Market Volatility Expected

Crypto analytics firm Glassnode predicts that Bitcoin (BTC) is entering a period of price volatility and correction after a significant rally this year.

Key Indicators Point to Correction

Glassnode cites two key indicators:

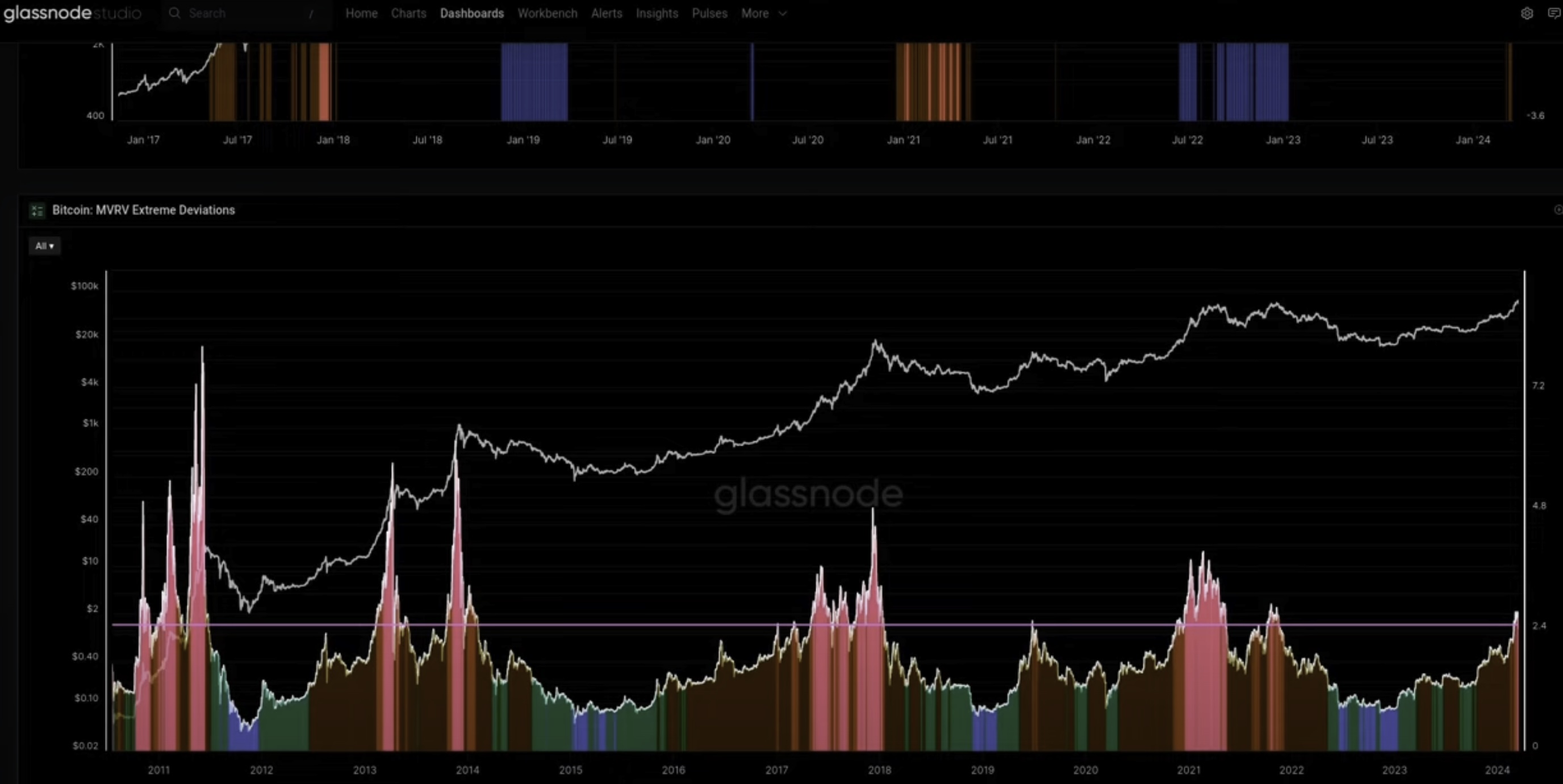

- Market-Value-to-Realized-Value (MVRV) Indicator: This ratio suggests that Bitcoin may be overvalued.

- Active-Value-to-Investor-Value (AVIV) Ratio:

This metric indicates that a correction is likely when Bitcoin’s price deviates significantly from its mid-point.

This metric indicates that a correction is likely when Bitcoin’s price deviates significantly from its mid-point.

Profit-Taking and Supply Decline

Glassnode notes that long-term holders are selling off for profits, leading to a decline in long-term holder supply. This has resulted in record-high realized profits of $3.5 billion per day.

Volatility Ahead

Glassnode expects Bitcoin to experience volatility in the coming period. Historically, sharp market rallies have been followed by equally sharp corrections.

Current Market Conditions

At the time of writing, Bitcoin is trading at $67,672, up 7.5% in the last 24 hours.