Global Money Supply: A Key Indicator

According to James Coutts, Bitcoin’s future looks bright due to shifts in global liquidity. He highlights the Global Money Supply (M2) as a crucial factor, as it represents the amount of money in circulation.

Momentum is Key

Coutts emphasizes that the rate of change in M2 is more important than its absolute value. He believes that a surge in M2 momentum could trigger a bullish signal for Bitcoin.

Credit Conditions and the Dollar

Corporate bond spreads and the US Dollar Index (DXY) also play a role in Bitcoin’s cycles. Coutts suggests that narrowing credit spreads and a DXY break below 101 could be bullish for Bitcoin.

Government Debt and Liquidity

Coutts predicts that continued deficit spending could further boost liquidity conditions, benefiting Bitcoin.

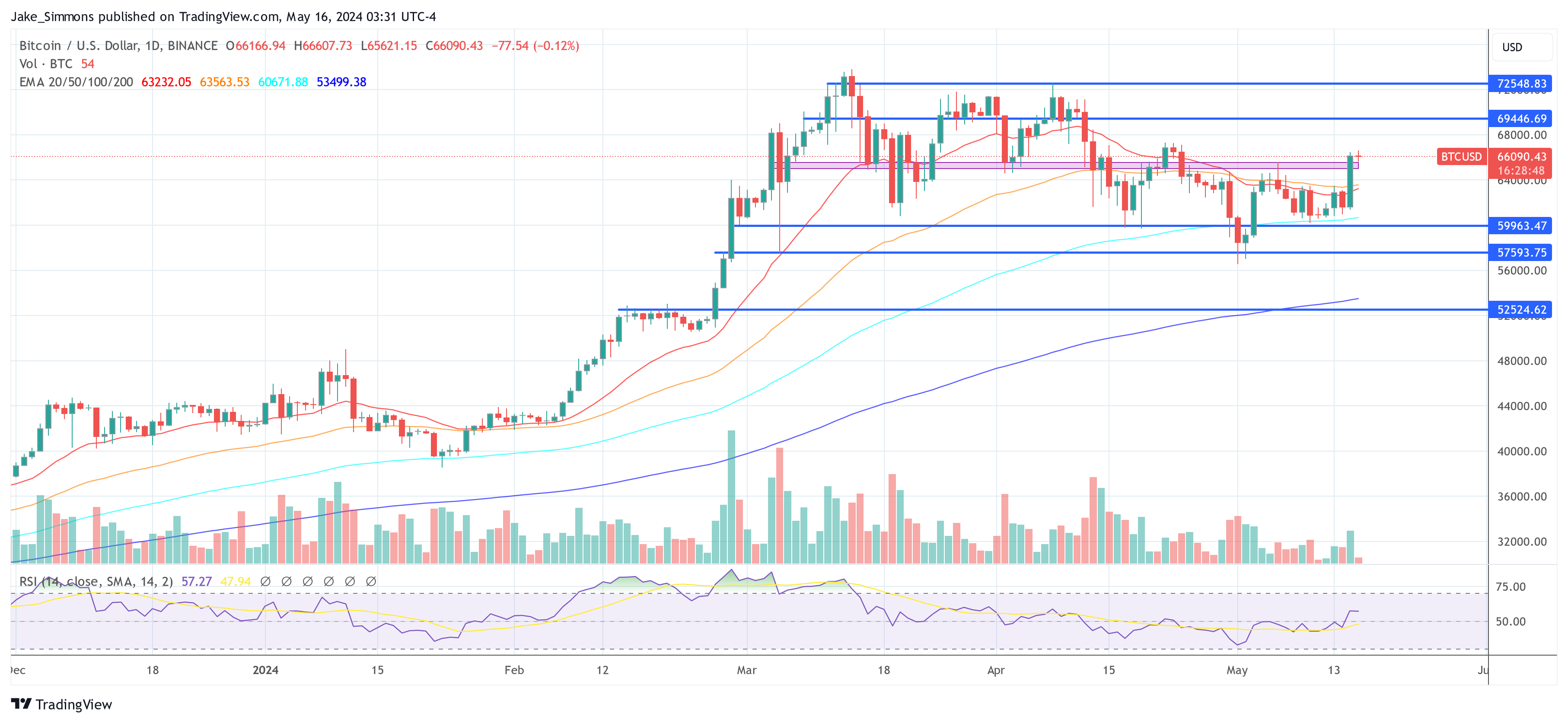

Bitcoin’s Future Outlook

Coutts believes that Bitcoin is likely to rally if it breaks above its all-time highs. He anticipates a potential rise towards $150,000 in this cycle.

Caution and Optimism

Coutts advises caution while remaining optimistic. He notes that while multiple indicators need to turn bullish for a sustained uptrend, Bitcoin may anticipate this inflection point before the indicators react.