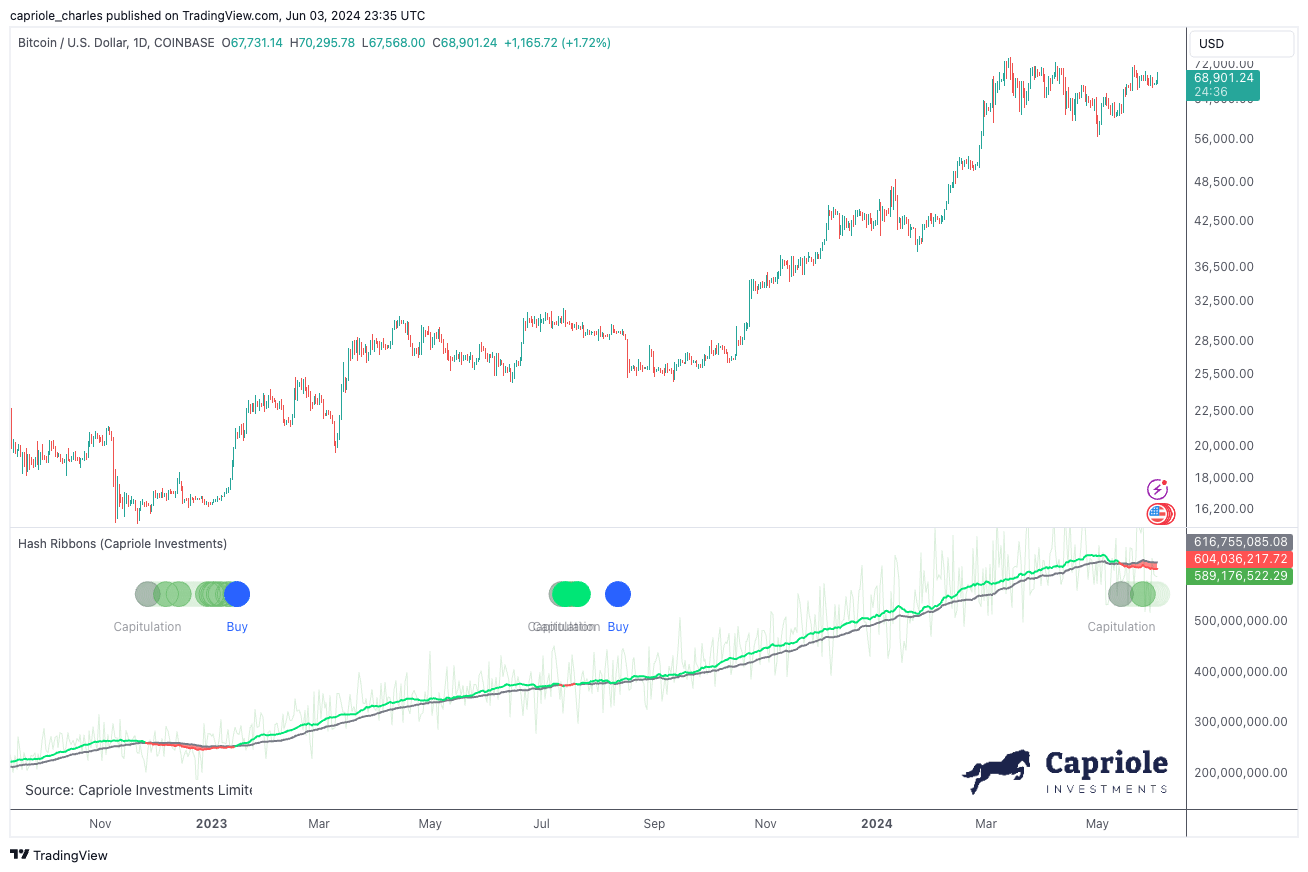

Hash Ribbons Indicator

Charles Edwards, CEO of Capriole, a Bitcoin hedge fund, has spotted a buy signal in the “Hash Ribbons” indicator. This signal has historically signaled good times to buy Bitcoin.

The Hash Ribbons indicator looks at mining data to predict when Bitcoin is a good buy. It looks at the difference between the 30-day and 60-day moving averages of Bitcoin’s hash rate. When the 30-day average falls below the 60-day average, it’s a sign to buy.

Edwards says this signal has been right most of the time in the past. It even worked last year when Bitcoin was trading around $20,000.

Miner Capitulation

Edwards also points to the current “Miner Capitulation.” This is when miners, who use computers to create new Bitcoins, are having a hard time making money. This can lead to them selling their Bitcoins, which can drive the price down.

Edwards says this is a good time to buy Bitcoin because miners are usually profitable. So, the fact that they’re selling now means they’re desperate.

Regulatory Landscape

Edwards also talks about how the regulatory landscape for cryptocurrencies is changing. The SEC recently approved an Ethereum ETF, which means ETH is now seen as a commodity. This could lead to more institutional investors getting into crypto.

Macroeconomic Factors

Edwards also mentions macroeconomic factors that could affect Bitcoin’s price. The government is printing a lot of money and raising interest rates to try to stimulate the economy. But Edwards warns that this could lead to inflation, which could make Bitcoin more attractive as a hedge against losing money.

Price Analysis

Finally, Edwards looks at Bitcoin’s price movements. He says Bitcoin recently broke above a key resistance level and has been consolidating. He thinks Bitcoin could reach $100,000 if it can keep going up and close above $58,000 this month.