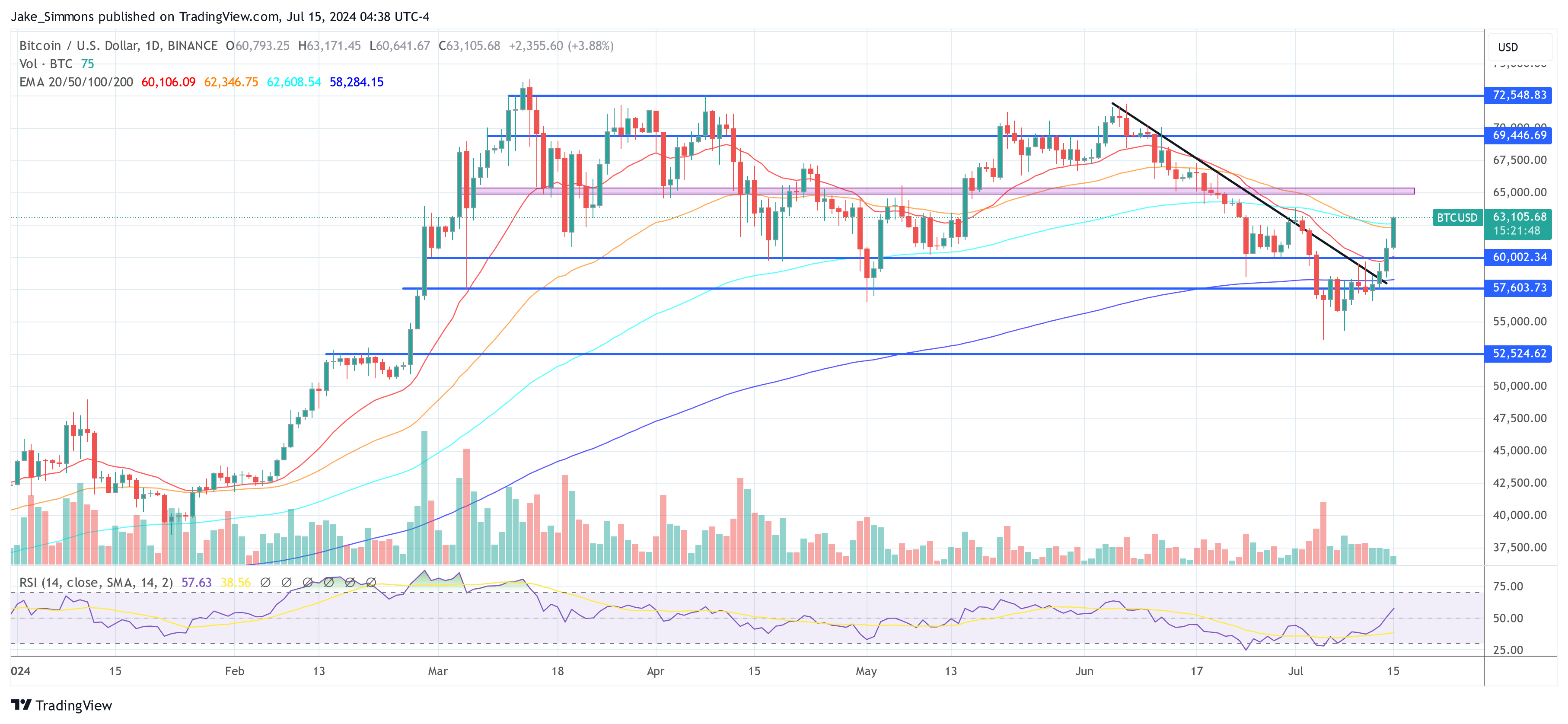

Bitcoin has been on a wild ride lately, plummeting to $53,600 last Friday before surging back to over $63,000 – a whopping 17% increase! This marks the highest price point in two weeks, and it’s all thanks to a combination of factors.

Trump’s Comeback Fuels Bitcoin’s Rise

The attempted assassination of former President Donald Trump has sparked a frenzy in the betting markets, with his odds of winning the 2024 election skyrocketing. This “Trump Trade” is seen as a bullish signal for Bitcoin, as analysts believe a Trump presidency could lead to more favorable regulations for cryptocurrencies.

German Sell-Off Ends, Bitcoin Recovers

Germany recently completed its sale of 50,000 Bitcoin seized from a pirate website, which had been putting downward pressure on the price. With the sell-off over, the market is breathing a sigh of relief.

Weak Dollar Pushes Investors Towards Bitcoin

The US dollar has been weakening lately, with the Dollar Index (DXY) falling to a five-week low. This is partly due to expectations of an interest rate cut and the growing US government deficit. As the dollar loses value, investors are looking for alternative assets, and Bitcoin is a popular choice.

Bitcoin Miners Are Recovering

Bitcoin miners have been struggling for a while, but analysts believe they are finally starting to recover. This could signal a reversal in the downward pressure on Bitcoin’s price, as miners are typically bullish when they are profitable.

Technical Indicators Point to a Bullish Trend

Bitcoin has broken through several key technical indicators, including the 200-day Exponential Moving Average (EMA) and a descending trendline. This is seen as a bullish signal, suggesting that the recent downturn may be over.

Overall, Bitcoin’s recent surge is a result of a combination of factors, including political speculation, market sentiment, and technical analysis. It remains to be seen how long this rally will last, but it’s clear that Bitcoin is still a force to be reckoned with.