Bitcoin’s been on a rollercoaster lately. It surged past $60,000 last week, giving investors a reason to cheer. But a crypto analyst, CRYPTOHELL, thinks things might not be as rosy as they seem.

Bullish Signals:

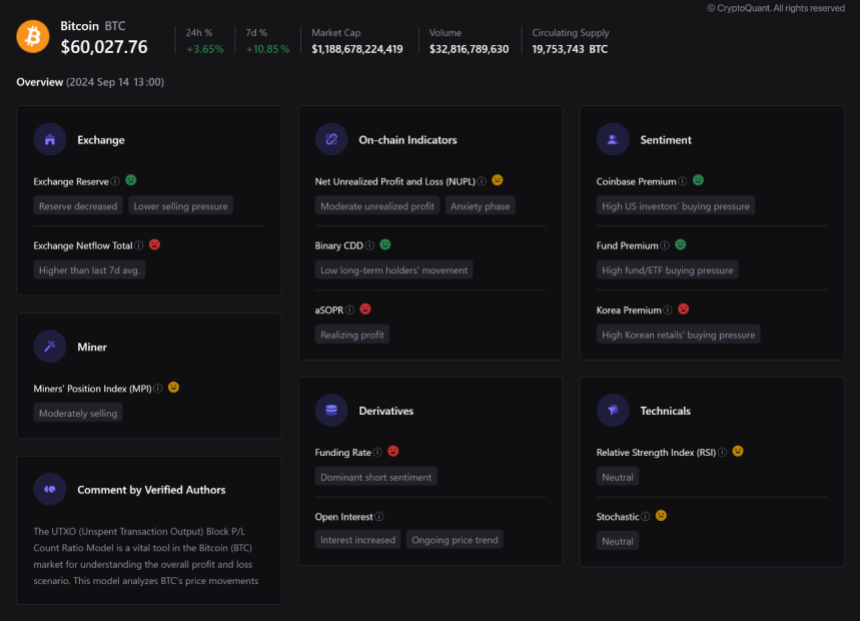

- Less Selling: Investors are holding onto their Bitcoin, hoping for higher prices. This is shown by a decrease in Bitcoin reserves on exchanges.

- Strong US Demand: Investors in the US are hungry for Bitcoin, with a lot of interest in Bitcoin ETFs.

Bearish Signals:

- Increased Selling Pressure: There’s been a spike in Bitcoin flowing back onto exchanges, suggesting some investors are selling.

- Profit Taking: Some investors are cashing in on their gains, which could lead to further selling.

- Negative Funding Rates: Traders are betting on a Bitcoin price drop, which could create downward pressure.

The Big Question: What’s Next?

All these conflicting signals have left the market in a state of uncertainty. While long-term investors are still holding strong, it’s anyone’s guess what will happen next.

Important news about Bitcoin adoption or regulation could be the deciding factor.

Leverage Levels Rise: A Cause for Concern

Another analyst, Ali Martinez, has noticed something else: Bitcoin traders are taking on more risk by using borrowed funds. While this can lead to bigger gains, it also means bigger losses. This increased leverage could lead to a market crash if things go south.

The bottom line? Bitcoin is at a crossroads. It’s a time for caution and careful consideration. /p>