Liquidation Surge

Cryptocurrency investors holding long positions have faced a massive liquidation of $365 million in the past day, as Bitcoin’s price plummeted below $66,000.

Derivative Market Meltdown

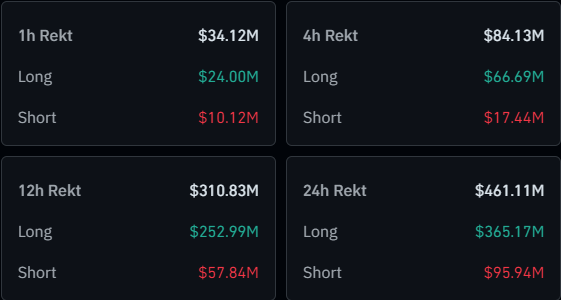

The cryptocurrency derivative market has witnessed significant liquidations, with over $461 million wiped out in the last 24 hours. Long investors bore the brunt of the pain, with $365 million in contracts forcibly closed.

Long Squeeze

The liquidation event was dominated by long traders betting on a bullish outcome, resulting in a “long squeeze.” A sharp price swing triggered a cascade of liquidations, fueling the price drop further.

Key Liquidated Assets

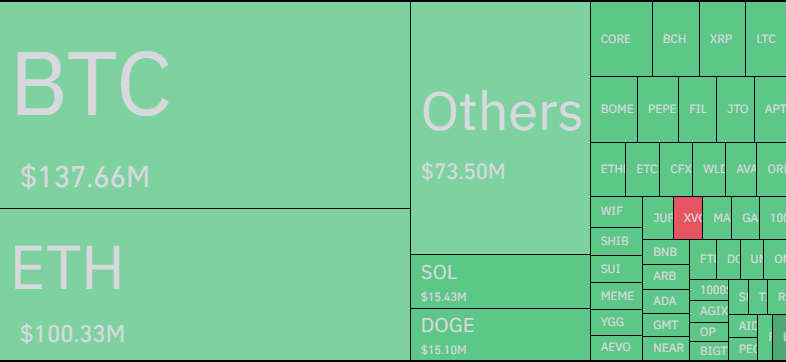

Bitcoin accounted for the largest share of liquidations ($137 million), followed by Ethereum ($100 million). Solana and Dogecoin also saw significant liquidations ($15 million each).

Volatility and Leverage

Mass liquidations are common in the cryptocurrency market due to high volatility and the availability of excessive leverage. Uninformed trading in the derivative market can be particularly risky.

Bitcoin’s Plunge

Bitcoin’s latest drop has brought its price down to around $65,200.