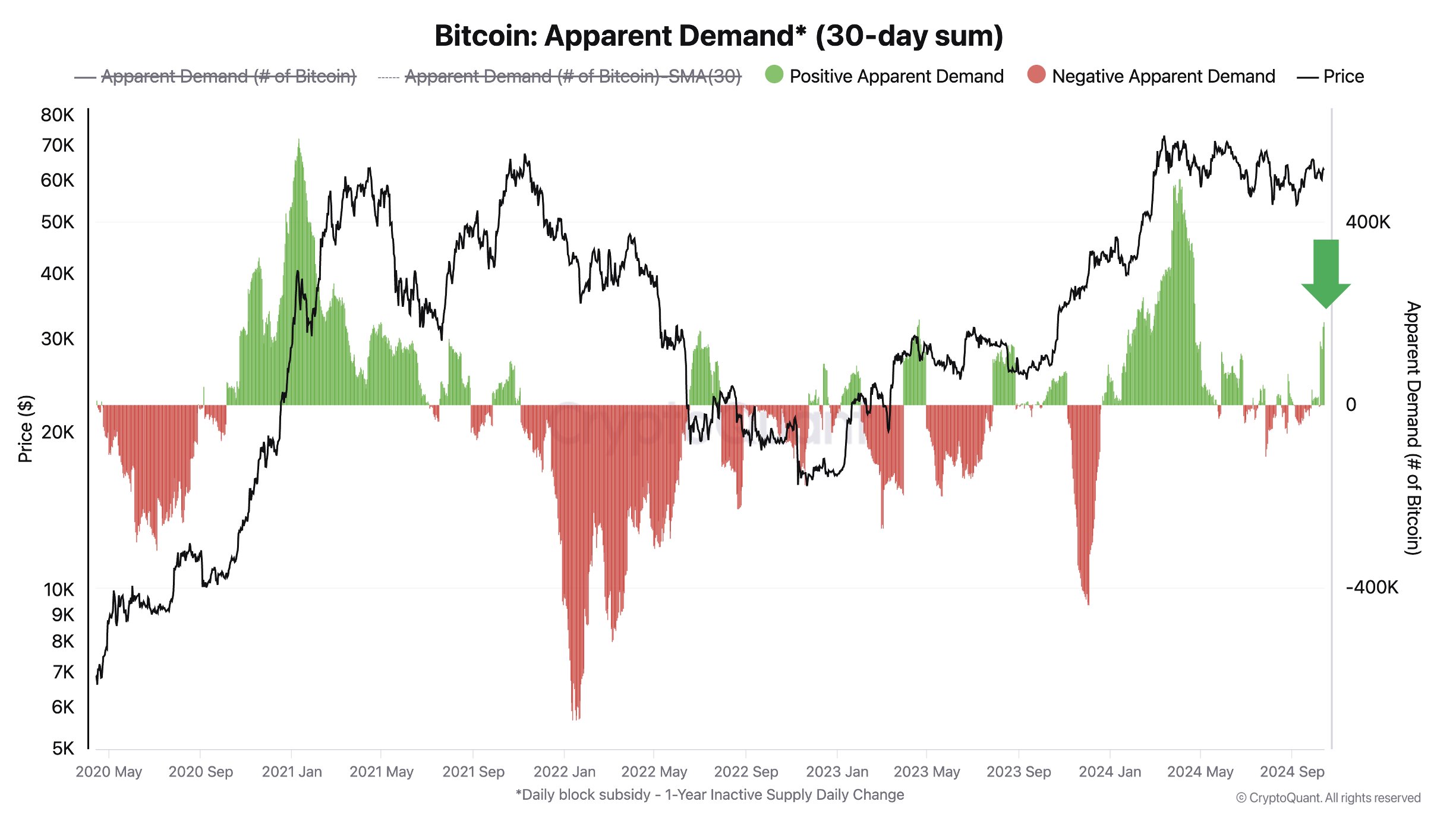

Bitcoin’s apparent demand is on the rise again, signaling a potential shift in market sentiment.

What is Apparent Demand?

Apparent demand is a measure of how much Bitcoin is being bought and sold. It’s calculated by looking at the difference between the amount of Bitcoin being mined (produced) and the amount of Bitcoin being held inactive for over a year (inventory).

- Positive Apparent Demand: More Bitcoin is being held inactive than is being mined, indicating higher demand.

- Negative Apparent Demand: More Bitcoin is being mined than is being held inactive, indicating lower demand.

Demand Is Back

After a period of flat demand, Bitcoin’s apparent demand has recently spiked back into positive territory. This suggests that investors are once again buying and holding Bitcoin, potentially driving up its price.

