Bitcoin just hit a new all-time high, blasting past $100,000 to reach $104,088! This incredible surge is fueled by several key factors:

Powell Compares Bitcoin to Gold

Federal Reserve Chair Jerome Powell compared Bitcoin to gold during a recent interview. He acknowledged Bitcoin as a speculative asset, similar to gold but digital. This comparison, coming from a top financial figure, is seen by many as a major boost for Bitcoin’s legitimacy. Some even see it as a sign that traditional finance is acknowledging the inevitability of digital assets.

Putin’s Openness to Bitcoin

Adding fuel to the fire, Russian President Vladimir Putin hinted at his acceptance of Bitcoin, stating that nobody can ban it. This, coupled with speculation about a global “Bitcoin Space Race” between superpowers, is generating significant excitement. The idea of countries building strategic Bitcoin reserves is gaining traction, particularly with the support of figures like David Bailey, who is advising on this for the incoming Trump administration.

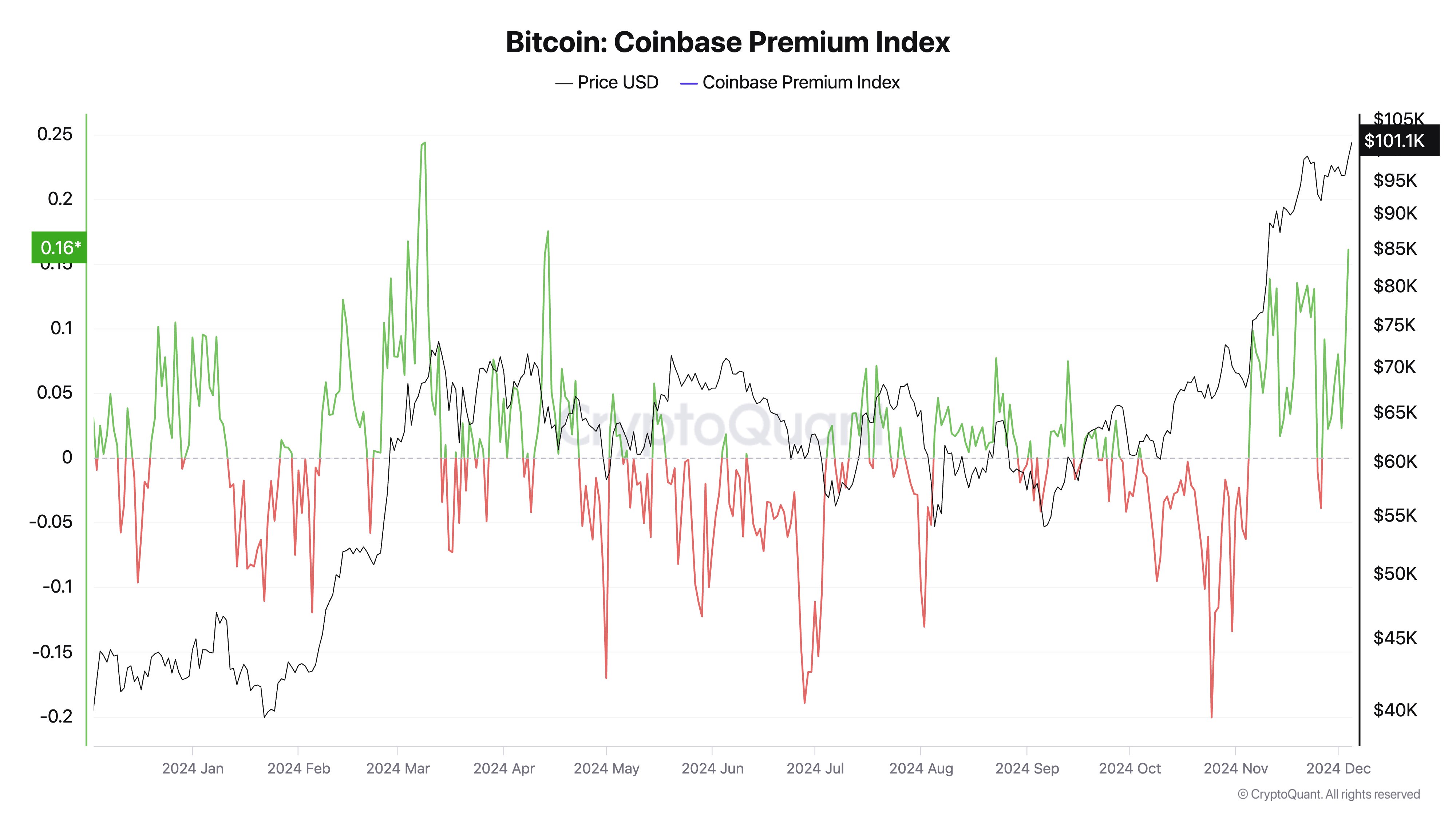

Institutional Buying and Strong Demand

The price surge isn’t just hype; it’s backed by real buying. Institutional investors are heavily involved, with a massive increase in Bitcoin futures open interest. The rally is driven by spot market activity, indicating strong, sustained demand, not just speculative trading. The “Great Sell Wall” at $100,000, previously a major resistance point, was broken, suggesting significant buying pressure from large players. Reports suggest that companies like MARA Holdings may have used recently raised funds to buy Bitcoin.

Retail Investors Still Hesitant

Despite the incredible price action, many retail investors remain skeptical. While whales (large investors) are accumulating Bitcoin, retail sentiment is cautious. Many are expecting a price correction. However, some analysts see this hesitation as a positive sign, suggesting the market might continue to rise despite the current uncertainty.

In short, a confluence of factors – positive comments from influential figures, institutional buying, and even retail investor hesitancy – has propelled Bitcoin to unprecedented heights. The future remains uncertain, but for now, Bitcoin is king.