Bitcoin is poised for a potential surge after forming a bullish pattern and attracting institutional investment.

Bull Flag Pattern

Analyst Ali Martinez identified a bull flag pattern on Bitcoin’s 4-hour chart, indicating a consolidation period after a significant price increase. The decreasing trading volume during this phase suggests a temporary pause rather than a reversal.

Consolidation Phase

Bitcoin’s recent dip below $61,000 tested the bull flag theory. However, the cryptocurrency rebounded to the $67,000-$70,000 range, supporting the pattern’s validity. This consolidation phase allows investors to reassess their positions.

Institutional Investment

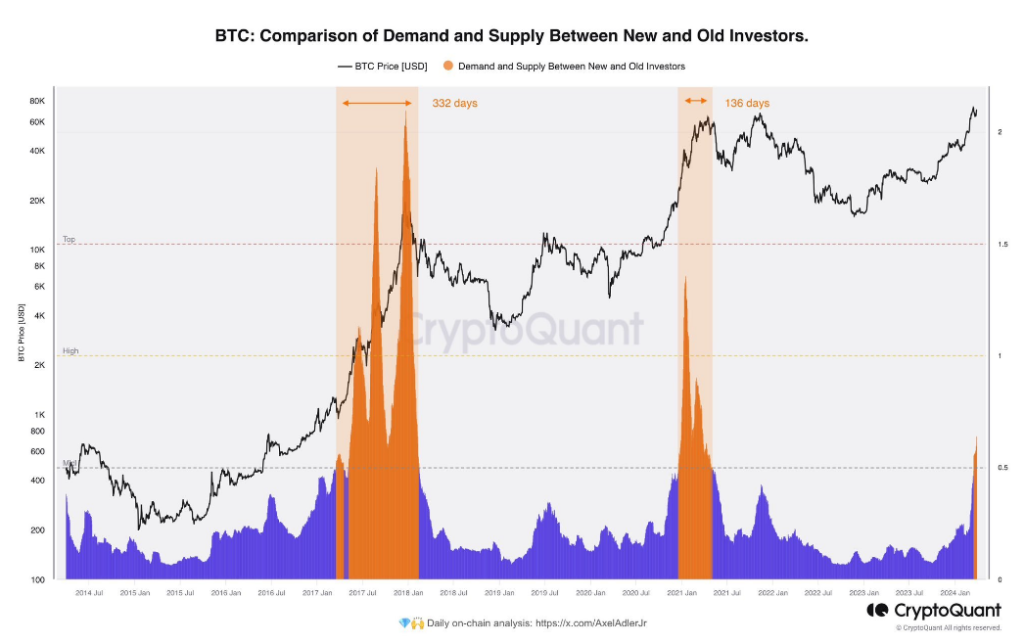

The launch of spot Bitcoin ETFs in the US has attracted institutional investors. These funds, backed by major financial institutions, are estimated to hold a combined 5% of Bitcoin’s supply.

Bullish Price Predictions

Some analysts are bullish on Bitcoin’s price. Martinez predicts a breakout above $73,750, while others forecast higher targets ranging from $100,000 to $500,000.

Caution

Experts caution against blindly following extreme price predictions. The cryptocurrency market is volatile, and technical analysis is not foolproof. The impact of institutional involvement on market dynamics is also unknown.

Conclusion

The combination of a bullish technical pattern and institutional investment has created excitement around Bitcoin. As it approaches uncharted territory, investors will watch closely to see if it can break new ground and set a new all-time high.