Analyst Ali Martinez is predicting Bitcoin could surge to $130,000, but only if it stays above a key support level. This prediction follows a recent price jump.

$110,000: The Make-or-Break Point

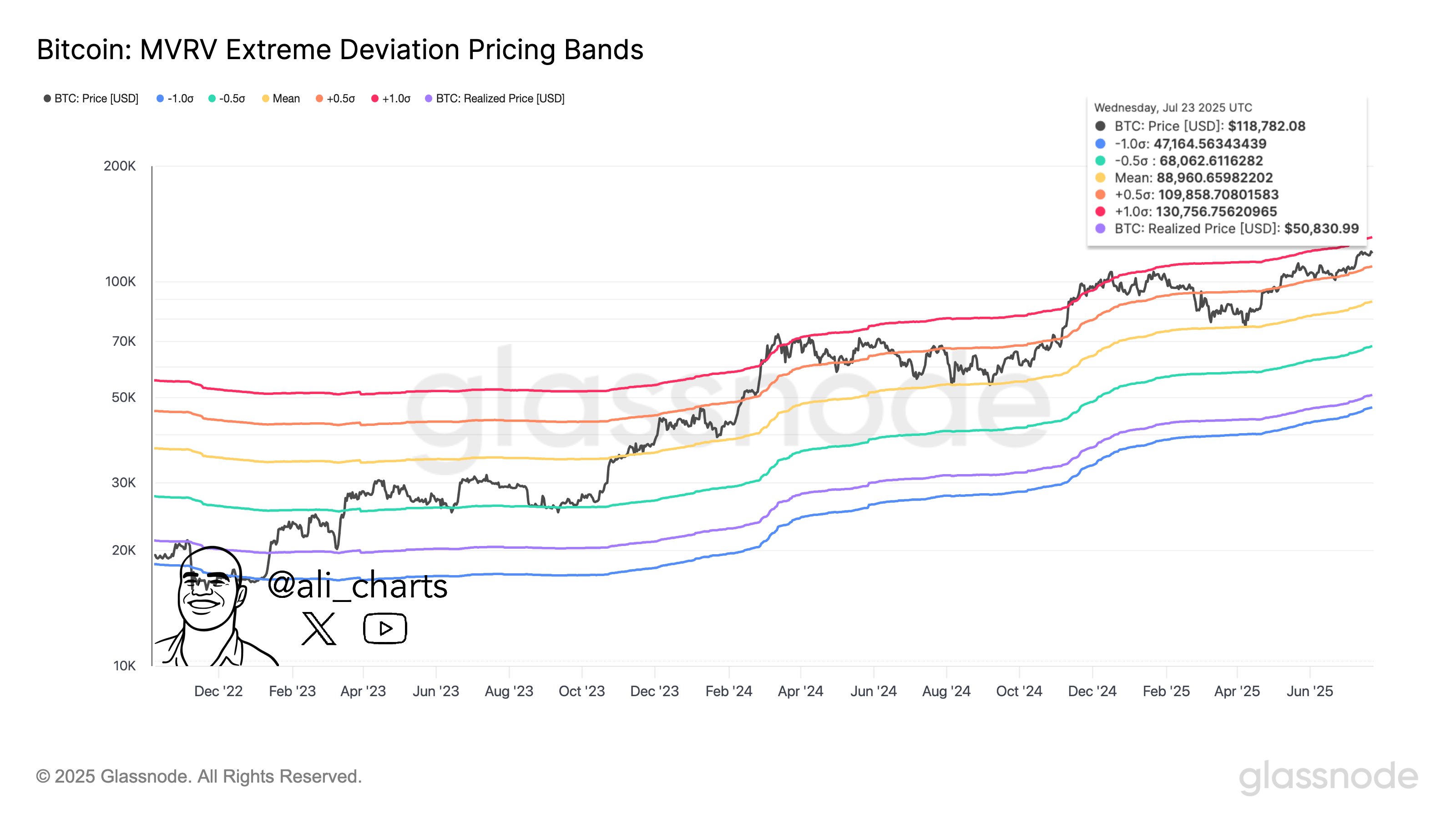

Martinez’s prediction is based on Glassnode’s MVRV (Market Value to Realized Value) pricing bands. These bands show whether Bitcoin is overvalued or undervalued compared to its historical price. Think of them as fancy Bollinger Bands, but using actual Bitcoin data.

Currently, Bitcoin is trading near $118,000. The MVRV model shows the next resistance level (and potential price target) at $130,000 (+1.0σ band). However, a crucial support level sits at around $110,000 (+0.5σ band). If Bitcoin falls below this, it could signal a much bigger drop, potentially to $89,000 (the mean band) or even lower. Staying above $110,000 is key for the $130,000 prediction to hold.

Investor Confidence and Market Sentiment

The gap between Bitcoin’s current price and its realized price (the average cost basis of all Bitcoins) is widening. This suggests investors are increasingly confident. While the price is up, daily trading volume is down significantly. Despite this, overall market sentiment remains bullish, with some analysts predicting further price increases in the coming days and weeks.