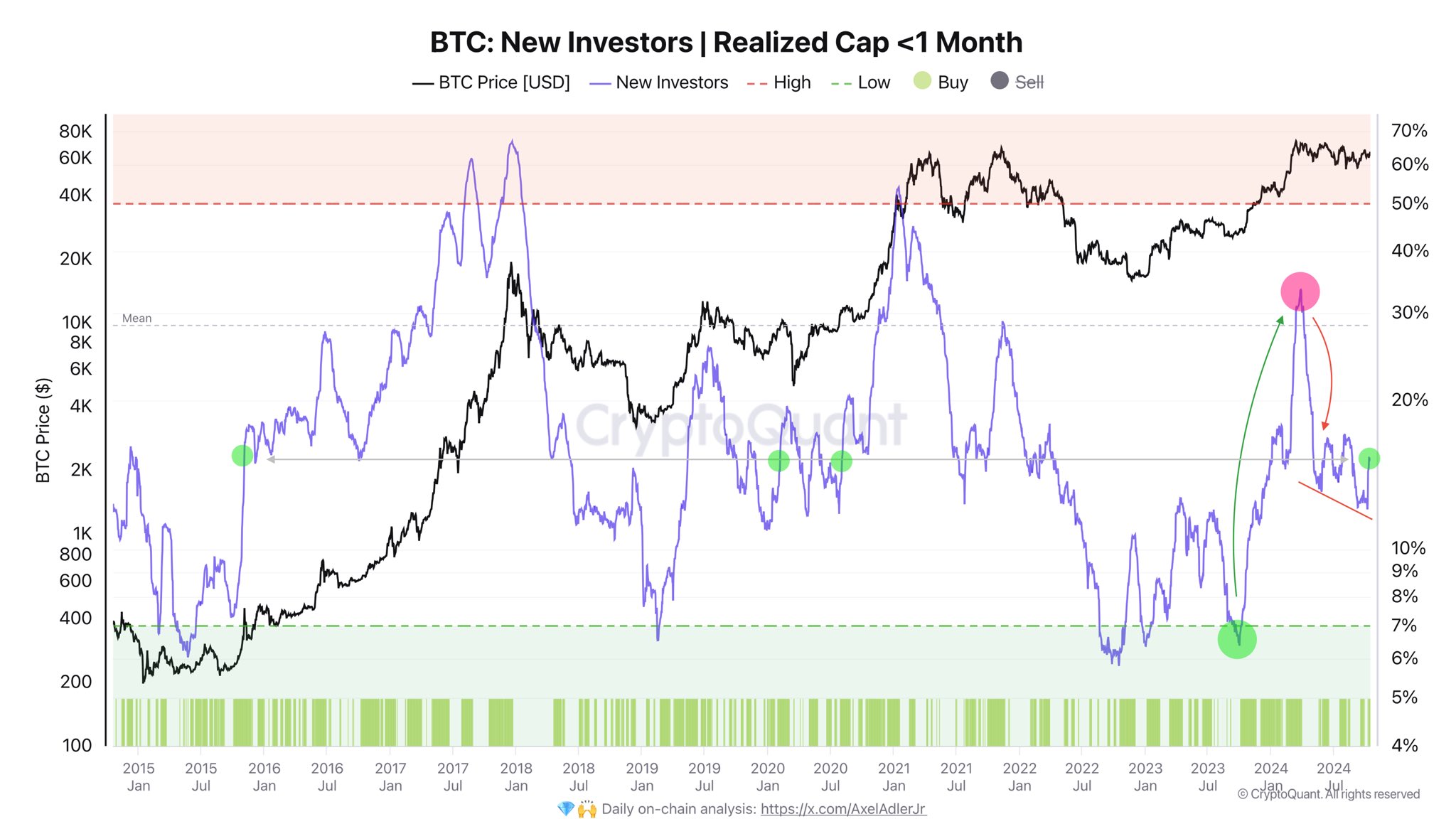

New Investors Are Also Buying

Another indicator, the Realized Cap of new investors, shows that new investors are also buying Bitcoin. This metric tracks the total amount of capital invested by investors who bought Bitcoin within the past month. A recent 3% increase in this metric suggests fresh capital is flowing into the market.

What Does This Mean for Bitcoin’s Price?

While Bitcoin’s price has recently pulled back from its highs, the increasing demand from both existing and new investors is a positive sign for the cryptocurrency’s future. It suggests that the market may be ready for another price surge.

However, it’s important to remember that the market is volatile, and prices can fluctuate rapidly. While the current indicators are positive, it’s too early to say for sure whether Bitcoin will continue to rise. /p>