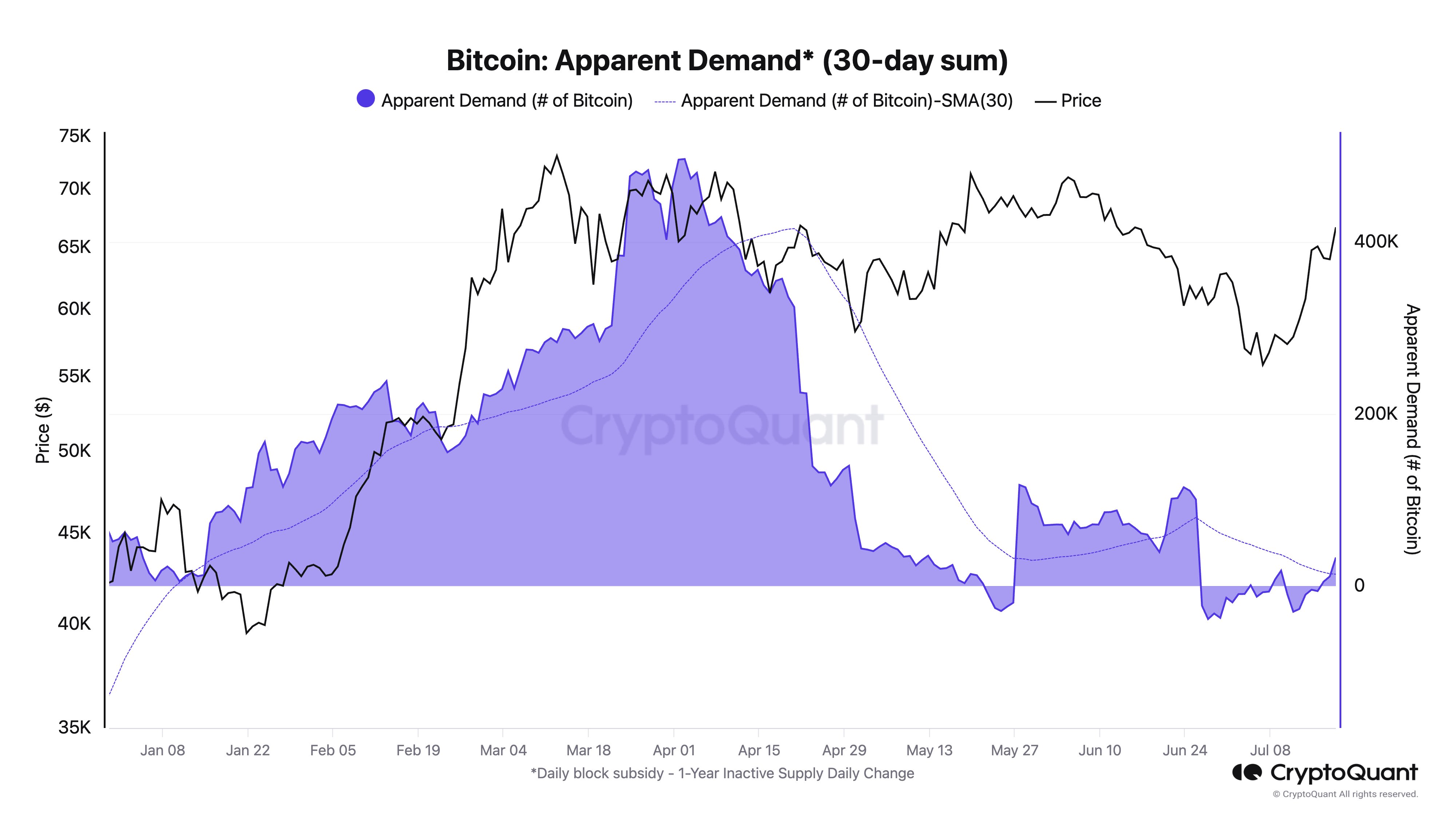

Bitcoin’s demand might be picking up, according to on-chain data.

A crypto analyst, Julio Moreno, who works for a company called CryptoQuant, has noticed some interesting trends in Bitcoin’s demand. He uses a metric called “Apparent Demand” to measure how much people want Bitcoin.

What is “Apparent Demand”?

Apparent Demand is calculated by subtracting the daily change in the one-year inactive supply from the daily block subsidy. Here’s a breakdown:

- Daily block subsidy: This is the amount of new Bitcoin that miners get for verifying transactions. It represents fresh Bitcoin entering the market.

- Daily change in the one-year inactive supply: This tracks how much Bitcoin has been sitting untouched for at least a year. A positive change means more Bitcoin is becoming inactive, while a negative change means some of that inactive Bitcoin is being moved.

The Recent Trend

The Apparent Demand for Bitcoin has been negative for most of the year, but it recently turned positive. This means that more Bitcoin is being bought than sold.

More importantly, the Apparent Demand has also crossed above its 30-day average. This is a bullish sign, as it suggests that demand is increasing.

What Does This Mean for Bitcoin’s Price?

While the Apparent Demand is positive, it’s still relatively low. This could mean that the recovery in demand is still in its early stages.

However, the fact that demand is increasing could be good news for Bitcoin’s price. The price of Bitcoin has already been rising over the past few weeks, and this could be a sign that things are looking up.

Keep an eye on the data.

Moreno suggests that it’s important to keep an eye on the Apparent Demand metric in the coming weeks to see if the trend continues.