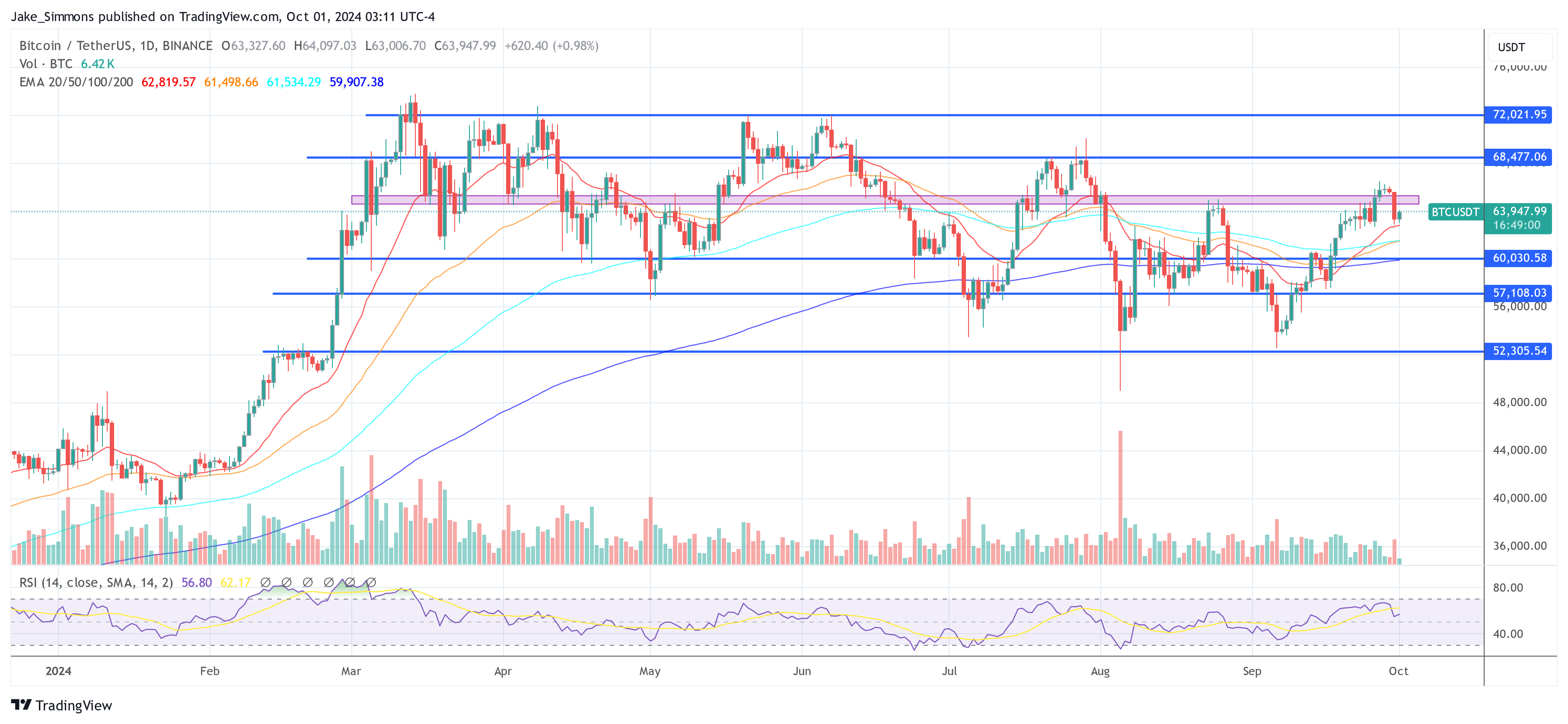

Bitcoin’s Strong Q4 History

Bitcoin has a history of strong performance in the fourth quarter. Since 2020, Bitcoin’s average Q4 return has been around 85%. This means that if Bitcoin follows its historical trend, it could reach $118,000 by the end of the year.

Why the Market Might Be Missing Out

Despite this potential, the market isn’t fully prepared to capitalize on it. This is partly due to concerns about the upcoming US election and the fact that other assets, like gold and Chinese stocks, are attracting a lot of attention.

Reasons to Be Bullish

However, there are several reasons to be optimistic about Bitcoin’s future:

- Global Stimulus: Major economies are pumping money into their economies, which could benefit Bitcoin.

- BNY Mellon’s Bitcoin Custody: The world’s largest custodian bank is now offering Bitcoin custody services, making it easier for institutional investors to get involved.

- ETF Flows: Bitcoin exchange-traded funds (ETFs) are seeing a surge in investment.

- Mining Efficiency: Bitcoin miners are partnering with cloud service providers to improve efficiency and reduce costs.

- Limited Supply: There’s not much Bitcoin left to sell, which could help support the price.

- FTX Cash Distribution: Money from the collapsed FTX exchange could flow into Bitcoin investments.

Potential Risks

While the outlook is positive, there are some risks to consider:

- Federal Reserve Actions: The Fed’s monetary policy could impact Bitcoin’s price.

- Equity Market Pullback: A decline in the stock market could dampen investor enthusiasm for Bitcoin.

Bitcoin’s Self-Reinforcing Cycle

Bitcoin is a “reflexive asset,” meaning that as the price goes up, it attracts more investment, which pushes the price even higher. This could create a self-reinforcing cycle.

The Bottom Line

If Bitcoin reclaims the $70,000 mark, it could trigger a surge in investment and potentially push the price to new highs. The fourth quarter could be a very exciting time for Bitcoin.