Crypto trader Ali Martinez is sounding the alarm, warning of a potential Bitcoin crash. He’s noticed a bearish signal on Bitcoin’s chart that previously signaled a major market downturn.

Bearish Divergence Spotted

Martinez, who boasts a large following on X (formerly Twitter), points to a “bearish divergence” on Bitcoin’s weekly chart. This means Bitcoin’s price is making higher highs and higher lows, but a key indicator, the Relative Strength Index (RSI), is showing the opposite – lower lows and lower highs. This discrepancy is a warning sign.

He notes that a similar divergence appeared in November 2021, just before Bitcoin plummeted from around $69,000 to roughly $15,500.

Lack of Support and Historical Comparisons

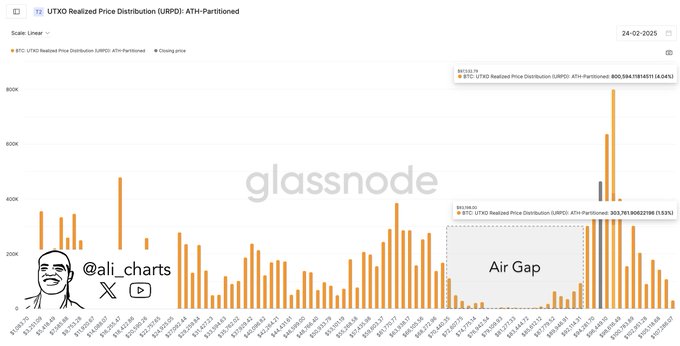

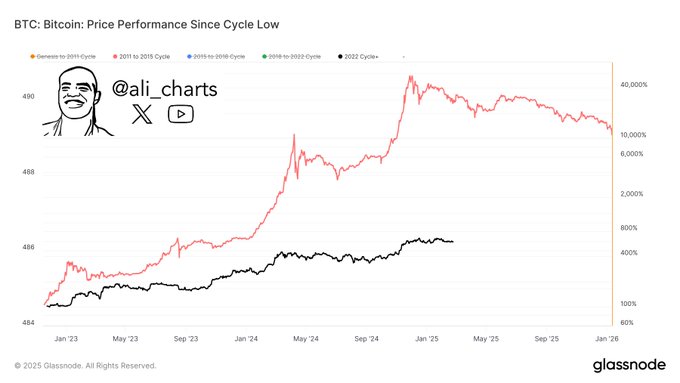

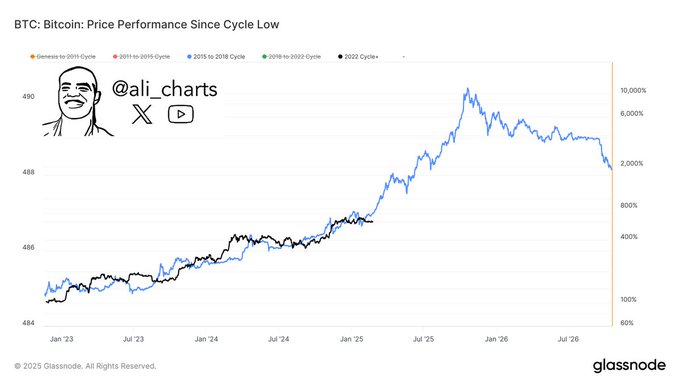

Martinez highlights a lack of significant support for Bitcoin below $93,198 and $70,440. He’s also comparing the current Bitcoin cycle to past cycles following Bitcoin halvings.

If the current cycle mirrors the 2011-2015 period, he believes Bitcoin might have already peaked at $108,800, suggesting further price drops are likely. However, if it follows the 2015-2018 cycle, there could be more upside potential before a top is reached.

Bitcoin’s Current Situation

At the time of writing, Bitcoin is trading around $85,822, down approximately 21% from its all-time high in January.

Disclaimer: This information is for general knowledge only and does not constitute financial advice. Always conduct your own research before making any investment decisions.

/p>