Bitcoin hit a major milestone, closing above $100,000 for the first time ever! But should we be celebrating or bracing for impact? One analyst thinks a big correction might be on the horizon.

Bitcoin’s Big Break and a Quick Dip

Bitcoin finally cracked the $100,000 mark, a huge psychological barrier. But almost immediately, it took a significant dip – about 13% – down to around $90,000. This reminded some of the drop it experienced after first hitting $10,000. Since then, it’s been bouncing around between $97,000 and $101,000.

A Repeat of History?

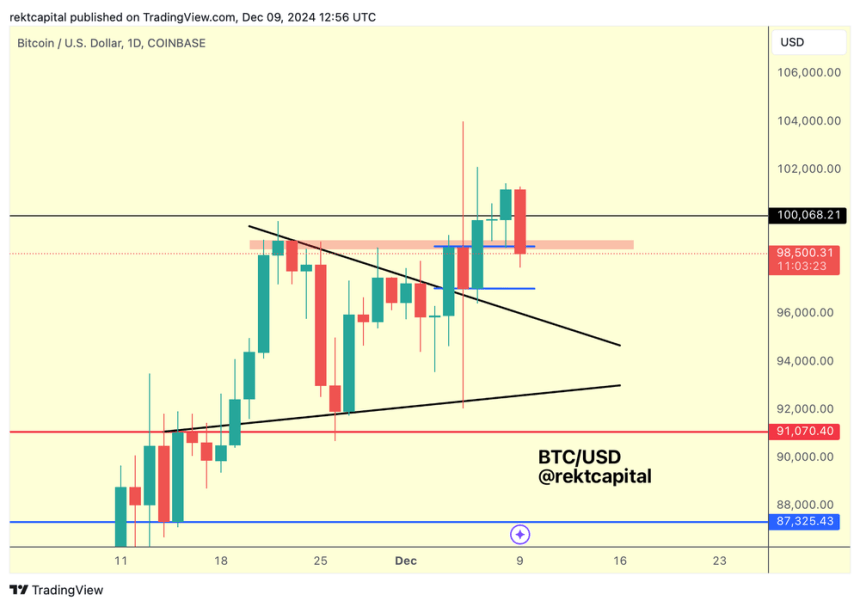

One analyst, Jelle, noted that Bitcoin’s price action mirrors its behavior after hitting $10,000 in 2017. After a few days, the new price level became a support level. Similarly, Bitcoin recently registered its first weekly close above $100,000. Another analyst, Rekt Capital, pointed out that the current price action is a “retest” of the $100,000 level and that the $98,000 level is crucial for support. Failing to hold this level could signal trouble.

Trouble Ahead? A Potential Big Drop

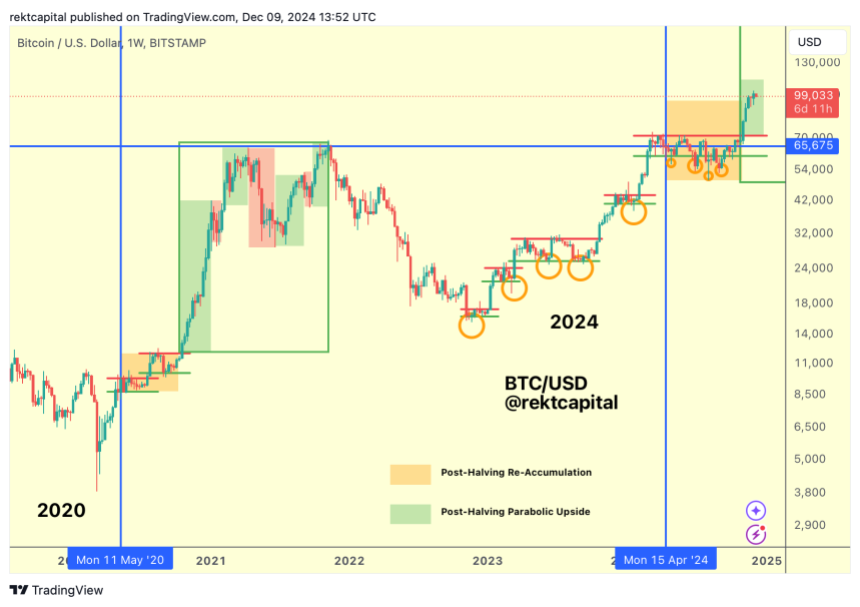

Rekt Capital issued a warning. He highlighted Bitcoin’s history after previous halving events. After each halving, Bitcoin typically enters a parabolic price increase lasting about 300 days. Historically, a significant correction (25% or more) happens around 6-8 weeks into this period. We’re now in week six, making a big drop a real possibility. He suggests a 25-40% drop could be on the cards, similar to what happened in 2017.

What to Expect

Rekt Capital emphasizes that the current retest of the $98,000 level is critical. If Bitcoin can’t hold this level, it could trigger a major correction in the coming weeks. He advises caution. However, he also notes that even after a correction, another significant price increase is likely. At the time of writing, Bitcoin is trading slightly below $98,000.