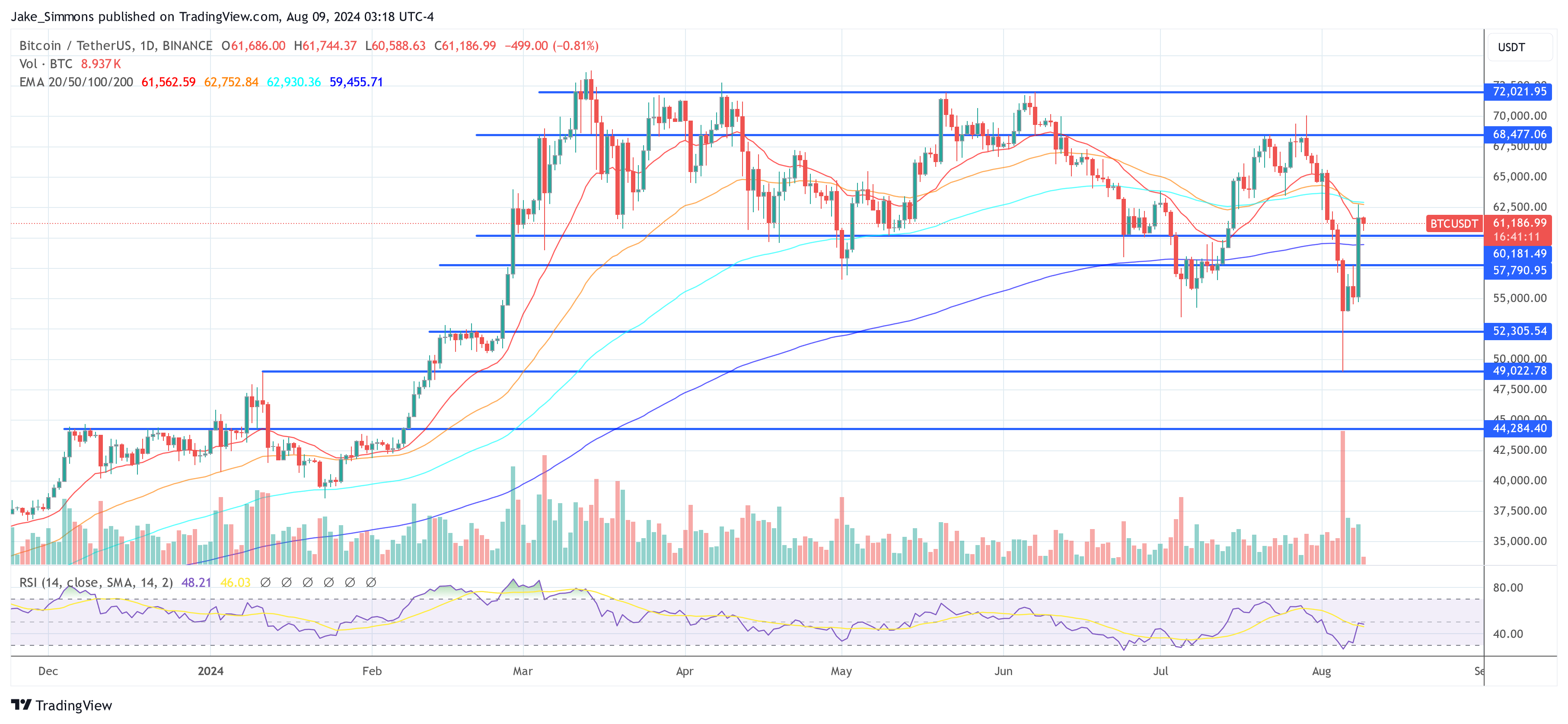

Bitcoin is back in the green, surging above $62,000 after a dip to $49,000 earlier this week. Here’s a breakdown of the key factors driving this rally:

Fading Recession Fears Boost Bitcoin

The recent market volatility was largely driven by concerns about a potential US recession. The July unemployment rate rose, triggering fears of an economic downturn. However, the latest jobless claims data showed a significant drop, easing market jitters.

Analysts believe this positive news, coupled with a general sense of relief after last week’s economic scare, has fueled the rally in both equities and Bitcoin.

