Investor Dan Tapiero predicts a massive Bitcoin price surge, potentially exceeding $180,000, fueled by an impending economic slowdown.

Economic Slowdown and Bitcoin’s Rise

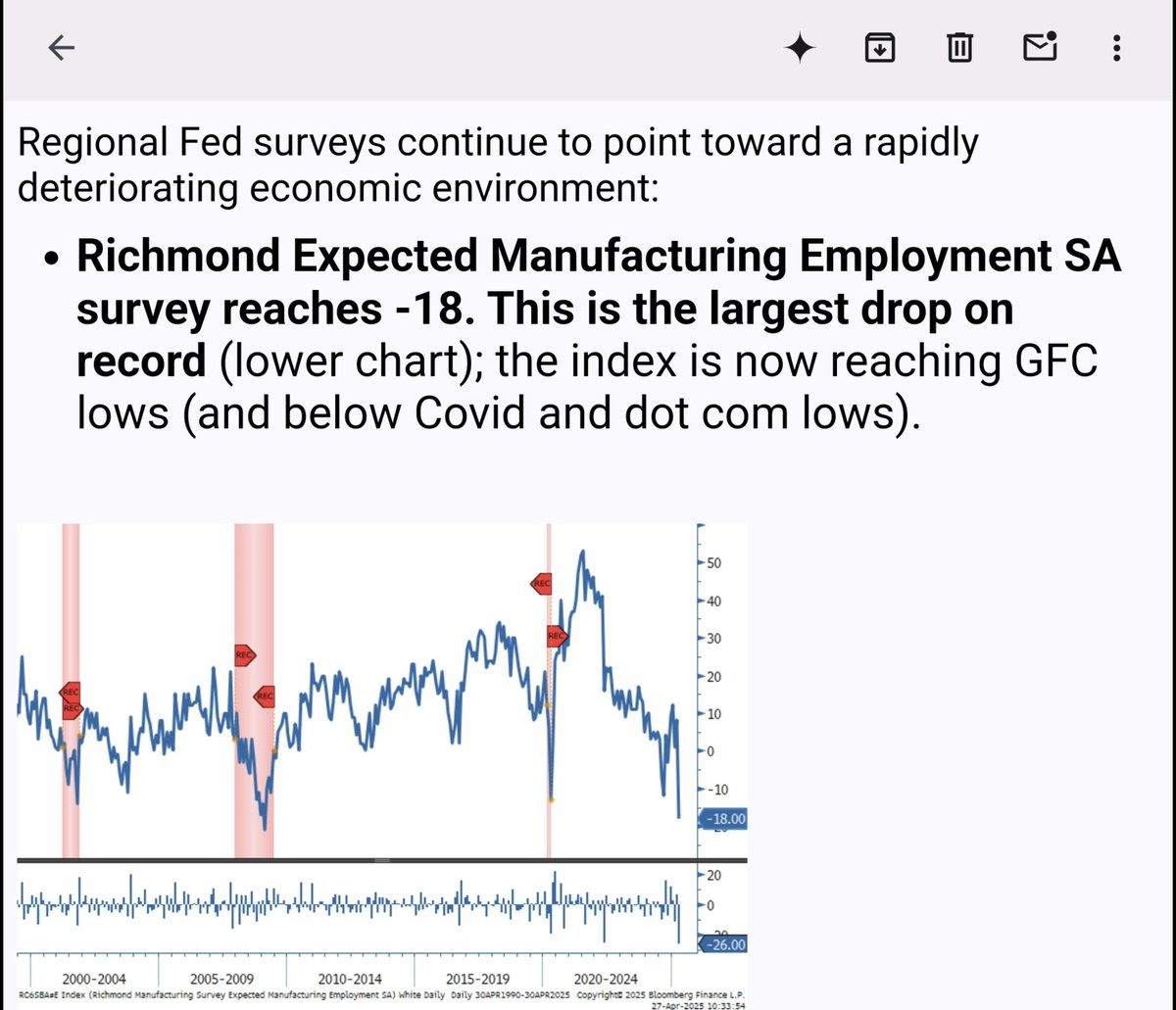

Tapiero, a macro investor with a significant following on X (formerly Twitter), points to weakening economic indicators as the primary driver for this prediction. He highlights the plummeting Richmond Fed’s Expected Manufacturing Employment index, which has reached crisis levels, similar to those seen during the 2008 financial crisis. He believes this signals a severe economic slowdown, forcing the Federal Reserve to cut interest rates and inject more liquidity into the market. This increased liquidity, he argues, will propel Bitcoin to new all-time highs. Tapiero expects this to happen before summer 2026.

The Dollar’s Weakness and Bitcoin’s Strength

Tapiero further contends that the worsening economic situation will lead to increased money printing, devaluing the US dollar. This, he believes, will drive investors towards Bitcoin as a safe haven asset, further boosting its price. He cites a massive collapse in consumer economic expectations as further evidence supporting his claim.

The Bottom Line

Tapiero’s prediction is bold, forecasting a more than 90% increase in Bitcoin’s price from its current level. While he presents compelling arguments based on macroeconomic indicators, it’s crucial to remember that this is just one investor’s opinion. Investing in Bitcoin and other cryptocurrencies carries significant risk. Always conduct thorough research and consider your own risk tolerance before making any investment decisions.