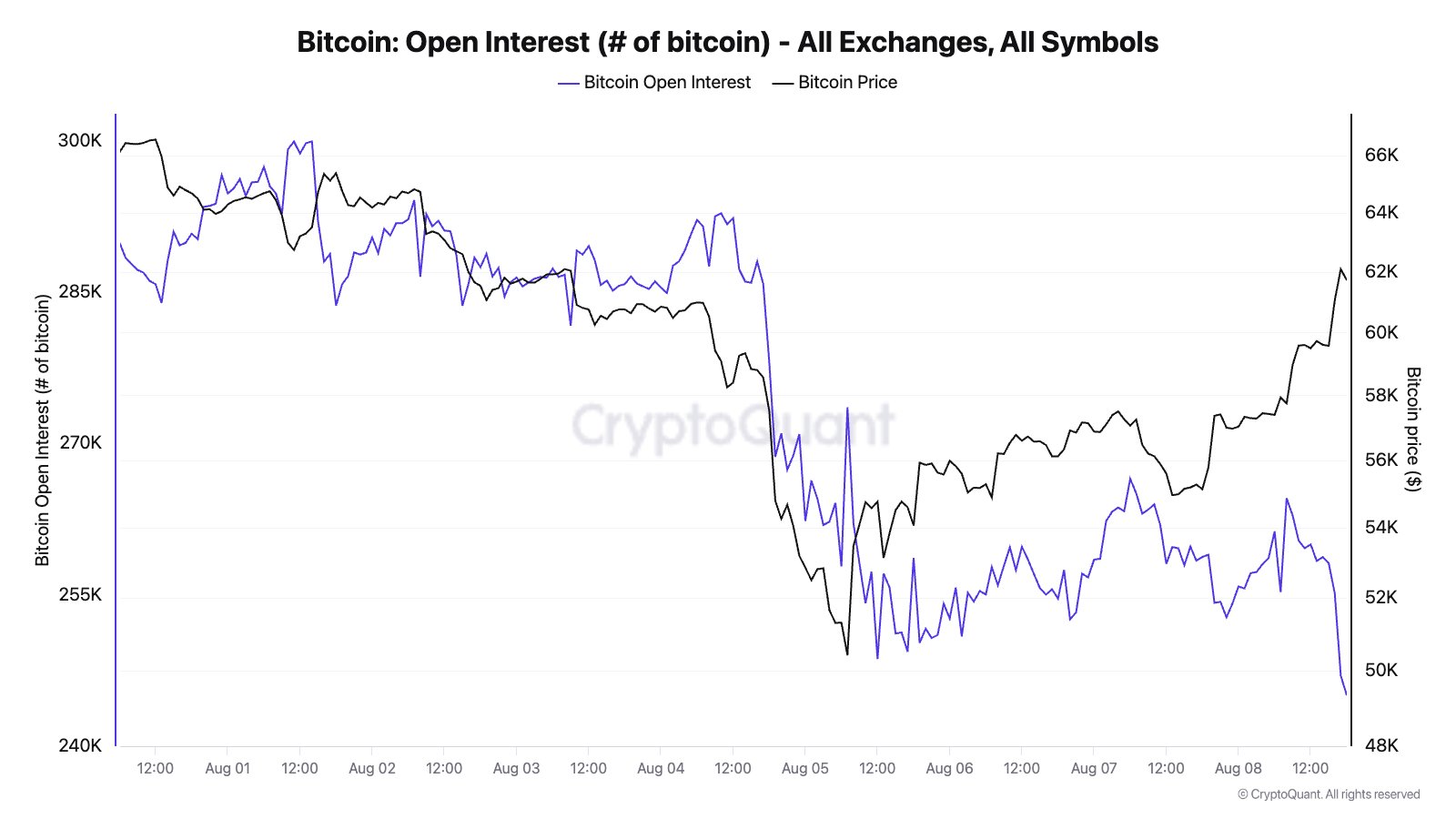

Short Liquidations Fuel the Surge

The volatile price swings also triggered a wave of short liquidations. Over the past 24 hours, over $222 million worth of crypto positions were liquidated, with Bitcoin accounting for a significant portion.

These liquidations, where traders who bet on a price decline are forced to close their positions, further amplified the upward pressure on Bitcoin’s price.

MicroStrategy’s Big Buy?

Another factor potentially contributing to the rally is speculation about a large Bitcoin purchase by MicroStrategy. The company, known for its massive Bitcoin holdings, recently announced plans to raise $2 billion to further increase its Bitcoin stash.

Analysts believe this could be the driving force behind the late-night surge in demand for Bitcoin.

Overall, the combination of fading recession fears, short liquidations, and potential institutional buying has pushed Bitcoin back into bullish territory. While the future remains uncertain, the recent rally suggests a renewed confidence in the cryptocurrency. /p>

/p>